- Federal Reserve’s forthcoming rate decision impacts market volatility.

- Investors await key inflation and employment figures.

- Crypto assets experience heightened volatility ahead of decisions.

Upcoming financial reports and central bank decisions will shape crypto and traditional markets in September, with investor focus on US CPI and Federal Reserve actions.

These events could drive significant volatility, potentially influencing asset prices and setting the tone for market directions across the coming months.

Federal Reserve’s Rate Decision and Economic Data Focus

In the coming week, market participants are focused on economic data from the US and Europe. These data releases, including US CPI and employment numbers, will play a pivotal role in shaping Federal Reserve policies. Projected shifts in interest rates could have broad effects across financial and crypto markets.

Expected changes in interest rates could affect funding conditions and liquidity. Market speculation centers on whether the Federal Reserve will implement a quarter-point or a potentially surprising 50-basis-point cut. This decision is expected to significantly impact speculative trading and investor risk-taking.

“The market is reacting to mixed signals from the labor market and inflation data, and we are closely monitoring these trends as we prepare for our next policy decisions.” — Jerome Powell, Chair, Federal Reserve

Bitcoin’s Market Dynamics Amidst Fed Speculation

Did you know? September has been the weakest month for US equities over the last three decades, often marked by volatility in response to Federal Reserve decisions.

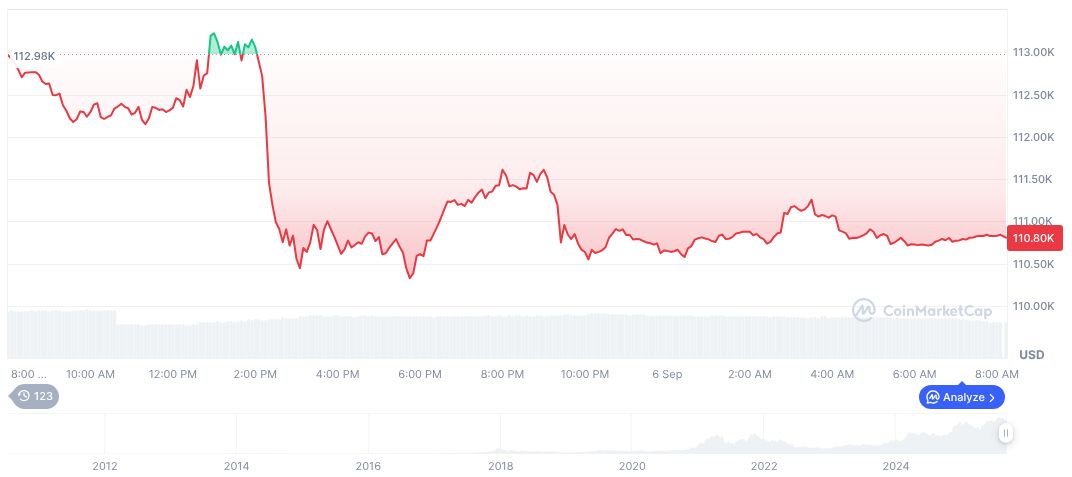

Bitcoin’s price is currently at $110,355.58, with a market cap of $2.20 trillion, according to CoinMarketCap data. The 24-hour trading volume is $28.03 billion, showing a 52.82% decline. The price has slightly dipped by 0.24% in the past 24 hours. Bitcoin remains a pivotal asset, representing 57.92% of market dominance.

According to Arthur Hayes, Co-founder, Bitmex, “Investors are skittish with CPI data looming. The outcome will be critical for crypto and equity markets alike.” Market volatility is expected to persist, influencing asset valuations and trade dynamics. Shifts in monetary policy could prompt long-term price adjustments, especially for crypto assets sensitive to USD liquidity conditions. These outcomes depend on how central banks balance economic signals with policy actions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/market-volatility-inflation-fed-rate/