- Deutsche Bank is rumored to be exploring stablecoins and tokenized deposits.

- No official statements have been released confirming these explorations.

- The introduction of digital currencies by traditional banks could impact financial markets significantly.

Market news indicates that Deutsche Bank is exploring ventures into stablecoins and tokenized deposits. As of yet, there are no official statements directly confirming Deutsche Bank’s involvement or details on this exploration.

Reports have surfaced suggesting that Deutsche Bank is investigating the feasibility of stablecoins and tokenized deposits. Despite these rumors, Deutsche Bank has not issued any official statements or provided updates on their corporate platforms. The financial market has been observing potential shifts, but exact implications and impacts remain undefined. The possibility of a traditional bank venturing into digital currency offerings could reshape financial landscapes. Market circles have kept an inquisitive watch on Deutsche Bank’s potential move, yet community discussions and reactions are untethered, given the lack of formal clarity on these reports.

Traditional Banks Eye Blockchain: A Case Study

Did you know? The proposed exploration aligns with a historical trend where traditional banks evaluate blockchain solutions to innovate customer offerings and streamline internal finance processes.

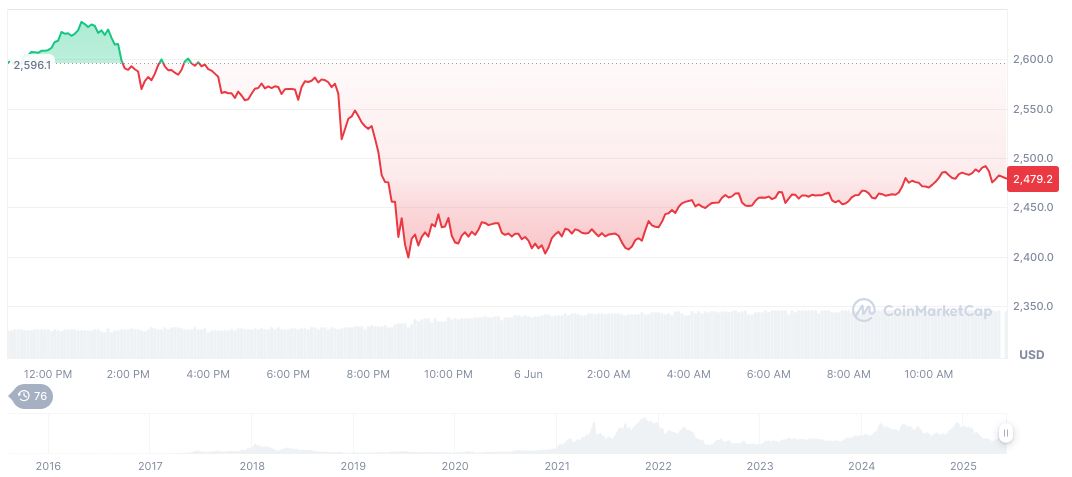

Ethereum (ETH) currently trades at $2,517.98 with a market cap of 303,975,468,347. Data from CoinMarketCap reveals a 2.95% drop in value over 24 hours, while the past 30 days saw a 38.44% increase. Market activity shows ETH’s trading volume at 27,704,839,243 with a decisive 50.06% change. Coincu analysts suggest if Deutsche Bank makes tangible strides towards stablecoins, it may influence regulatory dynamics and adoption strategies.

Expert analysis highlights potential technological advancements enhancing transaction efficiency and security, which could inspire further financial sector innovations. As the search results did not provide any direct quotes from industry leaders or Deutsche Bank representatives regarding their exploration of stablecoins and tokenized deposits, I cannot extract any quotes in the format specified. The current information available does not include official statements, KOL commentary, or market impacts directly associated with Deutsche Bank’s activities in this space. For future updates and to verify the latest information, it is advisable to monitor Deutsche Bank’s official communication channels.

Market Dynamics and Future Insights

Did you know? The proposed exploration aligns with a historical trend where traditional banks evaluate blockchain solutions to innovate customer offerings and streamline internal finance processes.

Ethereum (ETH) currently trades at $2,517.98 with a market cap of 303,975,468,347. Data from CoinMarketCap reveals a 2.95% drop in value over 24 hours, while the past 30 days saw a 38.44% increase.

Expert analysis highlights potential technological advancements enhancing transaction efficiency and security, which could inspire further financial sector innovations.

Source: https://coincu.com/341915-deutsche-bank-stablecoins-exploration/