- The Cryptocurrency Market Structure Act set for 2025 aims to clear regulatory duties between the SEC and CFTC.

- Patrick Witt emphasizes the act’s potential to repatriate overseas crypto companies.

- Proactive regulatory frameworks may lead to enhanced growth and stabilization in digital asset markets.

Patrick Witt, Executive Director of the White House Digital Asset Advisory Committee, announced at the Korea Blockchain Week that the Cryptocurrency Market Structure Act is expected to pass by 2025.

The act aims to clarify regulatory roles in digital assets, promoting repatriation of overseas crypto companies, impacting market structure and investor sentiment.

U.S. Crypto Regulatory Framework on the Horizon for 2025

Patrick Witt, Executive Director, White House Digital Asset Advisory Committee, stated: “The Cryptocurrency Market Structure Act is expected to pass by the end of 2025, aiming to clarify the regulatory split between the CFTC and SEC over digital assets and promote the repatriation of overseas crypto companies.” Source: Event Coverage at Korea Blockchain Week.

The act, central to regulatory clarity, seeks to delineate SEC and CFTC duties within the digital asset landscape.

Patrick Witt, Executive Director, White House Digital Asset Advisory Committee, stated: “The Cryptocurrency Market Structure Act is expected to pass by the end of 2025, aiming to clarify the regulatory split between the CFTC and SEC over digital assets and promote the repatriation of overseas crypto companies.” Source: Event Coverage at Korea Blockchain Week.

Historical Context and Financial Insights on Crypto Regulation

Did you know? The shift toward the Cryptocurrency Market Structure Act pushes the agenda further than the Infrastructure Investment and Jobs Act of 2021, which previously influenced market adaptability and compliance strategies.

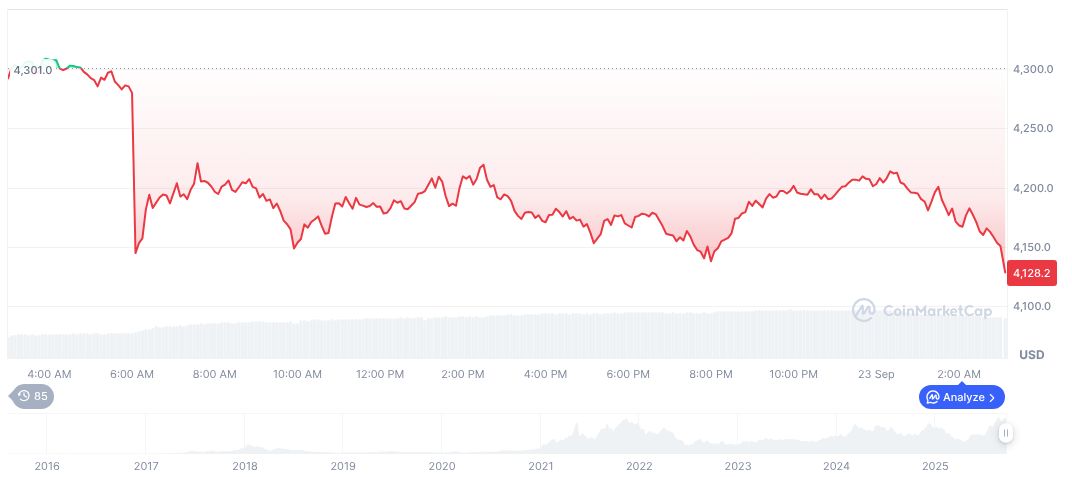

According to CoinMarketCap, Ethereum (ETH) is valued at $4,183.44, with a market cap of 504,956,917,820. Recently, ETH experienced a 7-day price decrease of 7.67%, despite a 90-day rise of 72.25%. The fully diluted market cap is consistent at 504,956,917,820, showcasing significant recent growth yet ongoing price fluctuations.

Insights from the Coincu research team suggest a mixed financial and regulatory impact as sectors adapt to this predefined regulatory landscape. Key historical trends indicate that proactive regulatory frameworks may enhance secure growth in U.S. digital asset markets. Regulatory clarification and technological advancement contribute to potential market stabilization, enhancing the crypto landscape’s global competitiveness.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/crypto-market-structure-act-2025/