- Solana price holds $224–$230 support while testing $246–$252 resistance as buyers eye $265 next.

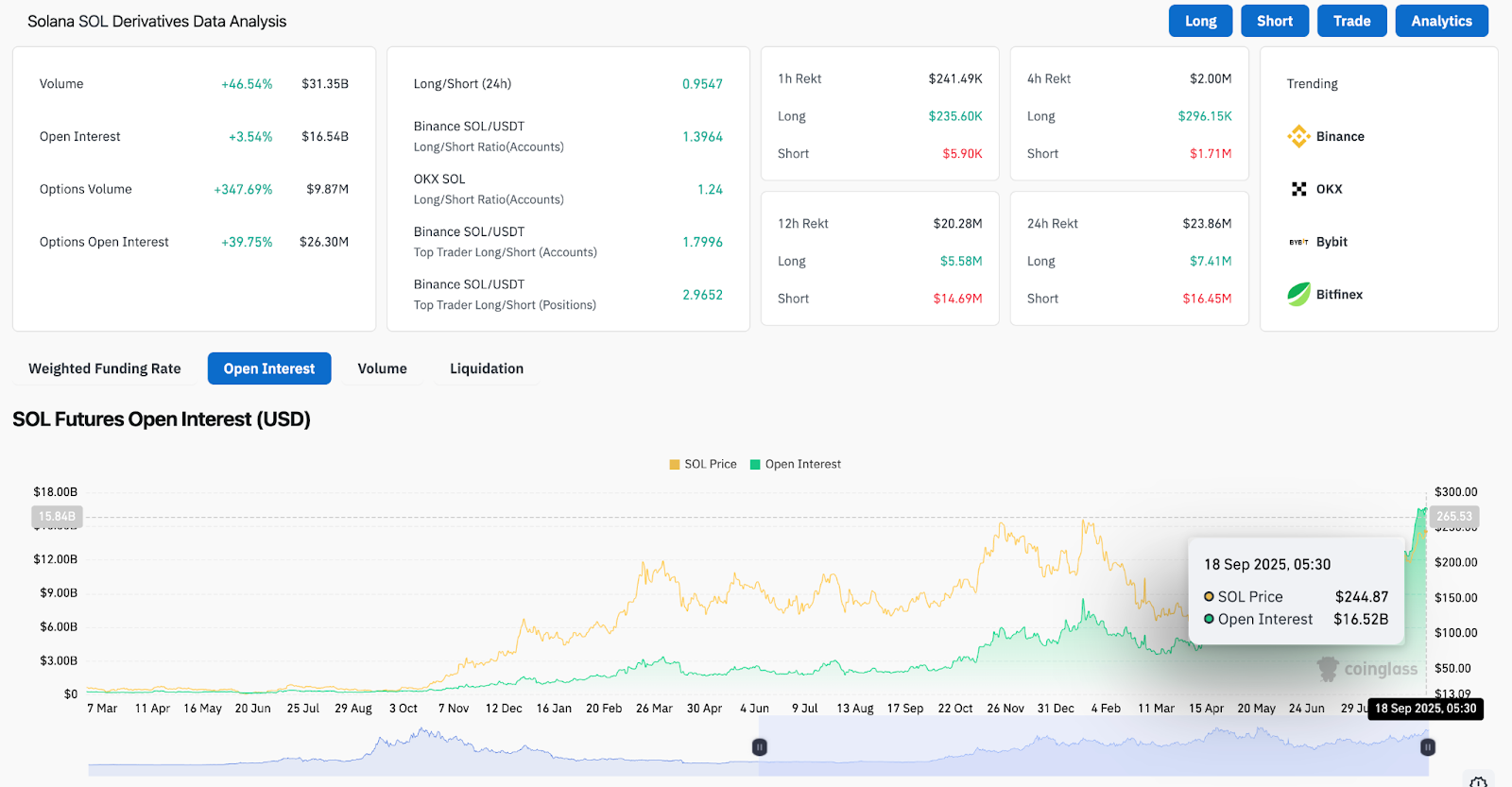

- ETF approval boosts institutional narrative, with derivatives data showing $16.5B open interest and rising longs.

