- EU regulators question US Treasury’s safe-haven role, affecting market dynamics.

- US Treasuries face scrutiny amid global financial uncertainty.

- Shift in asset allocation boosts gold and Euro value.

The European financial regulatory authority has raised questions regarding the safe-haven status of US Treasury bonds, as reported by FXStreet on April 17. This scrutiny surfaces amid ongoing tariff escalations and financial instability concerns.

This development holds significance as it may alter international investment patterns, influencing the demand for alternative assets and impacting global market stability.

EU Scrutiny of US Treasuries Signals Financial Shift

The European regulators’ inquiry into US Treasuries’ safe-haven role signals a potential shift in the global financial landscape, challenging longstanding asset hierarchies. Leading bodies such as ESMA and ECB are examining US Treasury bonds amid rising market volatility and geopolitical tensions. As US yields fluctuate, the appeal of these bonds as a dependable investment is being questioned, prompting a reassessment by investment communities worldwide. Market reactions are evident in the increased allocations towards gold and Euro-denominated assets, perceived as safer havens in turbulent times. Industry experts like Michael Cahill of Goldman Sachs have highlighted the ongoing crisis, calling it a significant shift in the US exceptionalism trade. “This represents the crisis of the US exceptionalism trade.” Similarly, Ayesha Tariq notes the renewed interest in gold as a key safe-haven option.

Coincu’s research team suggests that the EU’s evaluation of US Treasury bonds could lead to increased regulatory frameworks impacting global asset transparency. Technological advancements in market data consolidation may further influence future financial stability, reinforcing the importance of diversified investment strategies.

Industry experts like Michael Cahill of Goldman Sachs have highlighted the ongoing crisis, calling it a significant shift in the US exceptionalism trade. “This represents the crisis of the US exceptionalism trade.” Similarly, Ayesha Tariq notes the renewed interest in gold as a key safe-haven option.

Historical Role of Treasuries Under EU Examination

Did you know? During past market crises, US Treasuries historically served as global financial stabilizers, with central bank interventions restoring their safe-haven status—a role now under scrutiny by EU regulators amidst current geopolitical changes.

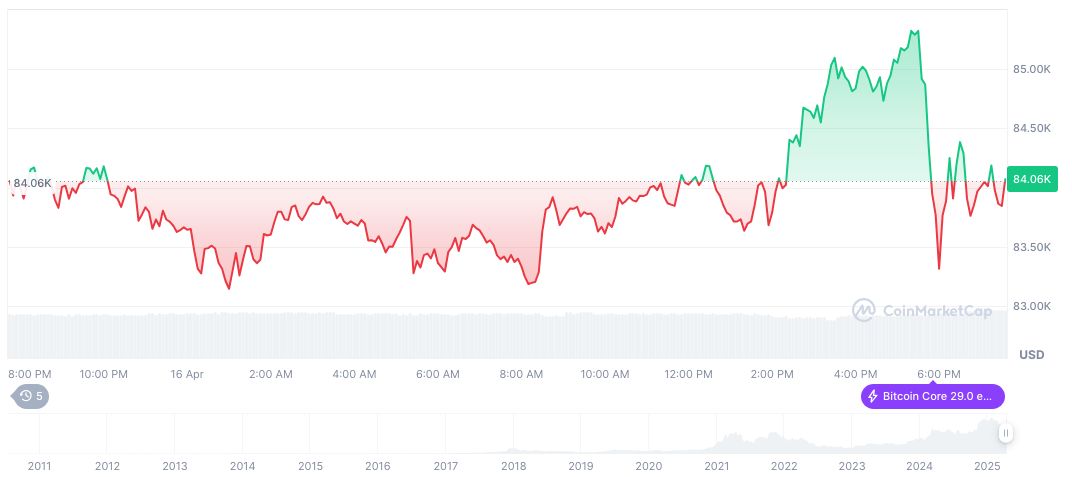

Bitcoin, according to CoinMarketCap data as of April 17, 2025, is valued at $84,437.22, with a market cap of $1.68 trillion and a dominance of 62.96%. Its 24-hour trading volume decreased by 6.07% to $25.22 billion. Over the past 60 to 90 days, Bitcoin’s price has seen declines of 13.03% and 17.60%, respectively.

Coincu’s research team suggests that the EU’s evaluation of US Treasury bonds could lead to increased regulatory frameworks impacting global asset transparency. Technological advancements in market data consolidation may further influence future financial stability, reinforcing the importance of diversified investment strategies.

Source: https://coincu.com/332733-eu-review-us-treasuries-stability/