In a surprising move, one of the popular crypto lending platforms with more than 3.5 million registered users filled for bankruptcy earlier today. According to the court filing, the holders are expected to ‘impair’ the Chapter 11 Process. In such a case, the holders may not get back exactly what they owed. In turn, the platform aims to repay its holders with the asset they hold or with the stock in the restructured company or Voyager token and with the money recovered from the 3 AC.

Also Read: Bitcoin Faces Constant Rejection at $20,000, Can Bulls Save the BTC Price Rally?

The crypto markets which shattered from the LUNA crash doesn’t seem to have eased as a series of illiquid crisis have been constantly knocking on the doors. After the Celsius Network crisis, 3 Arrow Capital faced liquidity issues. Later Babel Finance also underwent a similar crisis and the recently added to the group, Voyager Digital. According to the filings, 3AC owes Voyager more than $650 million.

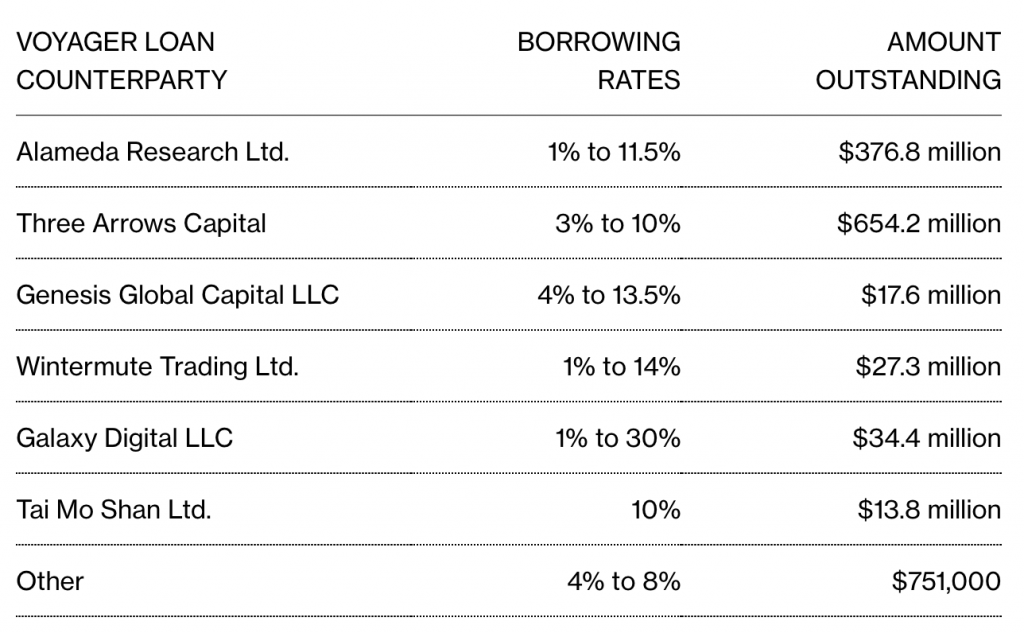

According to the reports, along with 3AC owing $650 million, Voyager has an outstanding amount of $1.12 billion worth of loans to the third party outstanding. Further according to a statement from Voyager, the holders who deposited USD will be able to recover their money after reconciliation from a Metropolitan Commercial Bank.

Also Read: Voyager Digital CEO Hopes For A Stronger Comeback! Here’s The Revival Plan

The current crisis which has now knocked on the doors of a popular crypto lending platform with a huge user base may impact the crypto space to some extent. Currently, the BTC & ETH prices are able to maintain a significant upswing above $20K and $1100 which may drain in the next couple of hours.

Was this writing helpful?

Source: https://coinpedia.org/news/cryptos-to-remained-tangled-as-voyager-digital-may-not-repay-their-customers-what-they-owe/