- Federal Reserve considers halting QT due to market strains.

- Bank reserves fall below 13%, raising liquidity concerns.

- Potential policy shift could stabilize financial markets.

Federal Reserve observers anticipate a potential halt in the liquidity drain strategy during the upcoming FOMC meeting, highlighting challenges in monetary policy execution amidst current market pressures.

This pause could influence Bitcoin and gold market reactions, as U.S. bank reserves reach critical lows, sparking discussions on liquidity and trading stability.

Federal Reserve’s Move to Stabilize Bank Reserves Under Watch

Analysts believe halting the liquidity drain through QT could support the smooth operation of monetary policy. Bank reserves have dropped below 13% of bank assets, a critical threshold as noted by financial expert Nick Timiraos. His observations have intensified discussions surrounding the current QT plan.

The Federal Reserve’s decision is crucial as it may address intensified friction in money markets impeding the Fed’s ability to manage inflation and employment targets. Market participants are watching closely for potential policy shifts.

“The critical levels of U.S. bank reserves have fallen below 13% as a share of bank assets, highlighting the importance of monitoring these during the Treasury’s cash balance rebuild.” — Nick Timiraos, Financial Journalist, The Wall Street Journal

Financial markets are currently reacting to this uncertainty. Investors are seeking safer assets, as evidenced by gold reaching all-time highs. Federal Reserve decisions at the upcoming meeting could shift market dynamics significantly.

Potential Impact on Cryptocurrency Markets and Historical Parallels

Did you know? In 2019, similar market conditions led the Federal Reserve to pause QT, underscoring the recurring tension between monetary policy and market dynamics.

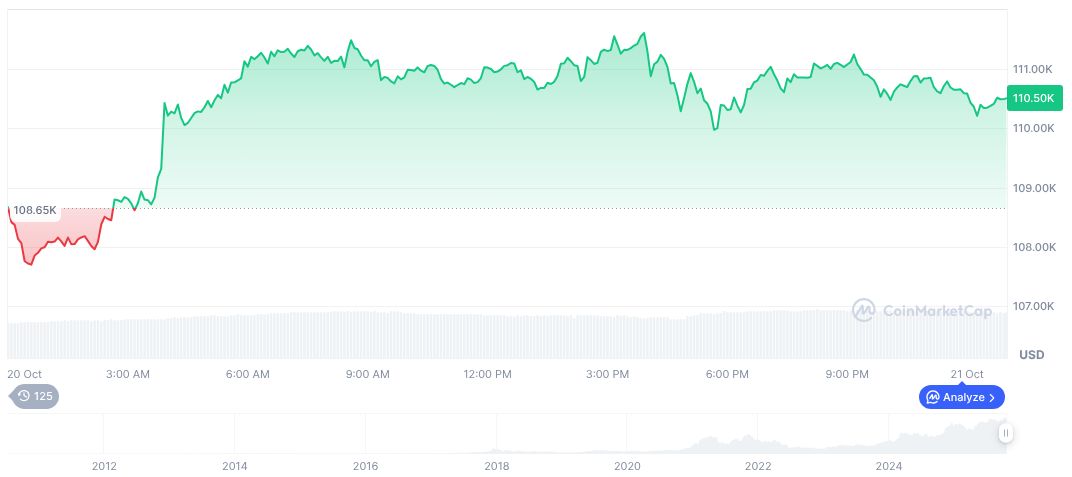

Bitcoin (BTC) currently trades at $107,701.95, reflecting a decrease of 2.74% over the past 24 hours according to CoinMarketCap. The cryptocurrency’s market cap is reported to be $2.15 trillion, commanding a dominance of 58.85% in the sector. BTC has seen a 5.00% decline over the past seven days and a 9.37% drop in 90 days. Trading volumes show a significant 9.50% activity change in the past 24 hours.

Insights from Coincu research indicate potential stabilization in markets if QT halts. Financial dynamics could shift, possibly calming volatility in cryptocurrency sectors. Historical patterns suggest regulatory frameworks may evolve similarly to prior QT suspensions, possibly influencing long-term technological integrations in financial systems, according to our research team. QT halts and potential Federal Reserve actions may influence the cryptocurrency sectors significantly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-considers-halting-qt-market-concerns/