- Monthly chart confirms cup-and-handle breakout setup, projecting a long-term target near $550.

Solana price today is trading near $244, consolidating after briefly testing the $246 resistance ceiling. Buyers continue to defend the $224–$230 support zone, which aligns with the 20-day EMA cluster. The key battle now is whether SOL can extend toward $252–$265 or if sellers will force a retest of lower trendline supports.

Solana Price Holds Rising Channel Support

The daily chart shows SOL trending within a rising channel, with support consistently defended since April. Price is currently pressing against the upper band near $246, while the 0.786 Fibonacci retracement level at $252 acts as the next critical barrier.

Related: Ethereum (ETH) Price Prediction For September 19

Short-term momentum remains constructive. The RSI stands at 68, approaching overbought territory but still supportive of further upside. Moving averages are stacked bullishly, with the 20-day EMA at $224 and the 50-day EMA at $205 providing layered defense zones. A sustained close above $246 would strengthen the bullish case toward $265, while losing $224 could open the door to $205 and $189.

ETF Approval Provides Fundamental Catalyst

Momentum received a major boost after the SEC approved generic listing standards, clearing the path for spot crypto ETFs to launch. Solana’s official account highlighted the decision as “crypto history in the making,” underscoring the scale of institutional access this regulatory shift provides.

ETF approval adds a structural demand driver that could replicate the liquidity surge seen in Bitcoin and Ethereum. Traders now view $246–$252 not just as a technical barrier but as a gateway for ETF-driven capital inflows that could redefine Solana’s medium-term trajectory.

Derivatives Market Shows Aggressive Positioning

On-chain derivatives data points to rising conviction among traders. Open interest surged to $16.5 billion, while trading volumes spiked by 46% in the past 24 hours. Options volume also jumped nearly 350%, highlighting speculative positioning ahead of the ETF catalyst.

Related: Bitcoin (BTC) Price Prediction For September 19

Notably, Binance data shows top traders holding a 2.96 long-to-short ratio, signaling strong accumulation. While these leveraged bets support upside continuation, they also raise risks of volatility in case of profit-taking. Liquidations in the past 24 hours totaled $23.8 million, with shorts taking the larger hit, showing bears under pressure as SOL pushes higher.

Broader Narrative Hints At Major Cup-And-Handle Breakout

The monthly chart has now confirmed a cup-and-handle formation, with the neckline at $246 acting as the breakout trigger. The measured move from this pattern projects an upside target near $550, representing more than 120% potential gains over the coming quarters.

This structure adds significant weight to Solana’s long-term bullish thesis, as cup-and-handle breakouts are historically powerful continuation patterns. Combined with ETF-driven inflows and Solana’s expanding ecosystem dominance, the breakout strengthens the argument for an extended bullish cycle well beyond short-term resistance zones.

Technical Outlook For Solana Price

In the short term, Solana price prediction hinges on the $246–$252 resistance cluster and the $224–$230 support zone.

- Upside targets: $252, $265, and $320 if bullish momentum accelerates.

- Downside levels: $224, $205, and $189 as layered supports.

- Trend support: $178 and $171 remain the deeper floors within the rising channel.

Outlook: Will Solana Go Up?

Solana’s immediate outlook depends on whether ETF-driven enthusiasm can propel price through the $246–$252 ceiling. On-chain flows and derivatives data suggest traders are positioning for continuation, while the long-term chart highlights a potential breakout from a multi-year consolidation.

Related: Dogecoin Price Prediction: Can DOGE Break $0.28 After ETF Approval?

As long as SOL holds above $224, analysts remain optimistic that momentum favors another push higher. A confirmed close above $252 would likely invite momentum buyers targeting $265–$320, while failure to clear resistance could see a short-term pullback before another attempt.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.