- Market volatility due to Federal Reserve’s interest rate division.

- BTC dropped below $110,000, ETH under $4,400.

- Over $9 billion liquidated in major tokens.

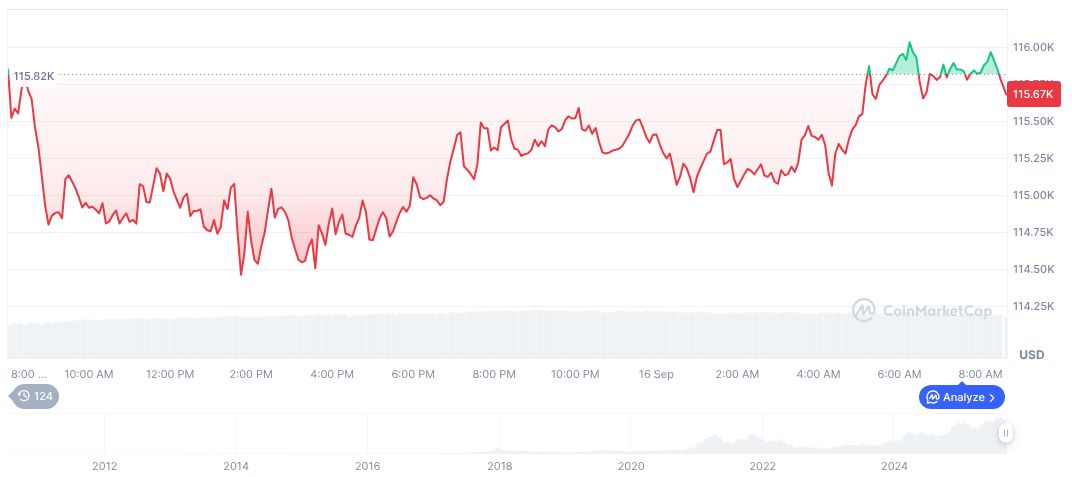

On September 17, 2025, the Federal Reserve’s internal division over interest rate decisions led to significant volatility in the cryptocurrency markets, affecting major tokens like BTC and ETH.

This interest rate uncertainty heightened market volatility, with BTC and ETH experiencing notable price drops and large-scale liquidations across major crypto exchanges.

Fed’s Interest Rate Indecision Sparks Crypto Market Turmoil

The Federal Reserve’s internal division on interest rates created heightened uncertainty on September 17th, 2025. Members were split with no rate decision made, resulting in market speculation and wide-ranging impacts on cryptocurrency valuations.

As a result, cryptocurrency prices entered a volatile state, with Bitcoin dropping below $110,000 and Ethereum falling under $4,400. Institutional and on-chain data highlighted significant liquidations and market jitters.

“As of today, we have not issued any official statements regarding a change in our interest rate policy. The division among FOMC members reflects the complexity of current economic conditions.” — Jerome Powell, Chair, Federal Reserve Source: BlockBeats Official Commentary

Bitcoin and Ethereum Prices Plunge Amid Fed Uncertainty

Did you know? Previous Fed meeting periods, similar to this event, have historically triggered sharp price swings in major cryptocurrencies, echoing trends observed during the September 2025 market upheaval.

Bitcoin (BTC) currently stands at $117,049.37, with a market cap of $2.33 trillion and a trading volume decreasing by 7.02% over 24 hours. As per CoinMarketCap, BTC has a 57.56% market dominance and circulatory supply nearing 19.92 million coins.

According to Coincu research, the continued volatility due to Fed uncertainties may drive renewed interest in cryptocurrency as a hedge. Historical trends suggest watching institutional investor moves for further indicators of market sentiment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-split-causes-crypto-volatility/