- Federal Reserve is researching tokenization and AI in payments.

- No immediate regulatory changes announced.

- Private sector remains the primary innovation driver.

Federal Reserve Governor Christopher J. Waller discussed tokenization and AI in payments at the Wyoming Blockchain Symposium on August 20, highlighting ongoing research and innovation engagement.

Waller’s remarks underscore potential shifts in payment systems, driven by private sectors, impacting stablecoins and decentralized finance without immediate regulatory or funding changes.

Federal Reserve Engages in Tokenization and AI Research

Waller emphasized the Federal Reserve’s engagement in understanding new payment technologies, such as tokenization, smart contracts, and AI. The initiative is part of the Fed’s broader strategy to balance innovation with risk management.

Key figures like Waller stress the private sector’s lead role in payment innovation, stating, “The private sector is the primary driver of payments innovation”. This underlines a collaborative rather than regulatory approach.

Payment innovation focus targets enhancing the role of stablecoins and distributed ledgers in everyday transactions, positioning the U.S. dollar in a key role in cross-border payments. This reflects a keen interest in stablecoin utility expansion.

Stablecoin Utility and Regulatory Alignment Challenges

Did you know? In past years, central banks globally have engaged with tokenization to enhance transparency and efficiency, notably seen in the European Central Bank’s digital euro experiments.

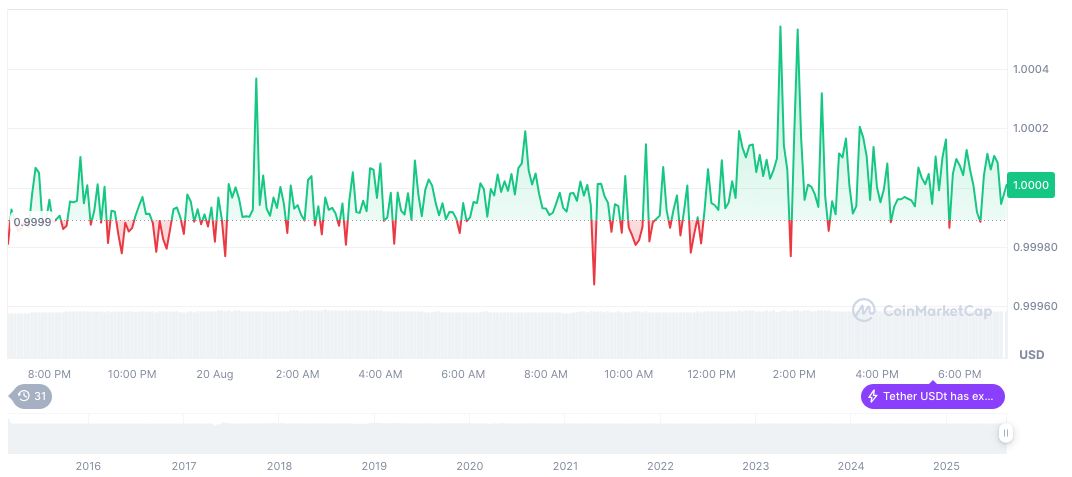

According to CoinMarketCap, Tether USDt (USDT) holds a market cap of $166.99 billion with a circulating supply of 167.01 billion tokens. Despite a stable price at $1.00, the token experienced marginal price changes over recent months. The 24-hour trading volume was noted at $131.04 billion as of August 20, 2025.

Insights from the Coincu research team emphasize the probability of regulatory alignment in tandem with technological advance. Historical precedents indicate a prolonged process before significant policy shifts, fostering a cautious yet optimistic outlook for future innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/fed-explores-tokenization-ai-payments/