- Federal Reserve Chair Powell discusses economic issues with President Trump.

- Policy decisions hinge on future economic data.

- Emphasis on non-political, objective analysis.

Federal Reserve Chair Powell’s Discussion with President Trump

Federal Reserve Chair Jerome Powell and President Donald Trump convened at the White House on May 30, 2025, to discuss economic conditions in the United States. Topics of conversation included economic growth, employment, and inflation metrics.

Federal Reserve Chair Powell Highlights Data Dependency at White House Discussion

Chair Powell, accompanied by other Federal Open Market Committee members, underscored the importance of data dependency in monetary policy, showing a commitment to future economic trends. There were no forecasts provided regarding monetary strategy shifts impacting the U.S. economy.

Future monetary policy decisions remain contingent upon forthcoming data, marking an ongoing evaluation of economic conditions. Both growth and employment statistics are core to the analysis presented during the meeting.

President Trump and Chair Powell displayed a unified front despite past tensions over rate stability. As Powell refrained from discussing future policies in detail, market responses were measured, maintaining current expectations.

“I might have to think about removing Powell from his position.” – Donald Trump, President of the United States The Street

Market Reactions and Historical Approach of the Federal Reserve

Did you know? The Federal Reserve’s emphasis on neutrality amidst political pressures has been a hallmark of its strategy since its establishment in 1913.

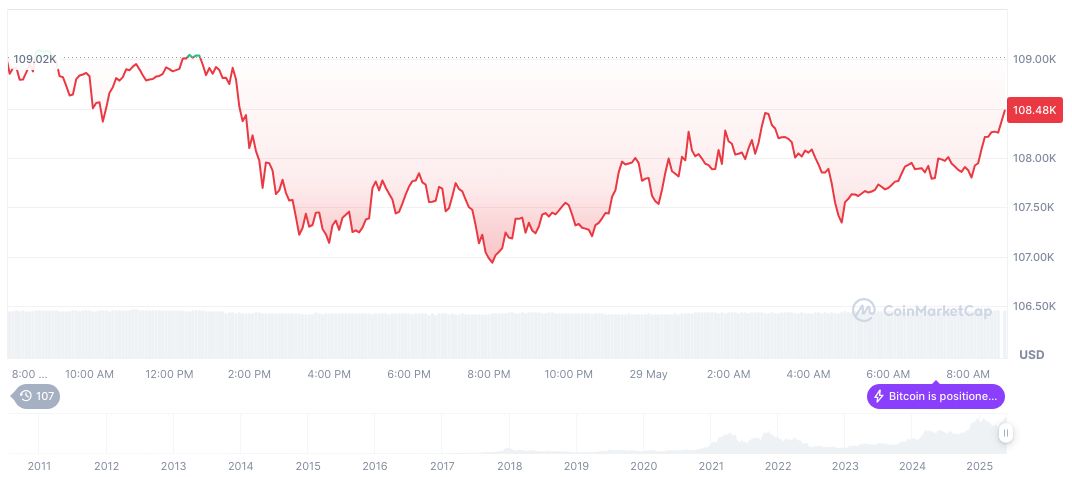

According to CoinMarketCap, Bitcoin stands at a value of $106,818.69, marking a market cap of $2.12 trillion. Despite a 0.49% decrease in the last 24 hours, Bitcoin has shown a significant 29.91% increase over the past 60 days, indicating robust market activity.

Coincu Research suggests potential challenges may arise from political interactions, though historical trends show economic stability as a driving force behind Fed decisions. A balanced approach to regulatory frameworks could enhance investor confidence.

Source: https://coincu.com/340544-federal-reserve-powell-trump-meeting/