- Musk warns of U.S. debt crisis at All-In Summit in 2025.

- Interest surpasses Defense budget, posing financial concerns.

- Cryptocurrencies may hedge dollar crisis fears.

Elon Musk, CEO of Tesla and X, warned at the September 10th All-In Summit about the US national debt reaching $37 trillion, with interest costs now surpassing defense spending.

Musk’s warning highlights potential financial instability that could affect cryptocurrencies like Bitcoin and Ethereum amid macroeconomic risks.

Musk Highlights Debt Interest Surpassing Defense Spending

Elon Musk discussed the U.S. national debt reaching $37 trillion during an All-In Summit interview, pointing out that the interest payments now exceed the Defense Department budget. “If you look at our national debt, which is insanely high, the interest payments exceed the War Department budget… So, if AI and robots don’t solve our national debt, we are toast,” said Musk (Financial Express). His remarks suggested AI and robotics may be the only viable solutions needed.

This revelation implies significant macroeconomic risk, potentially amplifying financial instability. U.S. debt levels raise concerns among investors, affecting crypto market sensitivities to such systemic risks.

Musk’s cautions drew considerable attention, but no immediate changes are expected in cryptocurrency markets. However, Bitcoin and Ethereum are likely to react if systemic dollar fears heighten.

Historical Debt Context Fuels Cryptocurrency Debate

Did you know? In 2011, during the debt ceiling crisis, the U.S. credit rating downgrade had a tangible impact, causing heightened volatility in global markets, including cryptocurrencies.

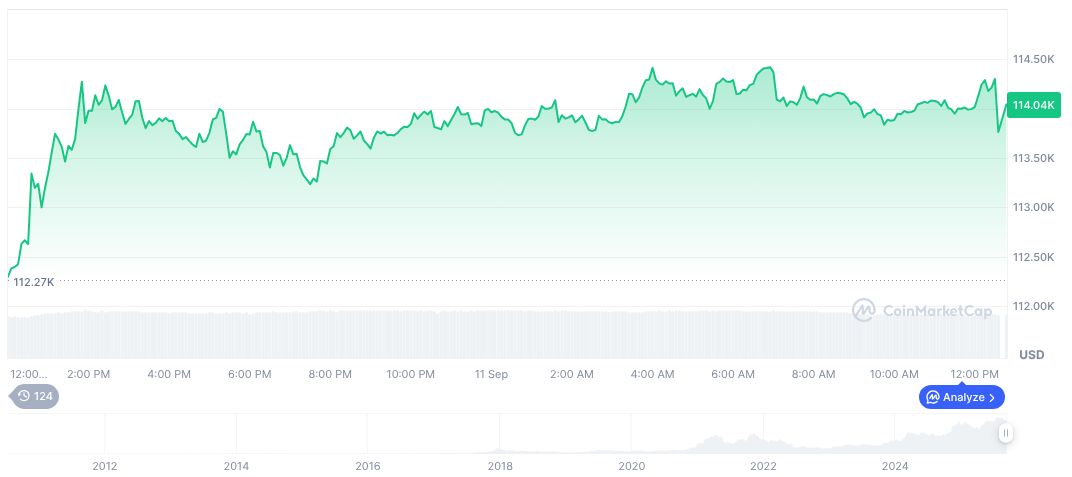

As of September 12, 2025, Bitcoin’s price is reported at $115,629.17, with a market cap of approximately $2.30 trillion according to CoinMarketCap. The cryptocurrency has shown recent price movements: a 1.50% increase over 24 hours and a 4.51% rise over the last week.

Insights from the Coincu research team underline that the debt warning may indirectly pressure market participants. Analysts highlight historical trends, where persistent debt concerns have triggered increased crypto adoption as a hedge.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/musk-us-debt-crisis-warning/