- Elon Musk launches $300 million stock sale for xAI, valuing it at $113 billion.

- This deal underscores strong investor interest in AI innovation.

- Major restructuring involves integration of social platform and AI business.

Elon Musk’s xAI company is conducting a $300 million stock sale transaction that values the artificial intelligence company at $113 billion, according to BlockBeats News citing the Financial Times.

The valuation reflects the strong investor interest in AI companies, spurred by Musk’s reputation and the strategic merger with X, formerly Twitter.

Merger Drives xAI’s $113 Billion Valuation

Led by Musk, xAI seeks to expand its influence within the technological sector through this major financial undertaking. The company, formed in less than two years, has already positioned itself as a formidable player by merging with the social media platform X. “xAI’s rapid valuation growth reflects the extraordinary investor interest in artificial intelligence companies.”

The stock sale targets employees and highlights xAI’s strategy to reinforce internal investment. Musk’s expanding AI business indicates a transformation within his tech empire, combining social media and artificial intelligence within XAI Holdings.

The AI sector is keenly observing xAI’s decisions, given its ambitious projects like the Memphis data center. Industry leaders and stakeholders are watching these changes, with notable statements anticipated in the coming weeks.

Regulatory Focus on xAI’s Rapid Growth

Did you know? The recent merger between xAI and X, completed in March 2025, closely mirrors historical industry patterns where significant tech integrations coincided with rapid valuation growth, marking a pivotal shift in Musk’s strategic direction.

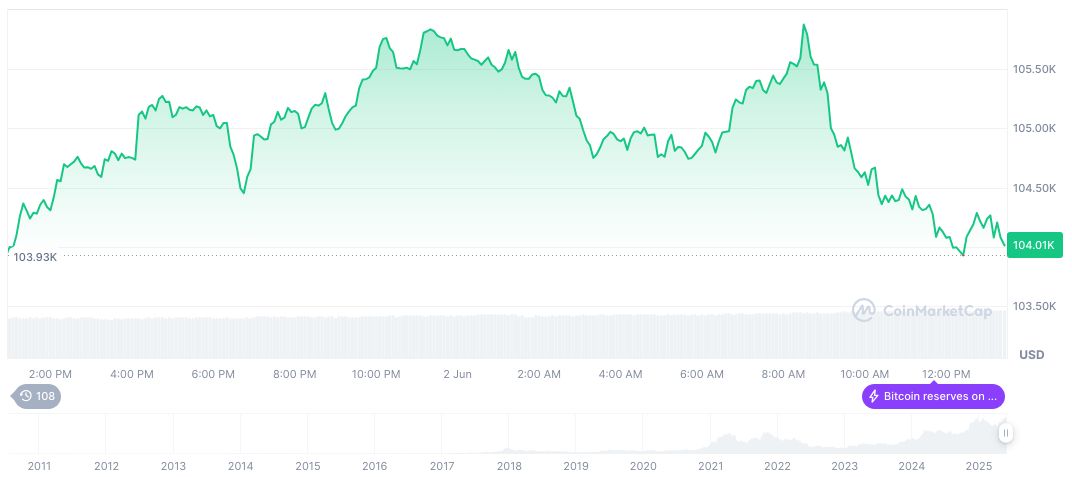

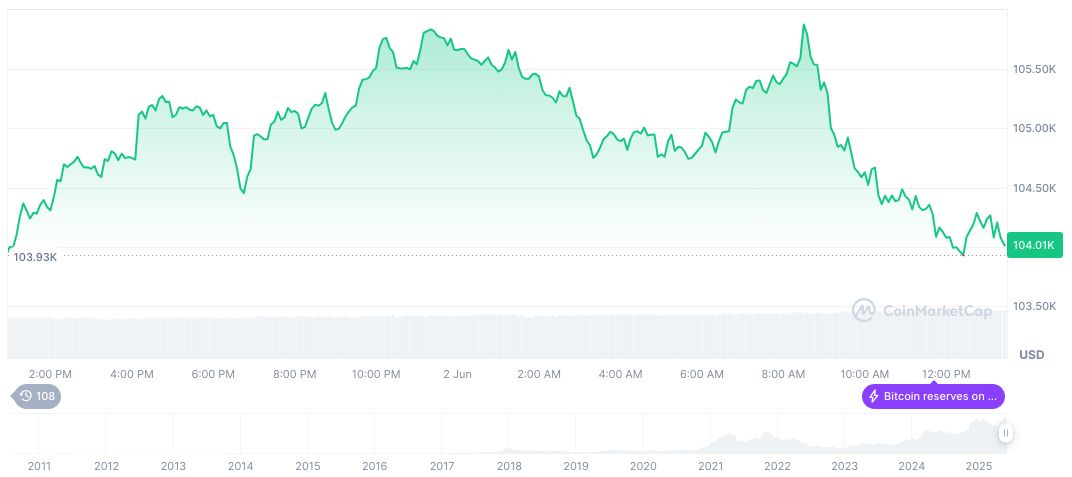

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $104,893.35, illustrating a 24-hour decline of 0.51%. The leading cryptocurrency boasts a market cap of $2.08 trillion and experiences a 30-day positive shift of 8.89%, indicating volatile but strengthening market sentiment.

Coincu Research suggests xAI’s financial maneuvers might prompt intensified regulatory scrutiny, given the scale and speed of its valuation rise. Historical data indicates similar scenarios led to significant policy discussions, shaping AI-sector regulations.

Source: https://coincu.com/341255-elon-musk-xai-300m-stock-sale/