- ECB’s Schnabel warns on Fed independence affecting global system.

- Political interference may raise U.S., global borrowing costs.

- Concerns echo past economic impacts from central bank meddling.

On September 2, 2025, ECB Board Member Isabel Schnabel warned that compromising the Federal Reserve’s independence might destabilize the global financial system, highlighting concerns over increased borrowing costs.

Schnabel’s warning underscores the necessity of maintaining central bank independence to ensure financial stability, as political interference could trigger global market volatility, impacting traditional and crypto assets alike.

Schnabel Highlights Dangers of Political Interference

Isabel Schnabel, part of the European Central Bank’s leadership, highlighted the severe risks to global financial stability if U.S. political pressures diminished the Federal Reserve’s independence. With a background in economics, Schnabel emphasized how crucial Fed autonomy is for both U.S. and European financial health. Concerns center around potential political interference intensifying if independence is compromised.

Potential consequences include increased borrowing costs in the U.S., leading to global capital market ripples. These ripple effects might affect the euro’s stability and international investment flows. Historically, periods of reduced confidence in U.S monetary policies saw heightened interest rates and economic unpredictability, echoing Schnabel’s concerns.

“If the Federal Reserve loses its independence, it will cause tremendous damage to the global financial system and will also have an impact on the European Central Bank. I really hope this will not happen,” said Isabel Schnabel, ECB Executive Board Member.

In response, the community is alert to statements from financial leaders. Historically, loss of Fed independence coincided with market volatility, raising questions on how economic policies might shift. Schnabel’s comments reflect widely held historical views on independence’s critical importance to policy consistency and market trust.

Bitcoin’s Role Amid Central Bank Uncertainty

Did you know? Political interference with central banks can lead to significant economic instability, as seen in various historical contexts.

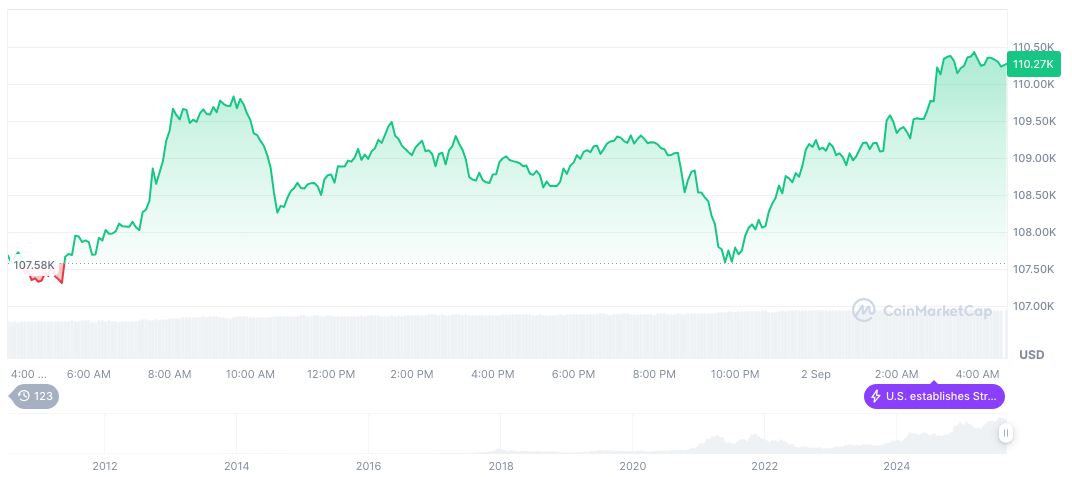

Bitcoin is currently priced at $110,544.54, with a market cap of $2.20 trillion and a 24-hour trading volume shift of 10.62%, per CoinMarketCap data. The market dominance stands at 57.74%, reflecting Bitcoin’s enduring influence. Its circulating supply is nearing completion at 19,915,121 of 21,000,000 max. Recent price changes exhibit moderate fluctuations over the quarter.

According to the Coincu research team, the loss of trust in fiat monetary systems typically drives investors towards decentralized assets like Bitcoin for stability. If U.S. Fed independence prompts global unrest, cryptocurrencies could see inflows owing to their decentralized nature. Such trends reflect ongoing shifts in risk management strategies within macroeconomic contexts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/schabel-warns-fed-independence-risks/