- The EU plans to ban multi-issuer stablecoins over market stability concerns.

- EU market regulation changes could impact major existing stablecoins.

- Notable figures call for robust regulatory equivalence regimes.

European Union regulators, led by ECB President Christine Lagarde, are advocating for strict regulations on multi-issuer stablecoins to prevent market instability and liquidity crises, according to recent announcements.

Stricter enforcement of MiCA regulations could lead to significant shifts in the stablecoin market, impacting institutional investors and encouraging a pivot towards European-compliant digital currencies.

EU Targets Multi-Issuer Stablecoins Amid Market Concerns

Regulators in the European Union, led by Christine Lagarde, are proposing a ban on multi-issuer stablecoins to curtail market instability risk. The proposal targets stablecoins issued across borders and aims to enforce compliance under the Markets in Crypto Assets (MiCA) framework.

MiCA stipulations require at least 60% of reserves in European financial institutions for stablecoins. As a result, non-compliance may lead to asset delisting by March 2025. This move aligns efforts to mitigate potential liquidity crises affecting significant digital assets.

Christine Lagarde emphasized the necessity for robust regulatory equivalence regimes to safeguard EU markets from external stability risks. She highlighted, “We know the dangers. And we do not need to wait for a crisis to prevent them. That is why we must take concrete steps now. European legislation must apply the same stringent reserve requirements to non-EU stablecoin issuers as to EU issuers.” Federico Cornelli stated the digital euro remains the only legal tender, reinforcing urgency for euro-denominated alternatives.

Regulatory Changes Could Reshape Stablecoin Liquidity Dynamics

Did you know? Historically, digital euro initiatives and euro stablecoins have positioned themselves as compliant models in response to regulatory clarifications, potentially influencing market direction as MiCA enforcement intensifies.

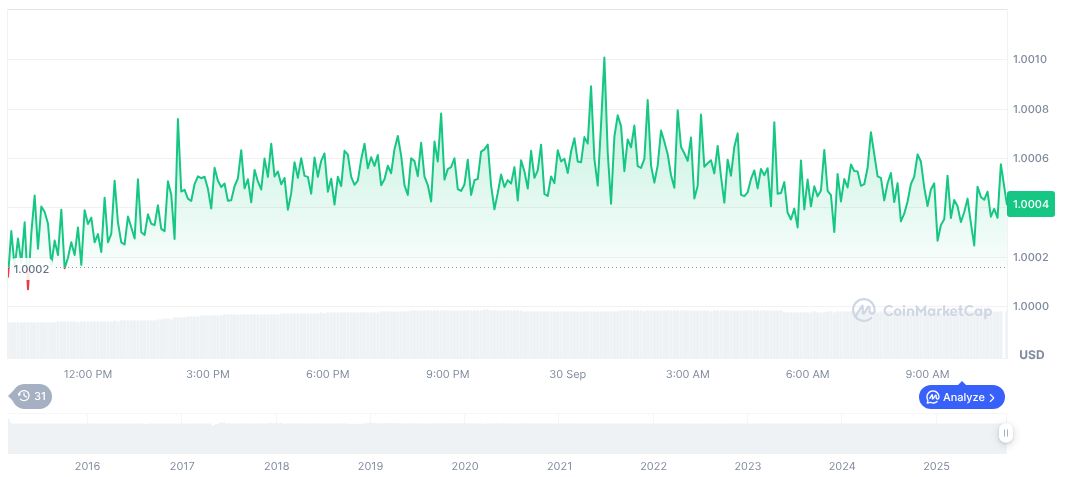

CoinMarketCap data reports that Tether USDt (USDT) maintains a price of $1.00 with a market cap of $174,775,147,983 and a 24-hour trading volume of $150,622,388,489. Price fluctuations have registered a 1.04% increase over 24 hours and a -0.45% change over the past week.

Insights from Coincu’s research team suggest that strong regulatory constraints on non-EU stablecoins may incentivize shifts to euro-pegged assets. Additionally, rising compliance standards could reshape liquidity dynamics in decentralized finance protocols, as noted in the Solana ETF staking support update.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/eu-considers-multi-issuer-stablecoin-ban/