- Von der Leyen leads EU in US tariff negotiations.

- Negotiations open; global trade implications possible.

- Market cautious; crypto unaffected for now.

Ursula von der Leyen, European Commission President, stated on July 3 that negotiations with the United States on tariffs are underway, with all options available if no agreement is reached.

The discussions are significant as they impact transatlantic trade dynamics, influencing markets, and risking broader economic ramifications.

EU-US Tariff Talks: History and Economic Ramifications

European Commission President Ursula von der Leyen addressed EU-US trade, emphasizing readiness for an agreement on tariffs while keeping options open. “We are ready for a deal. At the same time, we are preparing for the possibility that no satisfactory agreement is reached. This is why we consulted on a rebalancing list and we will defend the European interest as needed. In short, all options remain on the table.” European Commission. This follows a history of strained trade relations, with escalating tariffs on steel and automobiles. U.S. tariffs on EU goods have formed the core of this dialogue, with steel and car components among the sectors most affected by recent policies. Both sides have engaged in intensive consultations to explore pathways to stabilize trade import-export balances.

If talks resolve without consensus, the EU may implement a rebalancing list and other financial tools to mitigate trade disparities. Broader financial implications could manifest with potential impacts on risk assets and equities if frictions continue.

Market sentiment remains cautious. A failure in securing mutually agreeable terms may impact investor confidence. As officials deliberate, trading floors and exchanges are observing the potential ripple effects on international supply chains and pricing structures.

Comparative Insights: EU-US Talks and Crypto Market Stability

Did you know? The current EU-US tariff discussions are reminiscent of the US-China tariff rows in 2018-2019, frequently causing fluctuations in global markets.

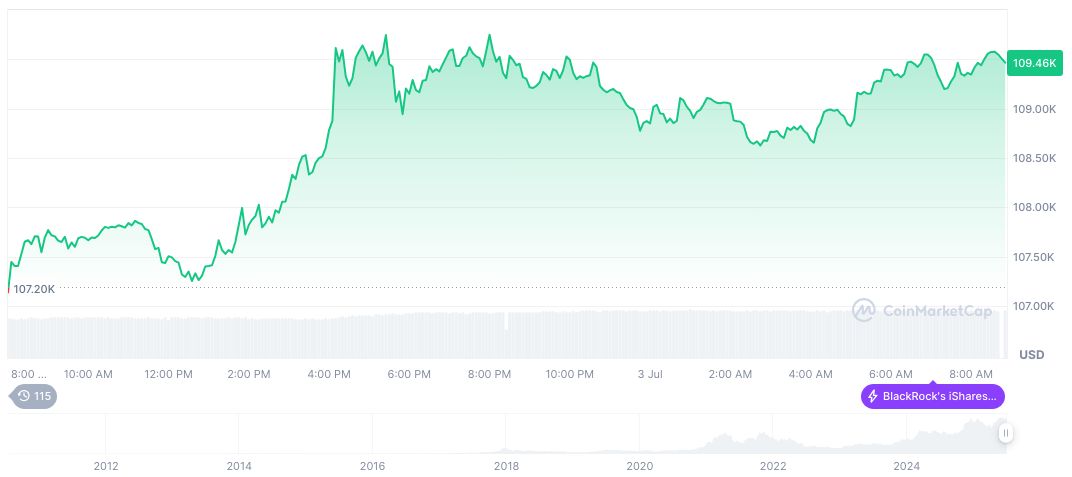

Bitcoin (BTC), as per CoinMarketCap, holds a market capitalization of $2.16 trillion with a trade volume nearing $58.34 billion, while its price has risen by 31.65% over the past 90 days.

The Coincu research team anticipates that ongoing EU-US negotiations could proceed without direct impacts on crypto assets. However, unexpected results from discussions may influence financial policies and strategies for digital currencies, which are already being monitored in light of historical trends. Michael Saylor’s strategy continues to support Bitcoin’s resilience.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346618-eu-us-tariff-agreement-options/