- Jerome Powell’s speech influences Fed rate cut expectations significantly.

- Potential 25 basis point cut probability jumps to 91.1%.

- Crypto markets may react to increased liquidity conditions.

On August 22, CME’s FedWatch tool indicated a 91.1% probability of a 25 basis point Federal Reserve rate cut in September following Chairman Jerome Powell’s speech.

With potential rate cuts, market dynamics shift, impacting asset classes including cryptocurrencies, as traders anticipate reduced yields and increased liquidity flows into riskier investments like Bitcoin and Ethereum.

FedWatch Data Propels Rate Cut Probability to 91.1%

PANews reported that Jerome Powell’s recent speech led to a 91.1% probability of a 25 basis point rate cut by the Federal Reserve in September.

The CME FedWatch Tool impacts market expectations, increasing the likelihood of easing at the FOMC meeting.

Market participants are closely observing the implications of this possible policy change. While official statements from Powell are absent, industry reactions focus on the increased likelihood of a cut. Digital Asset markets may reflect these expectations, though concrete asset-specific impacts remain speculative.

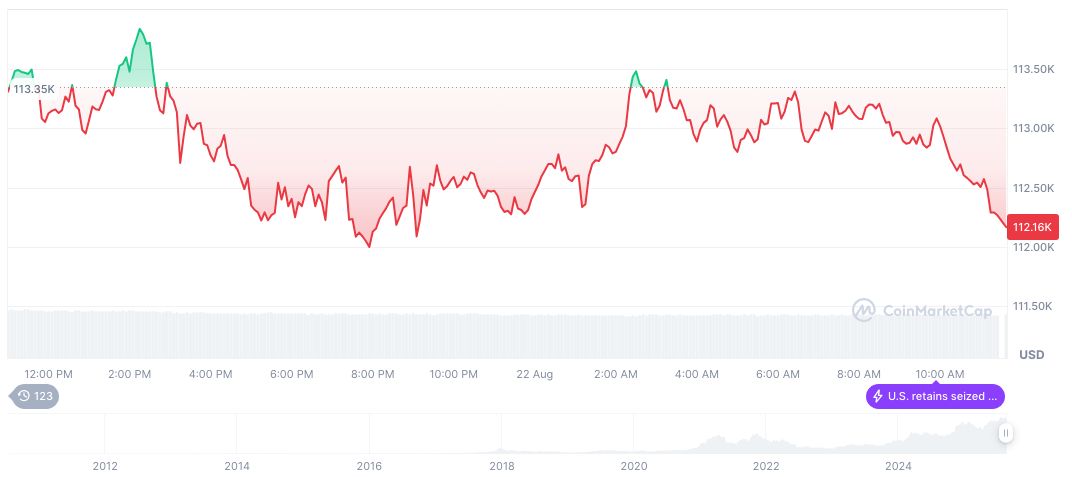

Bitcoin’s Price Surges 2.72% Amidst Fed Cut Sentiment

Did you know? Historically, Fed monetary policies have incited optimism in crypto spaces, acting as catalysts for price adjustments.

Bitcoin (BTC) is currently valued at $116,411.19, with a market cap of $2.32 trillion, as per CoinMarketCap. Experiencing a 2.72% rise in the last 24 hours, BTC continues to dominate the market at 58.40%, signaling strong investor interest amid volatility.

Coincu research suggests potential shifts towards looser monetary conditions may elevate asset valuations. This data underscores the analytical significance of Fed dynamics on digital asset trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-expectations-september/