- Federal Reserve considers rate cuts, impacting crypto.

- Potential rate cut could boost BTC and ETH.

- Expert analysis highlights crypto market expectations.

The Federal Reserve is considering a reduction in the federal funds rate in its upcoming July meeting, as indicated by recent meeting minutes released on July 9, 2025, by the Federal Open Market Committee (FOMC). This potential move is tied to economic expectations and could significantly influence market trends.

Potential changes in interest rates by the Federal Reserve could have broad implications for both traditional and crypto markets. Historical patterns suggest that dovish signals often precede market rallies in assets like Bitcoin (BTC) and Ethereum (ETH).

FOMC Signals Dovish Stance with Potential Rate Cut

Federal Reserve officials signaled that a rate cut could be appropriate later this year, pending economic developments. The FOMC includes Jerome Powell as Chair, alongside Governors and regional Fed presidents. The plan is set for discussion at the July 29–30 meeting. While no official statement has been made, the meeting minutes suggested a dovish stance, which could influence both traditional and crypto markets. The potential interest rate reduction could lead to a shift in market behaviors, impacting USD liquidity and altering macro risk premiums. Historically, crypto assets like BTC and ETH benefit from dovish monetary policies, as such signals often lead to market rallies.

Market responses have varied, with financial and crypto analysts anticipating rate cuts, despite no significant official remarks from major crypto figures like Arthur Hayes or Raoul Pal. According to Lloyds Bank, Economic Forecast Team, “The Fed is not expected to cut in July, despite internal divisions and a ‘dot plot’ still showing two cuts in 2025.” Community sentiment reflects optimism, awaiting further indications from the Federal Reserve. As on-chain data shows no significant liquidity movements, market positioning appears to account for a potential interest rate adjustment.

Market responses have varied, with financial and crypto analysts anticipating rate cuts, despite no significant official remarks from major crypto figures like Arthur Hayes or Raoul Pal. According to Lloyds Bank, Economic Forecast Team, “The Fed is not expected to cut in July, despite internal divisions and a ‘dot plot’ still showing two cuts in 2025.” Community sentiment reflects optimism, awaiting further indications from the Federal Reserve. As on-chain data shows no significant liquidity movements, market positioning appears to account for a potential interest rate adjustment.

Crypto Market Poised for Growth Amid Possible Policy Shift

Did you know? According to historical trends, when the Federal Reserve signaled rate cuts in 2019 and 2020, BTC experienced significant rallies. Such historical instances align with current expectations if dovish signals persist.

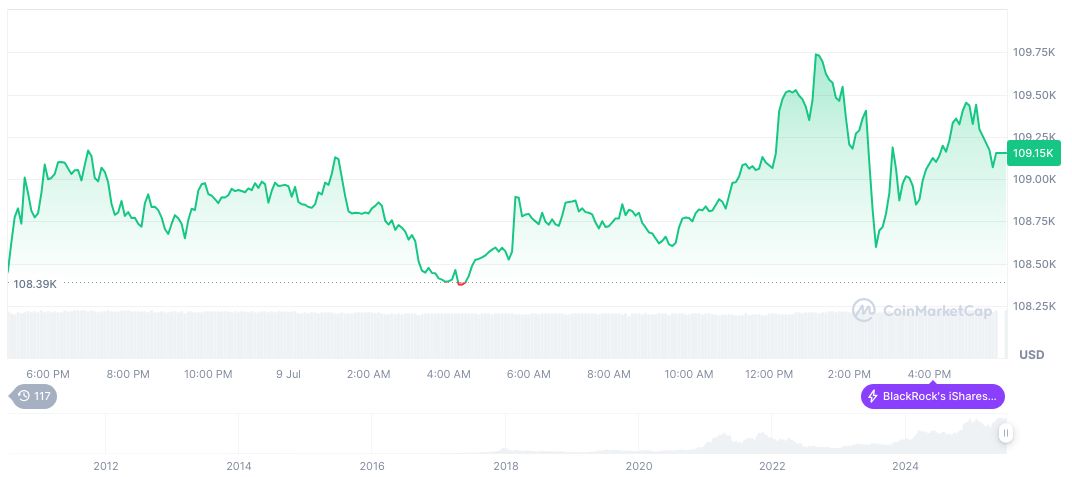

Bitcoin (BTC) is currently trading at $109,578.13 with a market cap of $2.18 trillion, according to CoinMarketCap. Its market dominance stands at 63.92%. The crypto has shown a 0.45% increase over the past 24 hours and a 37.61% rise in the past 90 days. Trading volumes reached $44.25 billion at the most recent update on July 9, 2025.

The Coincu research team suggests that a dovish pivot from the Federal Reserve could enhance the BTC rally, considering past market reactions. Such a shift could lead to immediate liquidity adjustments, influencing risk asset prices and crypto valuations significantly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347746-federal-reserve-interest-rate-cut/