- Dogecoin address activity surges 111%, signaling strong interest ahead of a potential massive rally.

- Historical patterns suggest Dogecoin could see a 12,000% rally as whales ramp up transactions.

Dogecoin [DOGE] has shown a recurring trend of sharp price increases followed by corrections. In 2017, DOGE climbed 212%, retraced 40%, and then gained 5,000%. Similarly, in 2021, it rose 476%, corrected by 56%, and later surged 12,000%.

In 2024, Dogecoin has followed a comparable trajectory, increasing by 440% from $0.065 to $0.39547 before retracing 46%.

According to crypto analyst Ali, this pattern suggests the potential for another significant rally if the trend continues as it has in previous cycles.

Source: X

Current price action and critical levels

Dogecoin was trading at $0.3167 at press time, reflecting a 1.43% decline over the last 24 hours and a 21.23% drop in the past week. The cryptocurrency has a market capitalization of $46.66 billion and a 24-hour trading volume of $4.37 billion.

Price data shows DOGE holding within its long-term logarithmic price channel. Support levels have been identified at $0.065 and $0.19-$0.20, while resistance is seen at $0.39547 and $0.73665, the record high set in 2021.

Analysts have projected a potential upper boundary of $17.94 if Dogecoin maintains its historical upward trend within this channel.

On-chain activity shows increased interest

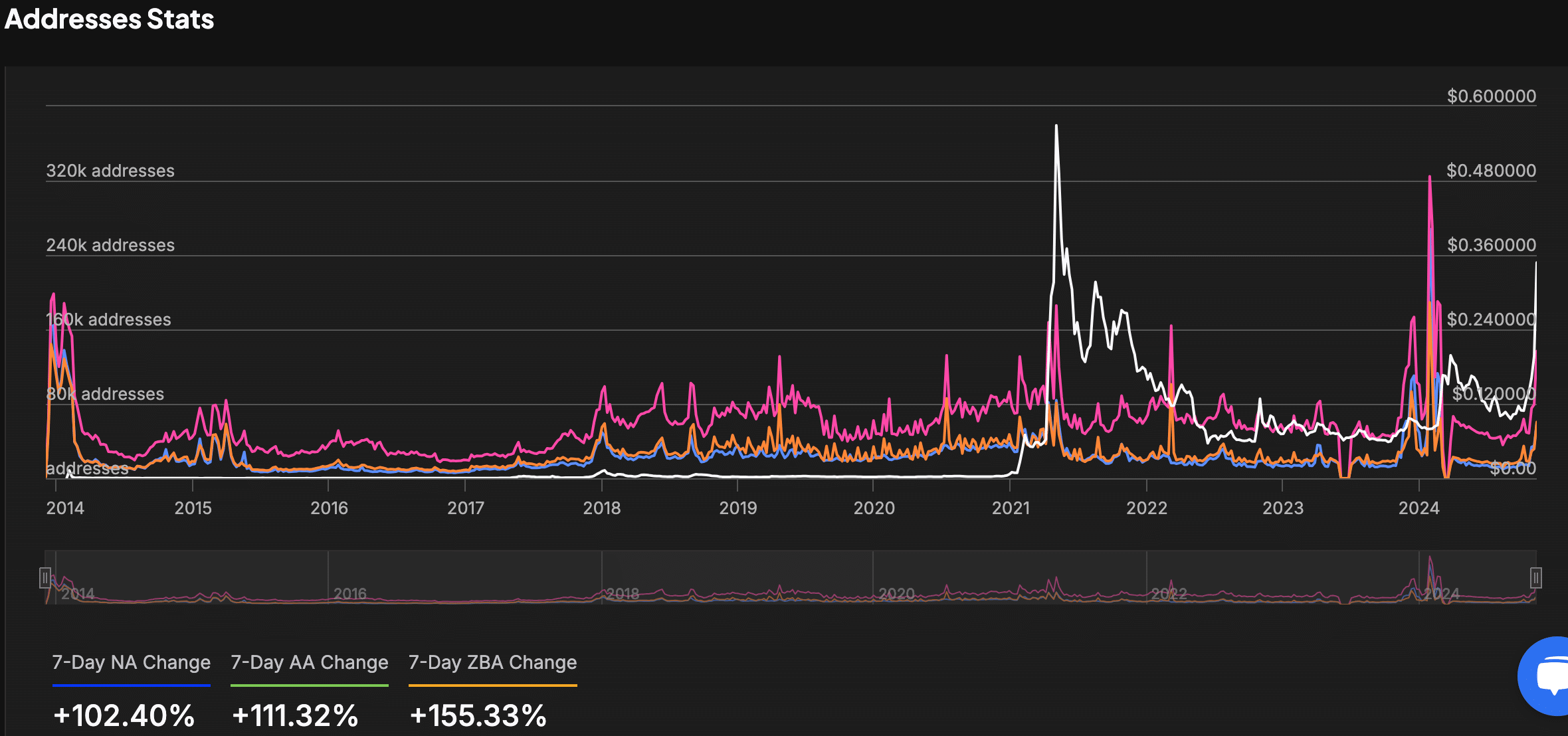

Data from IntoTheBlock indicates a rise in network activity. As of 11th November, active addresses totaled 136,850, with 58,990 new addresses created.

