- The ECB announced a rate cut amid global economic shifts.

- This move reflects strategic policy adjustments.

- Immediate market changes are expected following the decision.

The European Central Bank announced on April 17 a 25 basis point cut to the deposit facility rate, reducing it to 2.25%, influenced by global economic factors and currency volatility.

This decision by the ECB addresses issues from a weakening US dollar and escalating trade tensions, with potential impacts on inflation and economic growth.

ECB’s Rate Cut: Strategic Response to Economic Volatility

European Central Bank’s significant rate reduction on April 17 marked a noteworthy moment amid global economic shifts. This change follows a 25 basis point cut in the deposit facility rate to 2.25%, prompted by circumstances like the US dollar weakening and rising trade tensions. According to Euro Area Interest Rate Statistics and Analysis, such reductions are a part of a broader strategy to mitigate inflationary pressures.

Emerging market strategies are expected to track this change, as central banks may further ease monetary policies. Market volatility persisted with currency rates showing considerable fluctuations following the ECB’s move.

Christine Lagarde, ECB President, highlighted the policy adjustment’s reliance on data-driven decisions, emphasizing the need for adaptability in changing circumstances. “The Governing Council is determined to ensure that inflation stabilises sustainably at its 2% medium-term target. Especially in current conditions of rising uncertainty, it will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. The Governing Council is not pre-committing to a particular rate path,” she stated, according to the ECB Press Release on Monetary Policy for 2025. Businesses and investors closely monitor these shifts for potential financial repercussions.

Stablecoin EURS Surges; Liquidity Boost for Digital Assets

Did you know? Despite the ECB’s continuous rate cuts since 2024, global uncertainty remains a driving factor, contrasting past monetary policies during the 2012 European sovereign debt crisis.

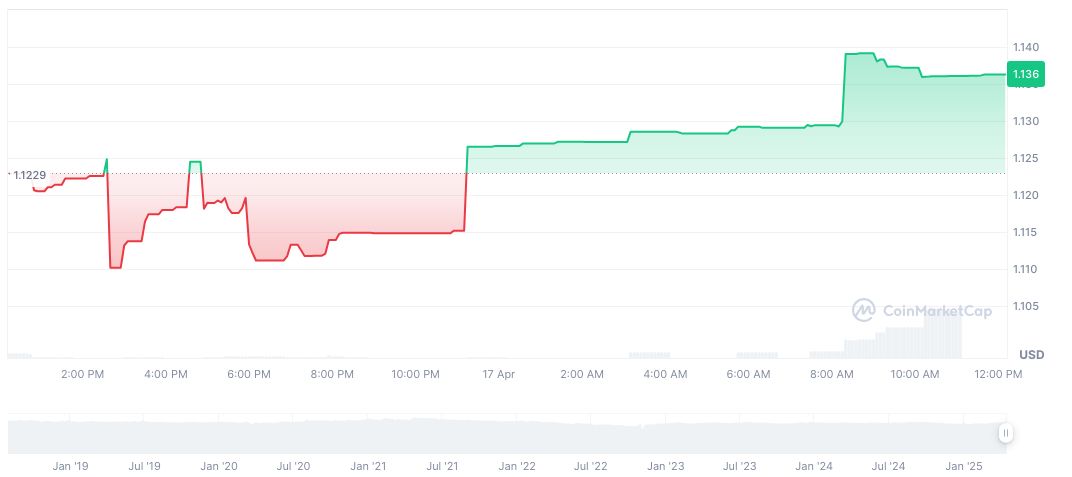

EURS, the STASIS EURO stablecoin, recently saw a 10.31% price rise over 90 days, currently trading at $1.14 with a market cap of $141.04 million, as reported by CoinMarketCap. Its trading volume decreased notably by 99.87%.

Coincu’s research team highlights that global rate cuts might lead to increased liquidity, influencing digital asset investments. Historical trends suggest further advancements in risk asset markets, including digital currencies, could manifest due to these economic dynamics.

Source: https://coincu.com/332719-ecb-rate-cut-economic-impact/