Dogecoin price is fairing well, as the asset gained 7% over the last few days before slightly retracing. The surge in price facilitated a breakout from a bullish pattern, and now DOGE is primed at 22%, but only if a key resistance level first breaks. Despite the bullish price action, there is an overall bearish sentiment by traders as DOGE saw huge exchange inflows yesterday. Are traders planning to crash the DOGE price, and will it survive the onslaught?

Dogecoin Price Defies Market Sentiment

The price of DOGE slightly dropped 1.2% over the last 24 hours to trade at $0.1039. This small drop is a large contrast from the bearish market sentiment building up against the meme coin.

Meanwhile, Elon Musk inadvertently brought attention to Dogecoin with his recent post about accepting a fictional Cabinet office offer abbreviated D.O.G.E. The tech mogul has also rehashed his cold war with UK justice minister Keir Starmer by calling the country a “police state”.

On Tuesday, there was a net exchange flow of $4.43 million, the largest since July 20, 2024. This signifies there may be a scheme to push the price of DOGE lower.

Data from Coinglass further shows that the open interest (OI) of DOGE increased while the price dropped over the last 24 hours. When this happens, it signals traders are entering Short positions, which is bearish for the price.

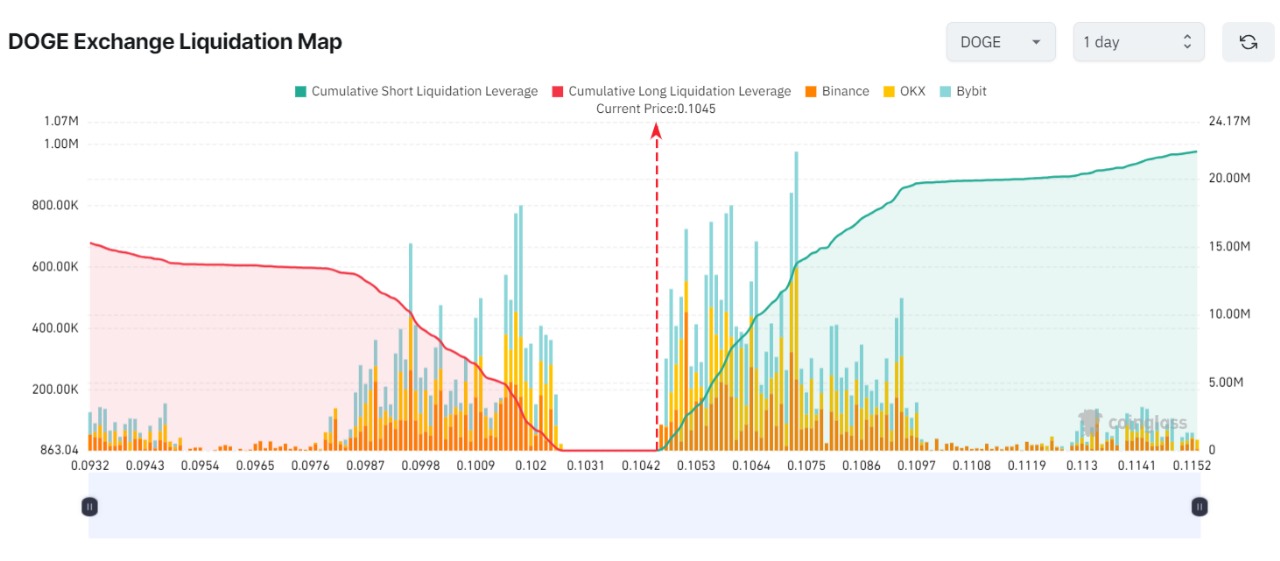

Further, the Coinglass Liquidation Map shows a larger cumulative Short Liquidation Leverage compared to Longs. The imbalance indicates that traders are bearish on the asset price as they anticipate the price will drop lower.

Despite negative market sentiment, Dogecoin price prediction show the asset is gearing up for a 22% jump in the coming days.

