- Lael Brainard’s dismissal signals White House intervention in Fed.

- Market volatility increases amid concerns over Fed independence.

- Potential impact predicted on USD and US Treasuries’ status.

Saul Eslake comments on the White House’s intervention in Federal Reserve governance after Lael Brainard’s dismissal, highlighting potential impacts on its independence.

This shift raises concerns over Federal Reserve independence, affecting US dollar stability, Treasury yields, and sparking cryptocurrency inflows during financial governance uncertainties.

Political Influence Raises Alarm on Fed Independence

Former Federal Reserve Vice Chair Lael Brainard’s removal has drawn attention, with Saul Eslake emphasizing a noticeable increase in White House interventions following President Trump’s institutional reforms. Brainard, a key figure with extensive experience in US economic policy, highlighted the risks to central bank independence and market credibility.

The changes at the Federal Reserve are seen as politically motivated, with alignment to political strategies at forefront. This fosters concerns over the transparency and reliability of economic data, potentially impacting the perceived stability of key financial instruments like the USD and US Treasuries.

Market volatility has intensified, with observers closely watching any implications for asset flows into traditional safe havens and cryptocurrencies. Notable insights include Kevin Hassett‘s comments on the preference for political loyalists in top financial roles to ensure that economic data suits political expectations. He stated, “The president wants his own people there so that when we see the numbers, they’re more transparent and more reliable.”

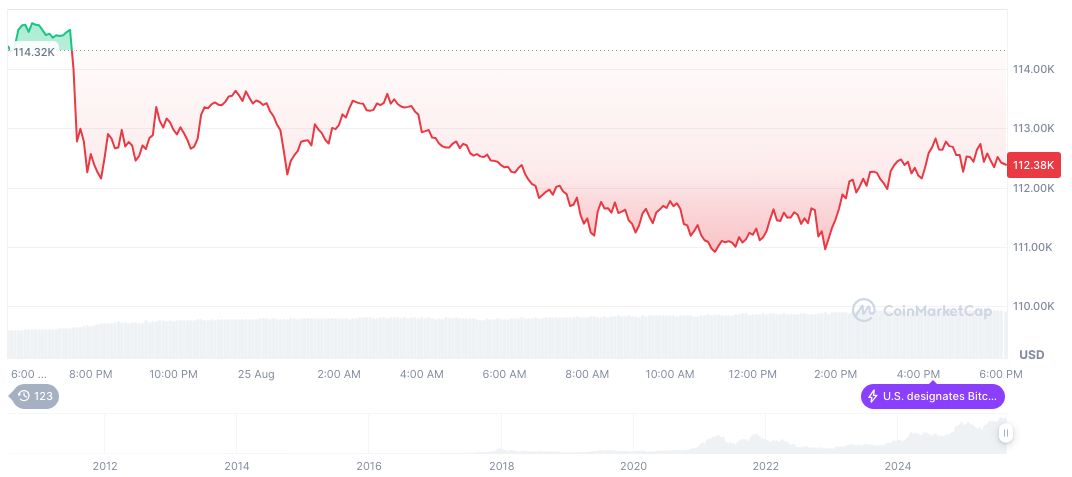

Bitcoin Prices Show Resilience Amid Federal Instability

Did you know? In past episodes of political influence over the Federal Reserve, such as in 2018 during President Trump’s tenure, Bitcoin saw increased demand as traders sought alternatives to traditional financial assets.

Bitcoin’s current price is $110,255.74 with a market cap of $2.20 trillion, according to CoinMarketCap data. Despite a recent 6.79% drop in 30-day price, BTC remains a prominent asset within the crypto sphere. Trading volume has increased by 23.00%, signaling active market participation despite price fluctuations.

The Coincu research team anticipates potential pressure on USD-pegged stablecoins if the Federal Reserve’s independence continues to erode. Historical trends suggest investors might move towards cryptocurrencies as protective hedge, impacting both market dynamics and regulatory discussions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/fed-leadership-changes-market-stability/