- Powell’s potential dismissal by Trump affects financial markets and investors.

- Congressional Republicans reportedly support Trump’s decision to consider dismissal.

- Uncertainty impacts financial confidence, causing possible market volatility.

Jerome Powell, U.S. Federal Reserve Chairman, faced renewed dismissal threats as reported on July 15 by Congress Republican member Anna Paulina. The potential dismissal is said to stem from a decision-making process involving former President Donald Trump.

The potential dismissal of Powell could disrupt financial stability, leading to potential volatility. Market confidence may be affected if Federal Reserve independence is compromised, influencing cryptocurrency and broader financial markets.

Powell’s Potential Dismissal Stirs Economic Concerns

Jerome Powell faces possible removal after a public declaration by Congresswoman Anna Paulina that the Federal Reserve Chairman might be dismissed by former President Trump. This consideration has reportedly received support from congressional Republicans, which adds an important political dimension to this unfolding scenario.

Financial markets remain on edge as the dismissal of a Fed chair is a legally untested move that might cause serious market consequences. Such actions could undermine the credibility of the institution, heightening investor anxiety about U.S. economic policy direction. Former President Donald Trump once commented, “I talked to them about the concept of firing him. I said, ‘What do you think?’ Almost all of them said I should. But I’m more conservative than they are,” highlighting internal Republican discussions on this issue (CBS News).

Mixed reactions have emerged, with strong opinions circulating. As Trump emphasized his conservative stance, stating, “I am more conservative than they are,” industry watchers await authoritative updates from CBS News on Twitter from relevant bodies or figures to assess the broader implications.

Market Volatility and Historical Parallels

Did you know? This kind of threat to Fed leadership, last witnessed under Nixon’s presidency, historically sparked substantial market volatility, impacting stock, bond, and crypto markets alike.

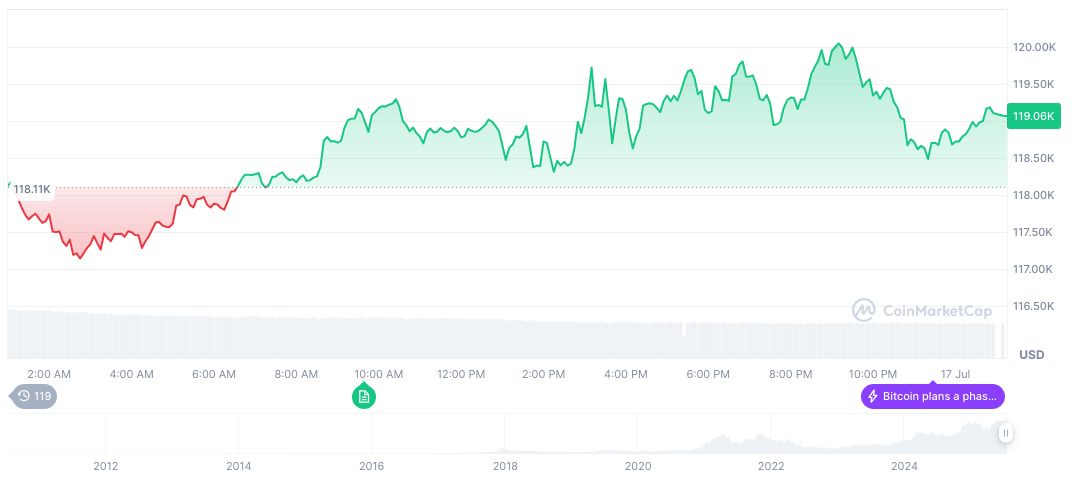

Bitcoin (BTC) currently trades at $119,051.50, holding a market cap of formatNumber(2368333500592, 2). Dominating 62.21% market share, BTC observed a trading volume dip by 26.72% over 24 hours. Price dynamics include a 7.26% increase over the past week, as reported by CoinMarketCap on July 17, 2025.

Coincu’s research team suggests potential implications of Powell’s dismissal could include regulatory uncertainty, shifting fiscal priorities, and reactive monetary policies affecting market stability. Analysis indicates possible spikes in volatility as historical trends show increased market disruptions during past Fed chair controversies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349091-federal-reserve-chair-dismissal-controversy/