- Fed Chair Powell opens door for rate cut in September 2025.

- Speculation grows amid labor market cooling.

- Inflation still a concern; markets react cautiously.

Federal Reserve Chairman Jerome Powell signaled a potential rate cut in September, citing a slowdown in the labor market during a recent announcement.

This potential policy shift could influence asset markets, including cryptocurrencies like Bitcoin and Ethereum, historically sensitive to Federal Reserve rate adjustments.

Powell Signals Fed’s Potential Rate Cut Amid Inflation

The possibility of a rate cut in September 2025 addresses market concerns about persistent inflation and a cooling labor market. Jerome Powell, chairman since 2018, highlighted these issues during a recent Federal Reserve Open Market Committee meeting. Dissent was noted among board members, with Michelle W. Bowman and Christopher J. Waller advocating a quarter-point cut. Inflation has exceeded the Federal Reserve’s target of 2% for over four years, affecting consumer costs and business investments. As financial markets react, cryptocurrencies like BTC and ETH often experience heightened risk-on flows, driven by investor speculation.

Market sentiment remains unsettled as the labor market’s cooling raises demand for a stimulus. However, Powell’s indication of a slower pace of rate cuts in light of inflation has tempered market enthusiasm. Official remarks state that uncertainty persists regarding the economic outlook, and risks to the dual mandate are being monitored. Digital assets may see price increases with speculative inflows as dollar liquidity potentially improves with rate cuts.

“Members agreed that inflation remained somewhat elevated. Members agreed that uncertainty about the economic outlook remained elevated and that the Committee was attentive to the risks to both sides of its dual mandate.” — Jerome Powell, Federal Reserve

Cryptocurrency Markets Brace for Fed Policy Changes

Did you know? The last Federal Reserve pivot towards easing in July 2023 led to a significant rally in BTC and ETH, demonstrating a pattern where crypto assets respond positively to potential rate cuts due to improved dollar liquidity.

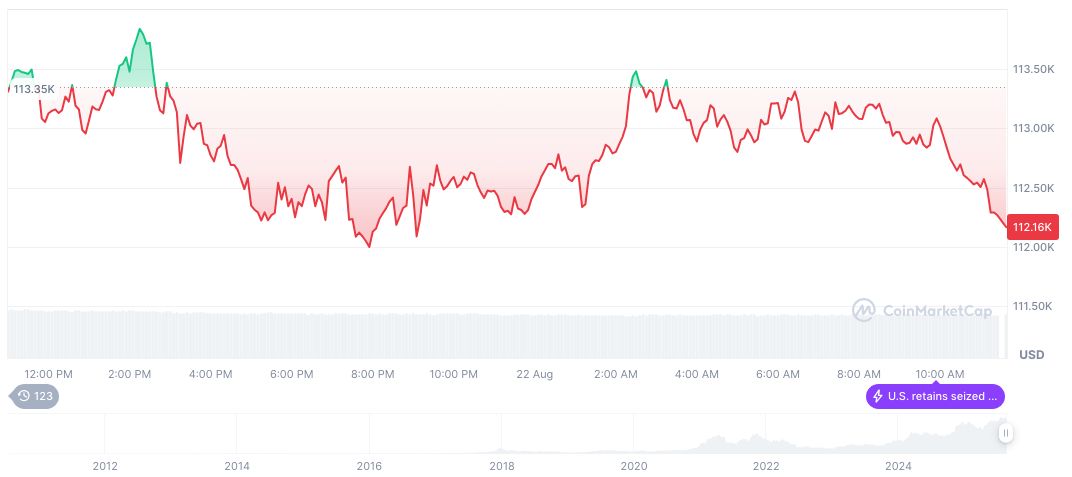

According to data from CoinMarketCap, Bitcoin (BTC) recorded a 3.99% increase over the past 24 hours, reaching a current price of $116,978.60. The market cap stands at $2.33 trillion, with trading volume rising 36.48% in the last day, reflecting broader market reactions to monetary policy changes.

The Coincu research team anticipates that crypto markets may respond with heightened volatility as a result of Powell’s announcement. Lower interest rates historically fuel investor interest in high-risk assets like digital currencies, which could benefit from changes in U.S. monetary policy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-inflation-september-2025/