- Interest rates reduced impacting financial markets.

- Accommodative stance boosts market liquidity.

- Implications for US investment and crypto markets.

On October 29, former U.S. President Trump claimed $21 trillion to $22 trillion could flow into the U.S., warning against Federal Reserve rate hikes, seeking chip industry prominence.

These remarks highlight the ongoing debate over Federal Reserve rate policy and investment flows, potentially impacting markets and the cryptocurrency sector as macroeconomic conditions evolve.

Federal Reserve Cuts Rates to 4%-4.25%

The Federal Reserve announced a reduction in interest rates to 4%–4.25%, reflecting a more accommodative monetary policy. This reduction follows concerns over economic growth and inflation levels, as indicated in a recent Federal Open Market Committee statement. Key figures, including Jerome H. Powell, emphasized the need for such a shift to bolster the economy.

Immediate implications include increased liquidity and potential investment inflows into various sectors. While no specific policy changes were attributed to any presidential interventions, the US equity markets and cryptocurrencies could see supportive momentum as a result of the lower cost of capital. This might encourage an uptick in investments and broader economic activities.

“The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.” — Jerome H. Powell, Chair, Federal Reserve

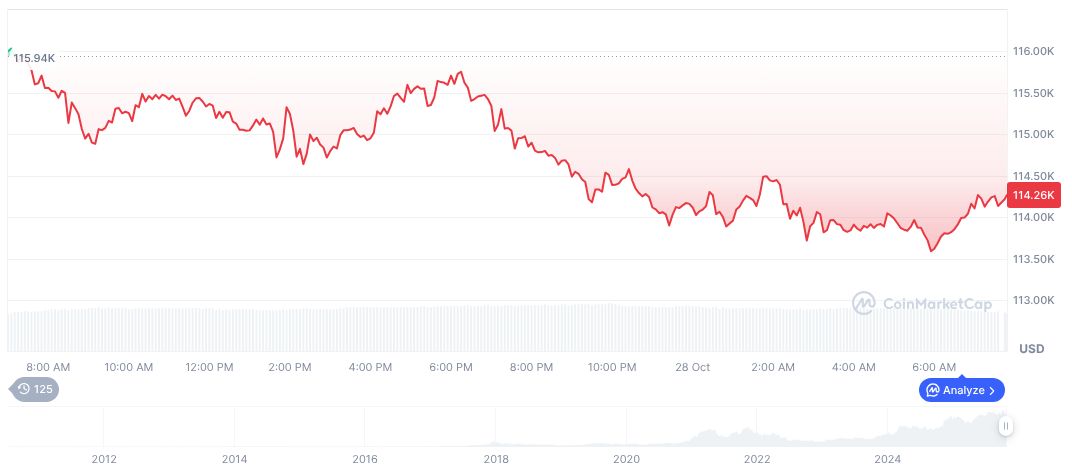

Market reactions have been mixed, with attention on both traditional financial assets and cryptocurrency markets like Bitcoin. Financial analysts and traders have expressed cautious optimism, noting the potential for sustained growth in asset prices under such an accommodative policy. The cryptocurrency community is closely monitoring the impact on major currencies like Bitcoin and Ethereum.

Positive Impact on Traditional and Crypto Markets

Did you know? Past rate cuts have often catalyzed significant influxes into cryptocurrency markets, with BTC and ETH frequently rallying during such periods, indicating historically positive correlations between lowered rates and crypto value increases.

Bitcoin (BTC) currently trades at $112,840.84 with a market cap of $2.25 trillion, commanding a market dominance of 59.22%. Over the past 24 hours, its trading volume reached $65.64 billion, a decrease of 0.93%. These figures reflect the cryptocurrency’s resilient positioning amid global economic shifts, reported by CoinMarketCap.

Insights from Coincu research indicate potential ramifications for financial stability and regulatory landscapes. They predict evolving technological integrations might strengthen the crypto sector’s role in global finance. Historically, rate cuts often correlate with increased market activity in digital assets, suggesting continued support for innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-cuts-interest-rates/