Over the past week, new addresses rose by 102.40%, active addresses by 111.32%, and zero-balance addresses increased by 155.33%.

Source: IntoTheBlock

This growth in address activity coincided with Dogecoin’s recent price move to $0.40. The increased participation suggests a resurgence in interest, possibly from both retail and institutional investors.

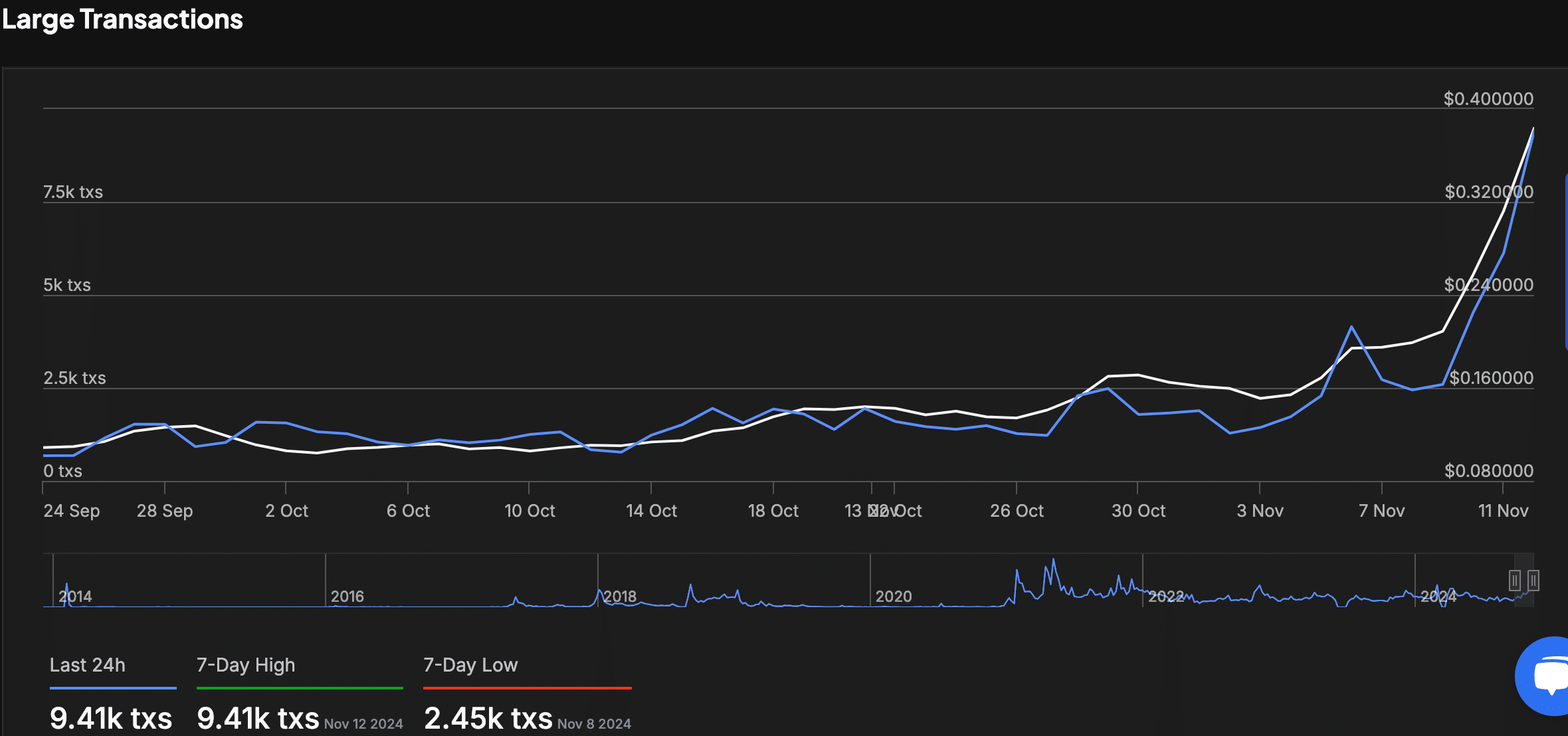

Large transactions involving Dogecoin have also seen an uptick. Over the past week, whale transactions reached a peak of 9,410, aligning with the recent price surge.

This marks a sharp increase from the weekly low of 2,450 transactions observed on 8th November.

Source: IntoTheBlock

Market data from Coinglass shows trading volume down by 24.83% to $7.42 billion, while open interest in futures contracts declined 4.71% to $1.95 billion.

Options trading volumes dropped 58.52% to $427.08 million, with open interest in options contracts at $1.18 million.

With historical trends, increasing address activity, and large transactions aligning, the data suggests that Dogecoin may be positioning itself for another significant price movement.

Source: https://ambcrypto.com/dogecoin-prepares-for-lift-off-historical-patterns-hint-at-a-12000-rally/