- XRP nears $2.999 Fibonacci resistance, signaling a possible bullish continuation.

- Renewed inflows of $19.6M and rising open interest fuel investor accumulation.

- Holding $2.94–$2.88 support is vital for XRP’s push toward $3.18 and beyond.

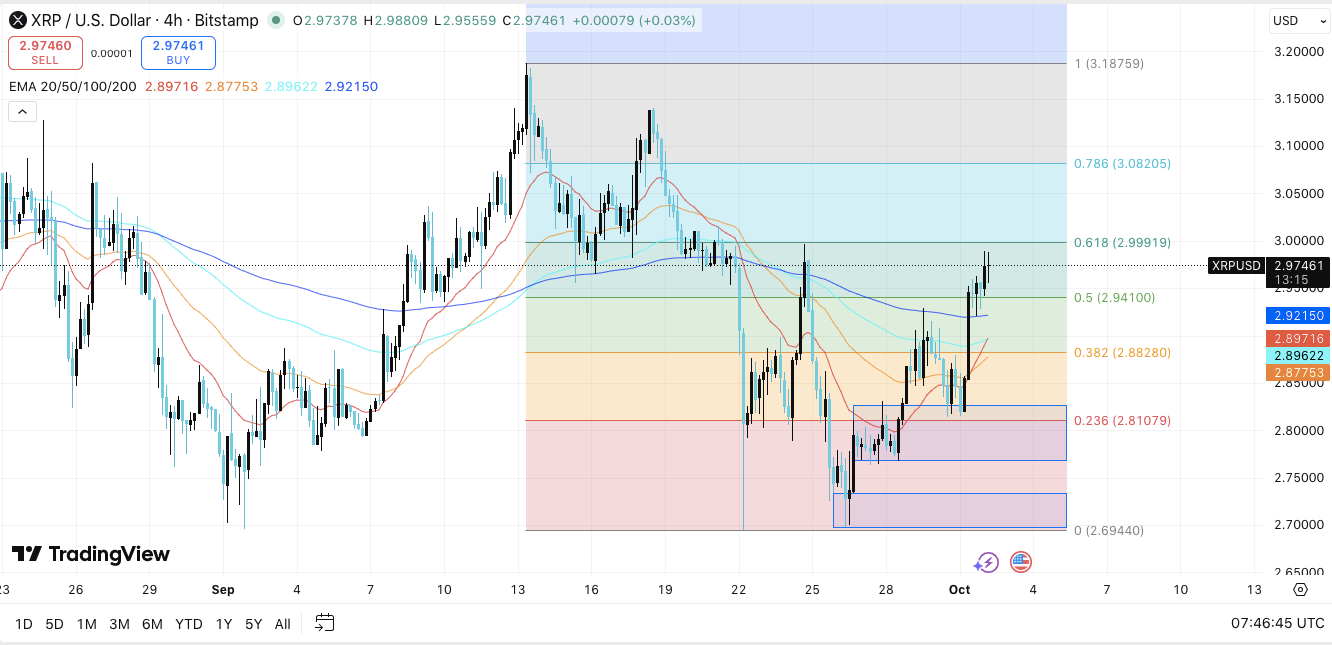

XRP/USDT has recently demonstrated a notable rebound, reflecting growing investor confidence and heightened market activity. The 4-hour chart highlights a robust recovery, with the cryptocurrency currently trading near $2.97.

This level sits just below the critical 61.8% Fibonacci retracement at $2.999, acting as a key resistance barrier. If XRP breaks decisively above this level, it could pave the way toward the 78.6% retracement at $3.08, followed by the previous swing high near $3.18.

Technical Momentum Supports Upside Potential

The short-term momentum remains bullish, supported by moving averages. XRP currently trades above the 20 EMA at $2.89, the 50 EMA at $2.87, and the 200 EMA at $2.92. This alignment reinforces the strengthening trend and signals that buyers are firmly in control. On the downside, immediate support exists at the 50% Fibonacci level of $2.94.

Should this level fail, the 38.2% retracement at $2.88 and the 23.6% level at $2.81 provide additional cushioning. A deeper pullback would test the recent low near $2.69. Consequently, the price structure suggests that XRP has solid short-term support while maintaining clear upside targets.

