- Key Point 1

- Key Point 2

- Key Point 3

DWF Labs has taken its next significant step in the realm of digital finance by deploying USD1 stablecoin liquidity, supported by WLFI, across the Ethereum and Binance Smart Chain networks.

This move signifies an important milestone for USD1, enhancing its trading potential among digital assets.

USD1’s Market Impact and Growing Institutional Interest

DWF Labs initiated the deployment of USD1 liquidity, a stablecoin by WLFI, backed by the Trump family. Supported trading pairs include USDT/USD1, USDC/USD1, and ETH/USD1 on Uniswap V3 and USDT/USD1, BNB/USD1 on PancakeSwap V3.

The deployment’s magnitude has drawn attention from major market players, with institutional interest heightening. However, no official statements from key figures or regulators have been issued.

“As the USD1 finds its footing among stablecoins, it mirrors the evolutionary journey of its predecessors like USDC, promising substantial market activity and robust growth,” an expert remarked.

Historical Context, Price Data, and Expert Insights

Did you know? USD1’s entry to the market mirrors early adoption stages seen with renowned stablecoins like USDC, highlighting its potential rise.

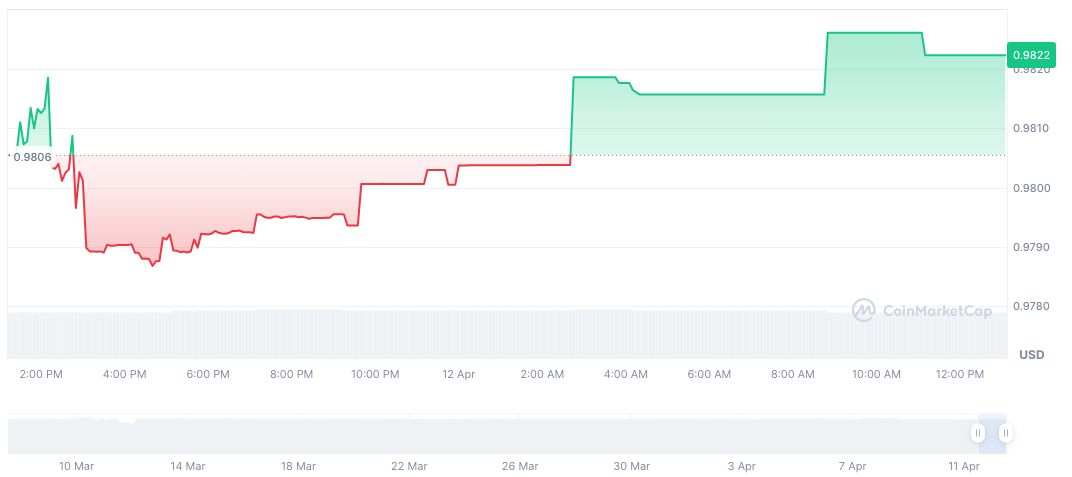

As of April 12, 2025, CoinMarketCap data shows USD One (USD1) trading at $0.98, with a fully diluted market cap of 11,786,809,380.32 and a 24-hour trading volume of $44,231.10. Price movements include a 0.17% increase over 24 hours and a 1.91% decline over seven days.

The Coincu research team’s observations point toward expanded financial prospects as USD1 stabilizes and gains market traction. Technological trends suggest upcoming innovations in DeFi could bolster USD1 utilization.

Source: https://coincu.com/331741-dwf-labs-usd1-liquidity-deployment/