- The Federal Reserve sustains interest rates at 4.25%–4.50% amid White House pressure.

- Chairman Powell emphasizes independence and data-driven policies.

- Market displays caution due to trade uncertainty and inflation risks.

Jerome Powell, Federal Reserve Chairman, reiterated that presidential calls for interest rate cuts won’t sway the Fed’s decisions, maintaining rates at 4.25%–4.50% during the May 2025 meeting. Economic data remain the main focus. You can review the Federal Reserve H.15 Release on Selected Interest Rates for more detailed information on current rates.

Market reactions have been characterized by increased volatility due to the uncertainties associated with the Fed’s stance and ongoing tariff policies. Investors move cautiously, preserving capital in response to potential inflation threats while navigating unclear economic conditions. Powell emphasized patience, stating that rushing policy adjustments isn’t necessary, with a focus on observing labor market conditions and inflation pressures before considering any interest rate changes, as detailed in the Federal Reserve Monetary Policy Report – May 2025.

Federal Reserve’s Decision

Despite market volatility, the Federal Reserve has maintained a steady approach, similar to 2019 when macroeconomic uncertainty demanded caution despite political pressures for rate changes.

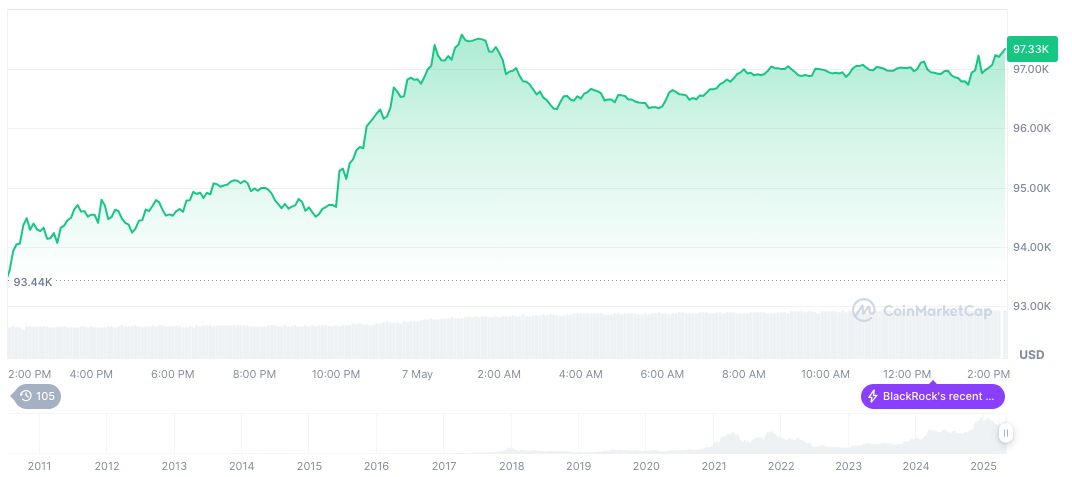

Bitcoin (BTC) is currently priced at $98,865.34 with a market cap of $1.96 trillion. The fully diluted market cap stands at $2.07 trillion. Its 24-hour trading volume is $49.05 billion, reflecting a 2.52% price change over the past day. Recent price movements indicate a 24.06% increase over 30 days, per CoinMarketCap.

“Pressures from the White House will not affect the work of the Federal Reserve.” – Jerome Powell, Chairman, Federal Reserve

Market Insights

Did you know? The Federal Reserve has historically faced political pressure during times of economic uncertainty, often emphasizing its independence in decision-making.

Insights from the Coincu research team indicate continued vigilance in financial sectors, noting that regulatory pressure may increase if inflation fears grow. Trends show resilience in Bitcoin demand amidst market turmoil, though consumption patterns remain sensitive to macroeconomic signals.

Investors are advised to stay informed and cautious as the Federal Reserve continues to prioritize data-driven policies over political pressures, which may lead to further market fluctuations.

Source: https://coincu.com/336305-fed-interest-rate-stance-powell-may2025/