Dogwifhat, one of Solana’s most recognizable meme-inspired tokens, is showing signs of consolidation after a brief retreat in recent sessions.

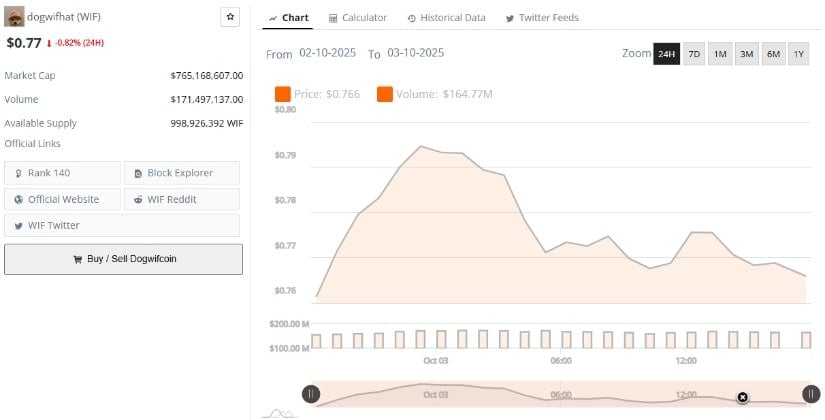

Trading at $0.77, the asset has slipped 0.82% over the last 24 hours, with its market cap hovering around $765 million.

While the asset has pulled back from its September high of $1.39, it continues to defend higher support levels, a sign that buyers remain engaged despite subdued momentum.

Open Interest Reflects Market Hesitation

On the lower timeframe, WIF’s hourly price action highlights a series of fluctuations between $0.75 and $0.80, forming a narrow consolidation band. This range has become the short-term battleground for traders seeking confirmation of the token’s next decisive move.

Source: Open Interest

Aggregated open interest (OI) offers clues into the current positioning. OI is holding near $118 million, indicating stability after a recent period of outflows. The flattening of open interest suggests traders are reluctant to place large directional bets until clearer signals emerge. While this prevents steep downside volatility, it also caps the upside, leaving the asset in a period of subdued conviction.

Market Data: $765M Cap with Steady Liquidity

According to market data, Dogwifhat is trading at $0.77, with a 24-hour decline of 0.82%. Its daily trading volume has reached $171.4 million, underscoring consistent liquidity, even as volatility remains muted. With a circulating supply of nearly 999 million tokens, the asset is ranked #140 among cryptocurrencies by market capitalization.

Source: BraveNewCoin

Despite its lighthearted branding, a “dog with a hat” serving as its mascot, the token has carved out a notable presence within the Solana ecosystem. The project reflects the ongoing cultural role of meme tokens, which continue to attract speculative capital and community-driven enthusiasm even in consolidating market conditions.

Technical Indicators Signal a Neutral Bias

The daily chart offers further context for WIF’s current phase. At the time of writing, the memecoin trades at $0.770, reflecting a 2.28% decline on the daily chart. The consolidation comes after the asset retraced from $1.39, with buyers stepping in to defend the $0.53 support level. This resilience underscores the presence of demand, even as the token faces difficulty breaking through its $0.90 resistance.

Source: TradingView

The Chaikin Money Flow (CMF) currently reads 0.05, suggesting modest inflows. While a positive CMF value typically reflects accumulation, the weak reading highlights limited conviction. A sustained rise above 0.10 would strengthen the case for bullish continuation, while a return below the neutral line could hand the advantage back to sellers.

Momentum indicators are less decisive. The MACD line stands at -0.033, slightly below the signal line at -0.030, with the histogram at -0.003. This alignment reflects a fragile recovery attempt, with momentum fading before it could gather strength. If the MACD histogram flips convincingly positive, it could validate a rebound, but current conditions favor sideways movement with only minor directional bias.

Source: https://bravenewcoin.com/insights/dogwifhat-wif-consolidates-at-0-77-as-traders-weigh-next-move