Related: XRP Price Nears Breakout as Ripple Locks 200 Million XRP in Escrow

Inflows, Outflows, and Futures Activity

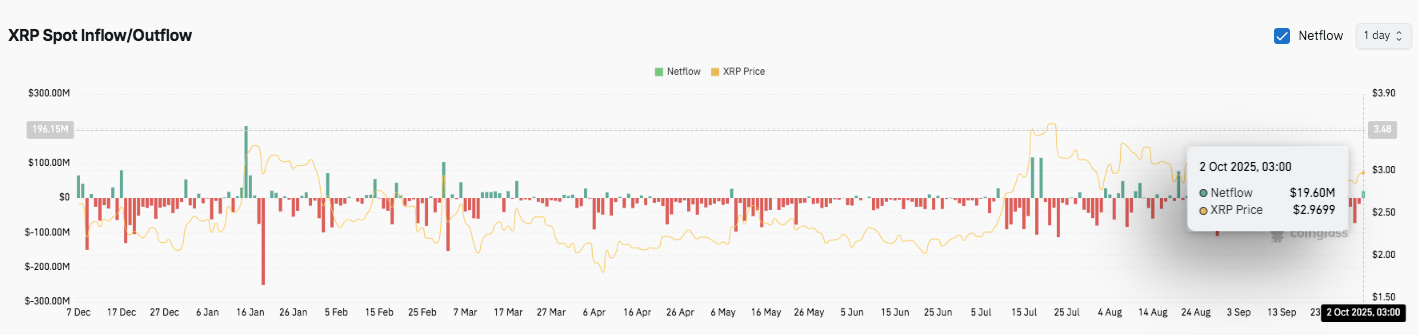

Investor activity in XRP has shifted notably in recent months. Between May and August, sustained outflows created selling pressure, suppressing prices.

However, inflows returned in late August and September, signaling renewed accumulation. On October 2, 2025, net inflows reached $19.6 million, coinciding with XRP’s push near $2.97. This pattern suggests fresh demand could support further upward momentum.

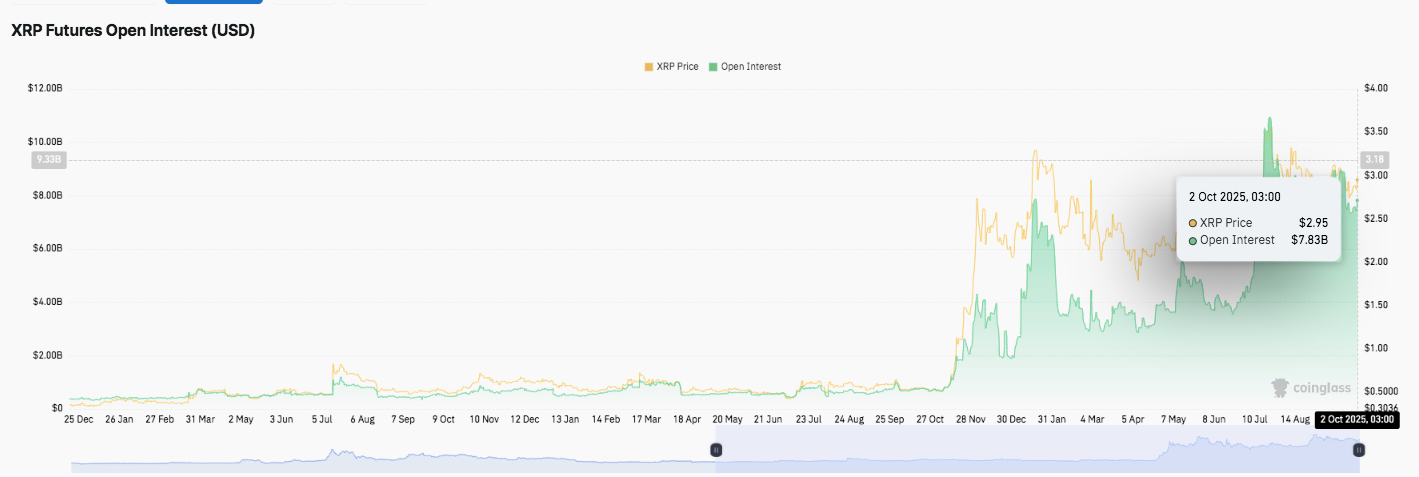

Additionally, the futures market reflects heightened trader activity. Open interest rose to $7.83 billion, highlighting speculative participation alongside price gains.

Frequent spikes in inflows and outflows indicate active profit-taking and leveraged trading pressure. Consequently, sustained inflows could drive prices higher, while heavy outflows might trigger short-term corrections or liquidation events.

Technical Outlook for XRP Price: Key Levels Heading into October

- Upside levels: $3.00, $3.08, and $3.18 serve as immediate resistance hurdles. A decisive break above $3.18 could open the way toward $3.30 and $3.45.

- Downside levels: $2.94 trendline support is the first line of defense, followed by $2.88 and $2.81. A breach of these levels could test the recent low near $2.69.

- Resistance ceiling: The 61.8% Fibonacci retracement at $2.999 is the key level to flip for sustained medium-term bullish momentum.

The technical picture suggests XRP is consolidating above key moving averages, creating a bullish alignment across short- and medium-term timeframes. Price compression near $2.97 indicates that a breakout in either direction could trigger a significant move.

Related: XRP Breaks Out? Classic Chart Patterns Align with ETF Deadline Surge

Will XRP Continue Upward?

XRP’s October trajectory depends on whether buyers can hold the $2.94–$2.88 zone long enough to challenge resistance at $3.00–$3.08. Positive inflows and growing futures activity hint at potential upside, while historical patterns suggest volatility may increase as capital accumulates.

If bullish momentum strengthens, XRP could retest $3.18 and aim for $3.30–$3.45. Conversely, failure to defend $2.88–$2.94 may trigger a deeper pullback toward $2.81 and $2.69.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-eyes-3-as-fibonacci-levels-support-recovery/