- Alleged statement from Nationwide economist about Federal Reserve’s potential rate cut.

- Market speculates on potential rate cut impact.

- Lack of primary source confirmation or official data release.

Nationwide Economist Kathy Bostjancic allegedly predicts a reduction of 75 basis points in Federal Reserve interest rates by year-end, citing weaker labor markets and mild inflation.

This alleged forecast highlights potential shifts in economic policy, impacting financial markets and cryptocurrencies, though no primary sources confirm her statement as of now.

Potential Market Effects of Predicted Monetary Policy Shift

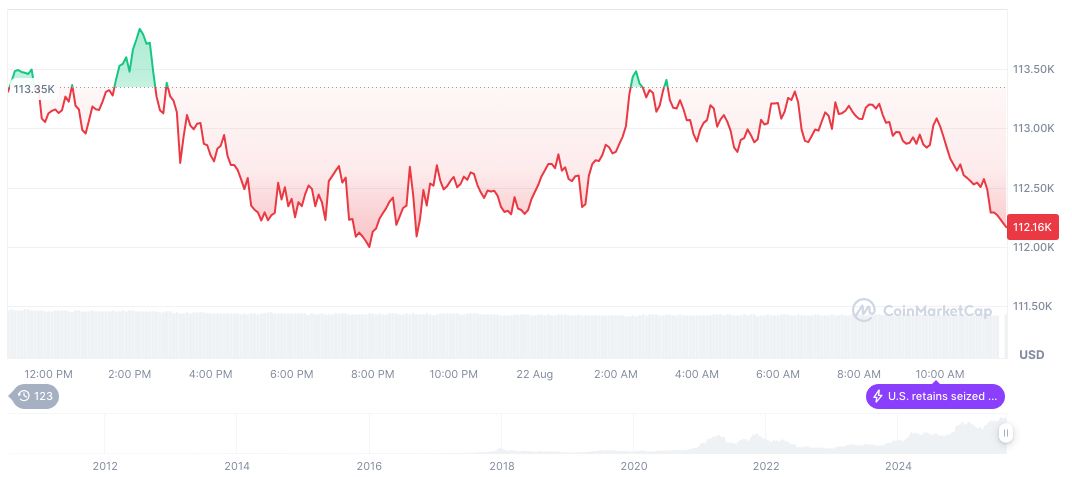

Bitcoin (BTC) currently trades at $116,567.33, according to CoinMarketCap, with a market cap of $2.32 trillion and a 58.24% market dominance. In the past 90 days, BTC experienced a 7.12% price increase, while its 24-hour trading volume hit $74.38 billion, up 23.92%.

The Coincu research team highlights potential impacts of such expected interest rate cuts on financial stability and cryptocurrency fluctuations. Historically, dovish monetary policies have encouraged a shift to riskier assets, possibly benefiting the crypto market. With rising liquidity concerns, any changes in interest rate dynamics could play a pivotal role in asset valuation.

Kathy Bostjancic, Chief Economist, Nationwide, remarked, “No official statement, tweet, or report found regarding predictions on rate cuts.”

Market Data Overview

Did you know? Previous dovish signals from the Federal Reserve, such as those in 2019, corresponded with increased activity in cryptocurrency trading volumes and a notable uptick in market cap for digital assets.

Bitcoin (BTC) currently trades at $116,567.33, according to CoinMarketCap, with a market cap of $2.32 trillion and a 58.24% market dominance. In the past 90 days, BTC experienced a 7.12% price increase, while its 24-hour trading volume hit $74.38 billion, up 23.92%.

The Coincu research team highlights potential impacts of such expected interest rate cuts on financial stability and cryptocurrency fluctuations. Historically, dovish monetary policies have encouraged a shift to riskier assets, possibly benefiting the crypto market. With rising liquidity concerns, any changes in interest rate dynamics could play a pivotal role in asset valuation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-rate-cuts-2025-3/