- Fed’s Waller proposes July rate cut amidst stable job market conditions.

- Increased rate cut probability could boost cryptocurrency values.

- Market anticipates Fed’s dovish tone affecting economic trends.

Fed Governor Christopher Waller stated that the Federal Reserve might implement a rate cut as early as July, highlighting concerns over the job market despite stable conditions as of June 20, 2025.

Waller’s comments imply a shift in U.S. monetary policy, emphasizing the Fed’s proactive stance to prevent an economic downturn. This approach has historically been favorable for cryptocurrency markets.

Waller’s Dovish Stance and Economic Implications

Christopher Waller, Governor of the U.S. Federal Reserve, indicated a potential rate cut in July, underscoring the Fed’s readiness for proactive policy easing. Waller noted, “I think we’re in the position that we could do this [cut rates] and as early as July… Why do we want to wait until we actually see a crash before we start cutting rates?” His remarks increased market confidence in a July rate cut, previously noted as a low probability event.

Waller’s statements refer to emerging labor market weaknesses, particularly graduate unemployment. This reinforces the Fed’s stance on acting before a crisis materializes, and supports looking through tariff-induced inflation when setting policy rates. Such policies historically benefit risk assets, including cryptocurrencies, triggering potential market shifts.

Financial markets responded positively, with investors adjusting their outlook on monetary policy. Cryptocurrency sectors, sensitive to interest rate cuts, anticipate beneficial impacts. Governor Waller’s emphasis on preemptive measures sets the stage for potential easing, aligning financial strategies across various sectors.

Impact on Cryptocurrency and Historical Analysis

Did you know? Historical contexts show that Fed rate cuts often boost Bitcoin, with previous dovish signals in 2019 and 2020 leading to significant price rallies of major cryptocurrencies.

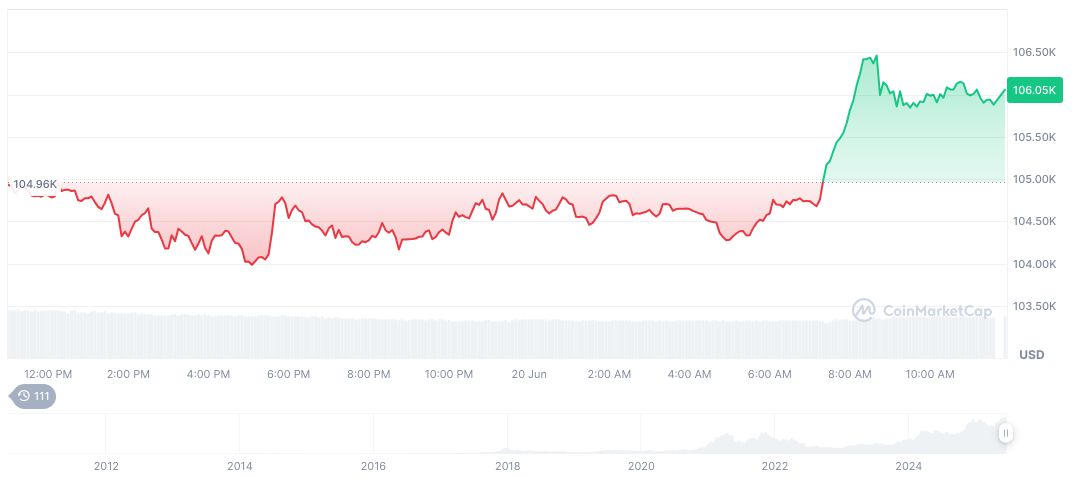

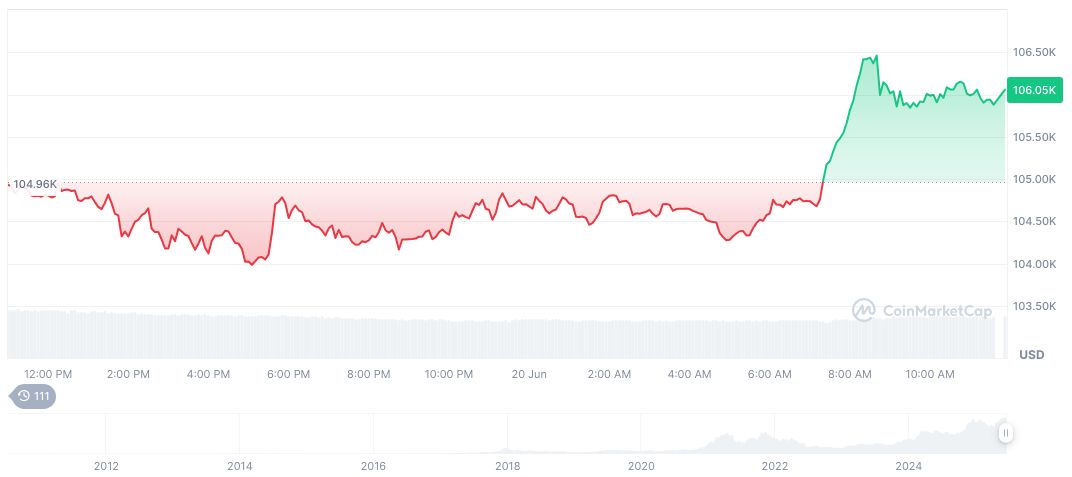

Per CoinMarketCap, Bitcoin (BTC) is currently at $106,117.44, achieving a market cap of $2.11 trillion, marking a 1.38% rise over the last 24 hours. The cryptocurrency exhibits a dominant 64.12% market share. Trading volumes reached approximately $40.19 billion, a 10.87% decrease from previous levels.

Coincu research suggests that U.S. monetary policy adjustments align with increased cryptocurrency investment, interpreting dovish signals as catalysts for digital asset markets. Rate cuts frequently drive crypto prices upward, emphasizing Bitcoin’s sustained growth amid macroeconomic policy shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344509-fed-governor-waller-july-rate-cut/