- Federal Reserve Governor suggests potential July rate cut.

- Rate cut may boost risk assets, including crypto.

- Historical precedence indicates crypto rallies post rate cuts.

Christopher J. Waller, of the Federal Reserve, announced a potential rate cut scenario by July 2025 during the FOMC meeting. This pivot gains attention in the financial and crypto sectors.

Rate cuts generally embolden market sentiment by reducing lending costs and boosting risk appetite, potentially driving capital into crypto assets.

Fed Strategies: July 2025 Interest Rate Reduction Insights

Federal Reserve Governor, Christopher J. Waller, hinted a possibility of interest rate cuts during the upcoming July 2025 meeting. This announcement marks a significant move by the Fed, suggesting monetary policy adjustments aimed at stimulating economic activity amid uncertain economic conditions. Waller, a pivotal figure, steers monetary policy discourse at the Fed. According to him, “there may be a possibility of interest rate cuts as early as the July 2025 FOMC meeting” federalreserve.gov.

The potential reduction in rates is expected to shift investor focus towards riskier assets, like cryptocurrencies. Such adjustments typically impact traditional investment avenues, encouraging a flow of capital into assets like Bitcoin (BTC) and Ethereum (ETH). By lowering borrowing costs, the Federal Reserve effectively enhances liquidity across financial markets.

The market response to this announcement has been one of anticipation and speculation. Key figures in the industry are yet to make public statements regarding the Fed’s prospective action. Financial experts anticipate rising interest in decentralized finance (DeFi) ecosystems and alternative tokens, driven by changed macroeconomic scenarios.

Crypto Markets Brace for Potential Fed-Induced Capital Influx

Did you know? The Federal Reserve cut rates in early 2020 during the COVID-19 crisis, which led to a significant increase in crypto adoption, with Bitcoin and Ethereum both seeing substantial gains.

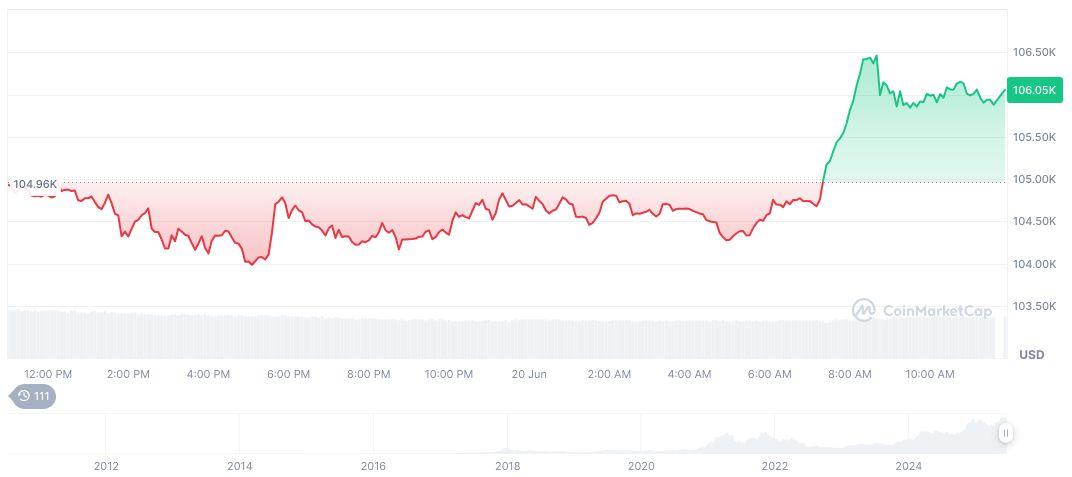

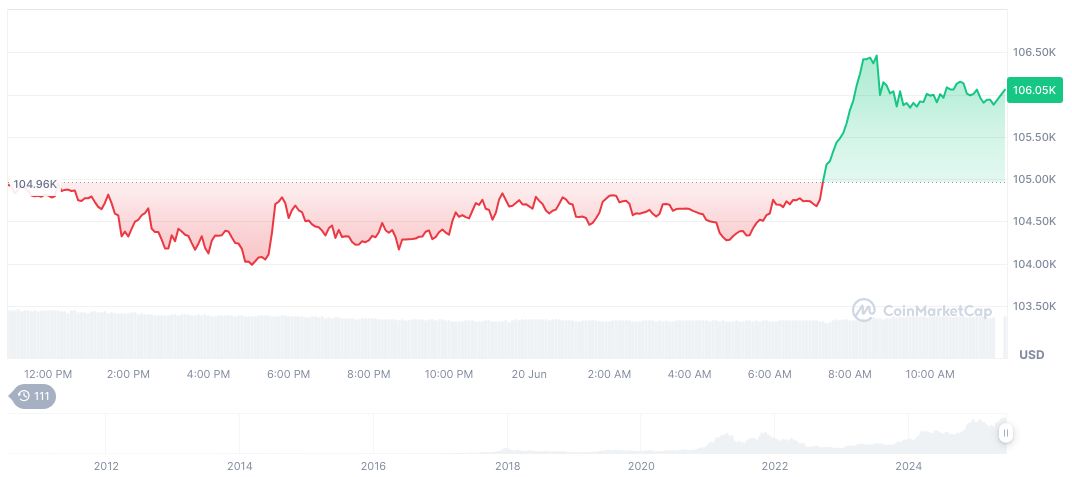

As of June 20, 2025, Bitcoin (BTC) is priced at $106,038.43 with a market cap of $2.11 trillion, accounting for a 64.10% market dominance. Trading volume stands at $40.93 billion, down 7.86% in 24 hours. BTC’s price increased 1.22% over the past day, while it rose 25.93% over the last 90 days, as reported by CoinMarketCap.

The Coincu research team offers insights on this potential monetary easing, suggesting increased capital flows into crypto markets. A history of rate cuts leading to crypto rallies paints a positive outlook. On-chain data and DeFi engagement metrics serve as indicators of future market behavior. The potential regulatory adjustments following such cuts must also be closely observed for comprehensive understanding.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344504-fed-july-interest-cut-crypto/