- 30% EU tariffs incoming on U.S. goods if U.S. tariffs proceed.

- Plan to impose tariffs worth approx. €100 billion.

- Tariffs affect Boeing, U.S.-made cars, bourbon whiskey.

ChainCatcher reports that the EU plans a response with 30% tariffs on U.S. goods, should U.S. President Trump enforce similar tariffs on EU exports after August 1.

Awaiting potential U.S. tariffs, the EU’s planned 30% tariff counteract could influence industries globally, affecting market dynamics and political relations.

EU to Target $100 Billion in U.S. Exports with Tariffs

Recent reports indicate that the European Union intends to impose counter-tariffs if the U.S. follows through with the current tariff threats. The list of targeted U.S. exports includes Boeing aircraft, U.S.-made automobiles, and bourbon whiskey, amounting to approximately €100 billion.

The situation remains volatile, with potential global market repercussions. These tariffs are set to take effect if the U.S. implements its duties next month. This development reflects heightened tensions between the EU and U.S. on trade matters.

Based on the structured review provided, it appears that there are no current verified quotes or statements from key players regarding the alleged U.S.-EU tariff escalation.

Global Markets on Edge as Trade Tensions Rise

Did you know? In the U.S.-China trade war (2018-2019), reaching similar impasses led to noticeable shifts in both global markets and cryptocurrency valuation patterns, setting precedents for today’s scenarios.

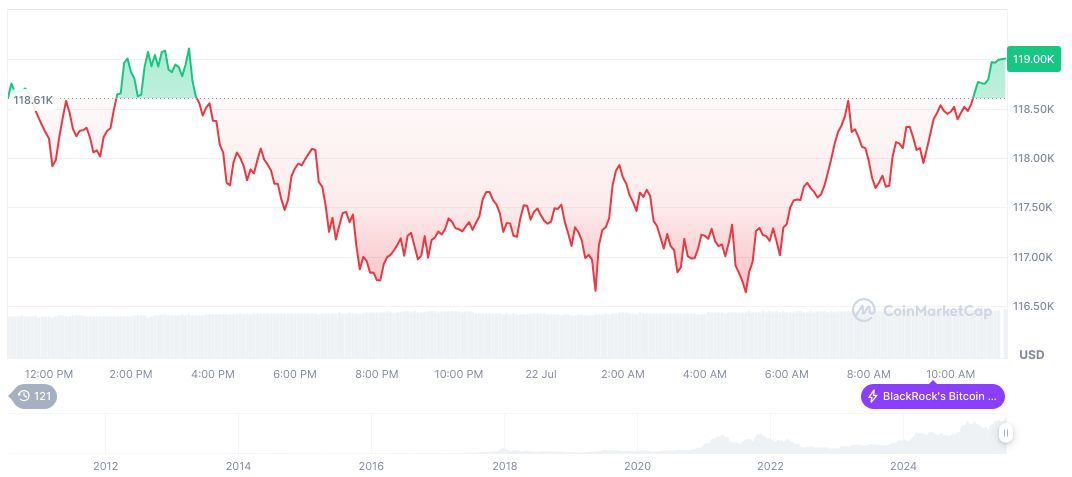

Bitcoin (BTC) currently trades at $118,385.32, as reported by CoinMarketCap, with a market capitalization of $2.36 trillion. BTC’s 24-hour trading volume stands at $69.52 billion with a slight dip of 0.54% in the last day, reflecting current market uncertainty.

The Coincu research team suggests that any further trade tensions could significantly influence cryptocurrency markets. Historical trade conflicts have led to increased crypto market interest, serving as a hedge or investment avenue during uncertain financial climates. Check Saylor Discusses Cryptocurrency Strategies and Market Insights for more insights.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/eu-tariffs-us-trade-threats/