DOGE Technical Analysis: All Eyes on $0.1085

The Dogecoin price chart broke out of a falling wedge that had been forming from early August, indicating potential bullish momentum. The recent candlestick pattern shows a strong upward move out of the triangle, which is typically a bullish signal, especially after a period of consolidation within the triangle.

The price of Dogecoin may find resistance around $0.1059 as it aligns with the upper Bollinger Band. Beyond that, it could rise to $0.1274 (approximately a 22% increase).

The price has moved towards the upper band of the Bollinger Bands, indicating strong momentum. If it stays near or above this band, it could suggest continued bullish pressure. Additionally, the bands are currently contracting, which indicates a period of low volatility that usually precedes an explosive directional move.

The Coppock Curve is positive, currently at 3.02571, indicating upward momentum. This is a bullish signal as the curve is trending upwards from below.

If already holding, as the price remains above the $0.0995 support, DOGE remains a good long bet. The next major target beyond $0.1274 could be the $0.1500 level, depending on broader market conditions.

Dogecoin price prediction shows that if the asset returns inside the triangle, it could signal market weakness, causing it to drop lower to $0.0985 and $0.0800.

Frequently Asked Questions (FAQs)

Despite recent bullish moves, bearish sentiment is growing. Increased exchange inflows and a rise in short positions suggest traders may be preparing to push Dogecoin price lower.

Elon Musk inadvertently drew attention to Dogecoin with a recent post involving the abbreviation “D.O.G.E.” for a fictional Cabinet office.

### FAQ: Dogecoin Price Analysis – Potential 17% Gains If Key Resistance Level Is Broken **1. What is the current status of Dogecoin’s price?** Dogecoin’s price experienced a 7% gain in recent days, followed by a slight retracement. It is currently trading at $0.1039 after a small 1.2% drop over the last 24 hours. **2. What does the recent price action suggest about Dogecoin’s future?** Despite a slight drop, Dogecoin recently broke out of a bullish pattern, indicating potential for further gains. Technical analysis suggests a possible 22% price increase if the asset can break through a key resistance level at $0.1085. **3. What resistance levels are critical for Dogecoin’s potential price surge?** Dogecoin faces initial resistance around $0.1059, aligning with the upper Bollinger Band. If it breaks this level, the price could surge to $0.1274, which is approximately a 22% increase. The next significant target could be $0.1500, depending on broader market conditions. **4. How has market sentiment affected Dogecoin’s price?** Despite recent bullish price action, there is a growing bearish sentiment in the market. Increased exchange inflows suggest that traders may be planning to push the price lower. Additionally, data shows that many traders are entering short positions, indicating bearish expectations. **5. What impact has Elon Musk had on Dogecoin recently?** Elon Musk inadvertently drew attention to Dogecoin with a recent post involving the abbreviation “D.O.G.E.” for a fictional Cabinet office. Although not directly related to the coin’s fundamentals, his influence often impacts market sentiment around Dogecoin. **6. What does technical analysis indicate for Dogecoin?** Technical indicators like the Bollinger Bands and the Coppock Curve suggest that Dogecoin is experiencing strong upward momentum. The Bollinger Bands are contracting, signaling a potential period of volatility, and the Coppock Curve is currently positive, indicating upward momentum. **7. What are the risks to Dogecoin’s potential rally?** If Dogecoin fails to maintain momentum and drops back inside the previous triangle pattern, it could signal market weakness. In this case, the price might decline to $0.0985 or even as low as $0.0800. **8. What should traders watch for in the coming days?** Traders should monitor whether Dogecoin can break through the $0.1085 resistance level. If it does, the price could see a significant rally. However, increasing bearish sentiment and market volatility could pose risks to this potential surge. **9. How might increased bearish sentiment affect Dogecoin?** If bearish sentiment continues to grow, it could thwart Dogecoin’s efforts to rally, potentially leading to a price decline instead of the anticipated gains. **10. Is now a good time to invest in Dogecoin?** If Dogecoin maintains support above $0.0995, it remains a promising long-term bet. However, investors should be cautious and consider broader market conditions and potential volatility before making decisions.

Related Articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/dogecoin-price-analysis-expect-17-gains-if-doge-breaks-this-level/

✓ Share: