- Fed Chairman warns tariffs are driving inflation expectations higher.

- Potential rise in inflation may affect employment.

- Significant implications for U.S. monetary policy.

Jerome Powell, Chairman of the Federal Reserve, highlighted that recent tariff increases are significantly driving inflation expectations, possibly leading to higher inflation and lower employment if they persist.

Survey respondents pointed out that tariffs are the main factor driving inflation expectations. The impact of tariffs has been much greater than expected so far. If the announced significant increase in tariffs continues, there will be higher inflation and lower employment. Avoiding sustained inflation will depend on the scale, timing, and inflation expectations of the tariffs.

Tariffs Drive U.S. Inflation Concerns

Jerome Powell, Chairman of the Federal Reserve, identified tariffs as a primary driver of inflation expectations. Survey respondents have shown concern over the substantial role tariffs play in fueling inflation. If these increases continue, the impact could move towards higher inflation and reduced employment levels. Powell’s insights are drawing attention across financial markets globally.

A continued increase in tariffs could lead to inflationary pressures affecting diverse sectors, such as manufacturing and consumer goods. Market responses to Powell’s warning are tepid, with investors watching for further policy shifts. Countries engaged in tariff disputes consider potential mitigation strategies to counteract emerging inflation pressures, driving speculation on future economic impacts.

Survey respondents pointed out that tariffs are the main factor driving inflation expectations. The impact of tariffs has been much greater than expected so far. If the announced significant increase in tariffs continues, there will be higher inflation and lower employment. Avoiding sustained inflation will depend on the scale, timing, and inflation expectations of the tariffs.

Bitcoin as a Hedge in Economic Volatility

Did you know? In past tariff hikes, such as during the 2018–2019 U.S.-China trade tensions, Bitcoin (BTC) often reacted as a risk-off asset during heightened volatility, reflecting its potential as a hedge against macroeconomic instability.

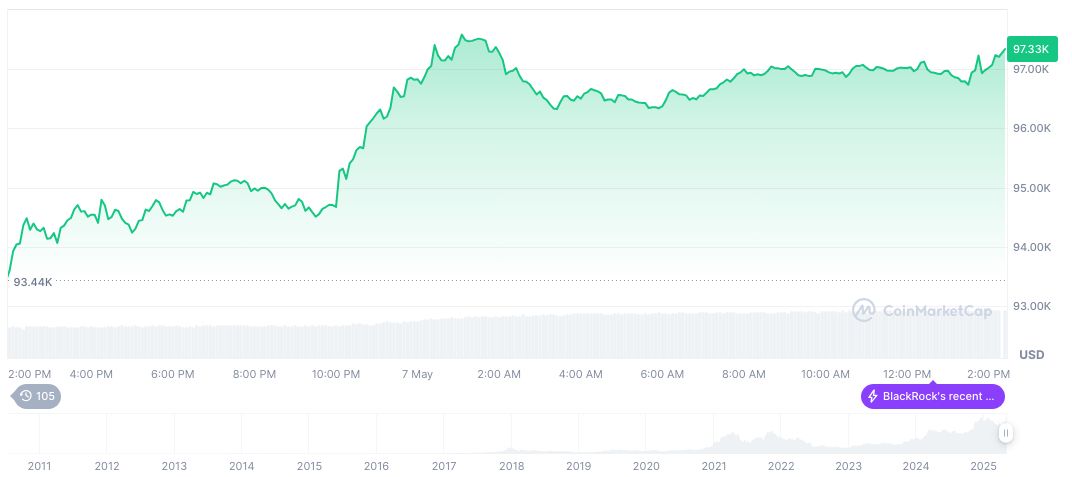

As of May 8, 2025, Bitcoin (BTC) holds a market cap of $1.97 trillion and trades at $99,152.97, reflecting a 2.80% price increase over the past 24 hours. Bitcoin’s market dominance stands at 64.18%, according to CoinMarketCap.

Insights from the Coincu research team suggest that Powell’s remarks could catalyze discussions on potential regulatory measures impacting financial markets. Enhancing policy transparency might stabilize investor sentiment, offsetting volatility linked to macroeconomic uncertainties.

Source: https://coincu.com/336302-fed-powell-tariffs-inflation-warning/