- The DOJ seized $201,400 in a Hamas terrorism financing scheme.

- Key international law enforcement agencies were involved.

- Increased monitoring aims to curtail further funding to Hamas.

The U.S. Department of Justice recently announced the seizure of $201,400 in cryptocurrency as part of an operation targeting a terrorism financing scheme associated with Hamas. Key agencies involved in this operation included international law enforcement entities, illustrating a coordinated global response.

These efforts reveal extensive laundering activities since October 2024, funding Hamas with over $1.5 million. The primary focus is USDT (Tether). In response to the operation, substantial steps have been implemented, such as increased monitoring of fundraising addresses linked to the group. This act expects to curtail further funds reaching Hamas and emphasizes global efforts to disrupt terrorism funding through crypto-assets.

Market Reactions and Industry Insights

Market reactions involved measured expressions of support for the DOJ’s efforts, along with highlights from industry leaders. Past U.S. Treasury criticisms aimed at exchange platforms’ complicity stress the ongoing challenge of addressing such illegal activities. As Janet L. Yellen, Secretary of the Treasury, put it, “Binance turned a blind eye to its legal obligations in the pursuit of profit. Its willful failures allowed money to flow to terrorists, cybercriminals, and child abusers through its platform.”

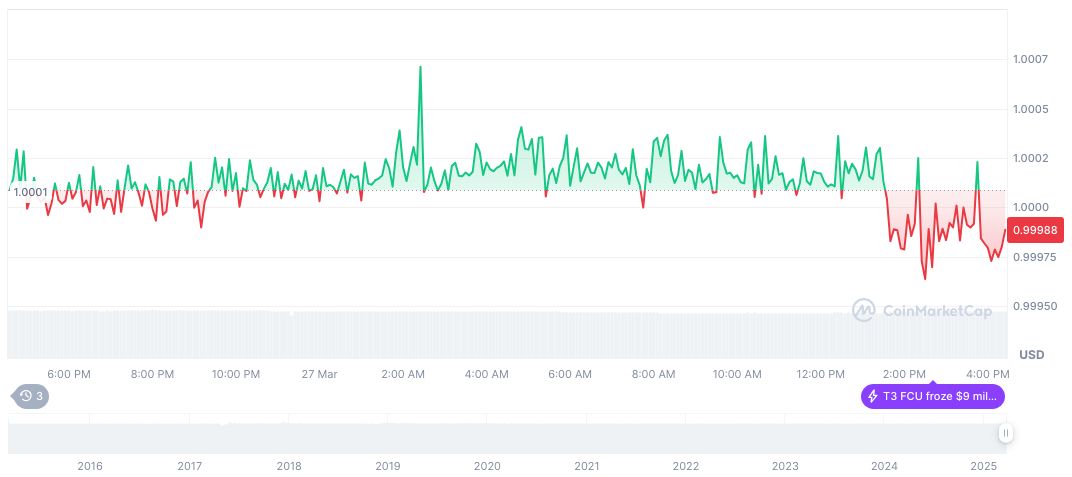

According to CoinMarketCap, Tether (USDT) maintains its $1 value, with a notable 24-hour trading volume of $59.22 billion. Despite recent fluctuations — up 1.89% over the past week and rising 12.55% over 90 days — the market dominance and cap are at 5.06% and $144.14 billion, respectively.

The Coincu research team notes that such regulatory actions may influence stricter compliance requirements globally for crypto exchanges. Enhanced transparency and assurance of legal utilizations are projected outcomes as historical patterns reveal recurring intervention impacts in the crypto landscape.

Hamas Crypto Seizure: Historical Patterns and Market Insights

Did you know? In June 2021, Israel targeted similar Hamas-linked wallets, part of a continued effort to undermine terrorist financing channels using cryptocurrencies.

According to CoinMarketCap, Tether (USDT) maintains its $1 value, with a notable 24-hour trading volume of $59.22 billion. Despite recent fluctuations — up 1.89% over the past week and rising 12.55% over 90 days — the market dominance and cap are at 5.06% and $144.14 billion, respectively.

The Coincu research team notes that such regulatory actions may influence stricter compliance requirements globally for crypto exchanges. Enhanced transparency and assurance of legal utilizations are projected outcomes as historical patterns reveal recurring intervention impacts in the crypto landscape.

Source: https://coincu.com/328946-doj-seizes-cryptocurrency-hamas-funding/