- DWF Labs withdrew $6.43 million in meme tokens, experiencing a 13% loss.

- 6 out of 7 tokens withdrew are at a loss.

- DWF’s actions could impact secondary market liquidity and volatility.

DWF Labs has recently withdrawn $6.43 million worth of meme tokens from multiple centralized exchanges, experiencing a 13% loss.

The move signifies DWF Labs’ strategy in the meme coin market, amidst a net loss of approximately $850,000 across its token holdings.

DWF Labs’ $6.43M Token Withdrawal Sparks Market Concerns

DWF Labs has withdrawn meme tokens totaling $6.43 million from various centralized exchanges. Among these tokens, six are currently at a loss while one reports a gain. This activity reinforces DWF Labs’ ongoing involvement in the meme token sector.

The total loss observed in this investment amounts to $850,000, representing a 13% drop from the initial value. The adjustment reflects the volatility typical in the secondary market for meme tokens.

“Memecoins are a powerful cultural force within the crypto landscape, often uniting communities around shared humour and creativity. The Meme Fund is our way of supporting this vibrant sector and enabling developers and communities to turn their ideas into impactful projects.”

Historical Insights and Expert Analysis on Meme Tokens

Did you know? DWF Labs’ investment in meme tokens like JST links to a larger history of both profitability and volatility in crypto, often driving liquidity and speculative trading.

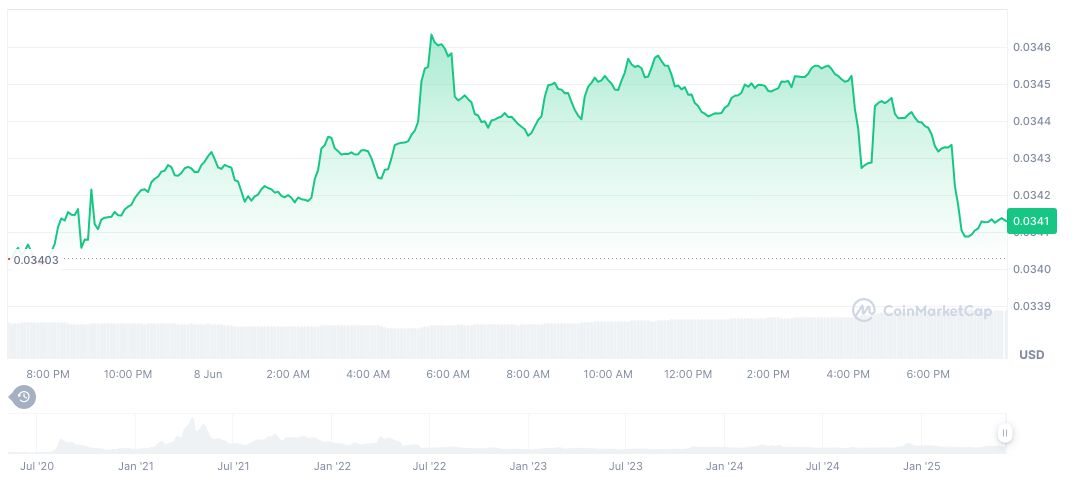

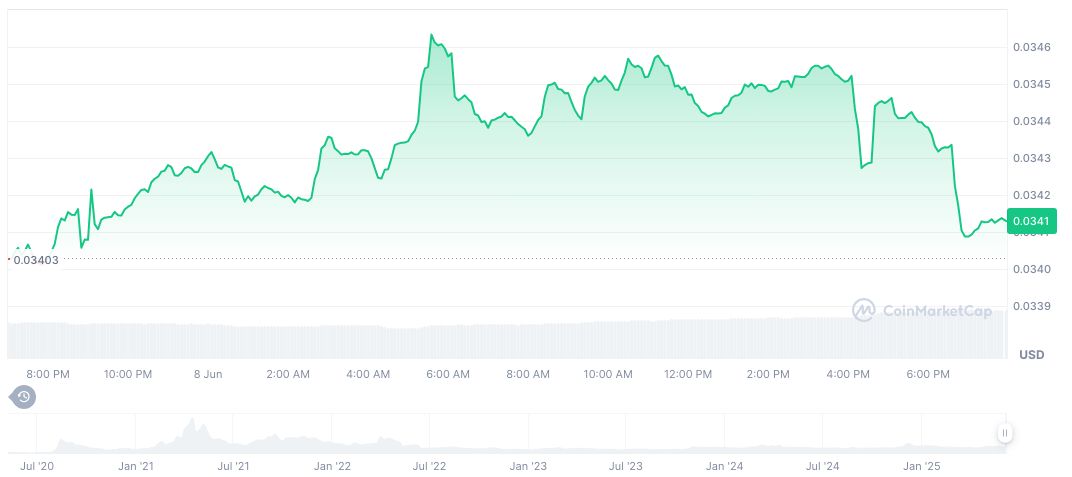

JUST (JST) currently trades at $0.03, with a market cap of $337.85 million and a 24-hour trading volume nearing $18.82 million. According to CoinMarketCap, JST’s price movements over the past 90 days span increases up to 11.88%.

Insights from Coincu research emphasize that DWF Labs’ activities could lead to short-term volatility. Despite recent losses, DWF’s market influence remains substantial. Such decisions may affect meme tokens significantly.

Source: https://coincu.com/342265-dwf-labs-meme-token-650million/