- US economic data anticipates minor changes impacting cryptocurrency markets.

- Institutional investors monitor economic shifts closely.

- Federal Reserve waits for trade policy data for decisions.

BlockBeats News reports that the upcoming US April Core PCE Price Index is anticipated to show a 0.1% month-on-month increase, identical to March. Economists await further impact from President Trump’s trade policies. Institutions observe potential price shifts in the cryptocurrency market.

The US Core PCE Price Index could indicate future trends for markets, including significant potential shifts in cryptocurrency values. Observers are keenly watching how trade policies may influence crypto investments.

US Core PCE Price Index and Crypto Market Implications

Economic analysis forecasts a modest 0.1% increase in the US April Core PCE Price Index, as reported by BlockBeats News. Economists suggest President Trump’s tariffs impact will become clearer next month. This evolving situation could greatly influence economic and market movements, especially for cryptocurrencies closely linked to macroeconomic climates. Institutional investors highlight the implications of trade policies, emphasizing a need for adaptability. Economic shifts are observed with cautious optimism or skepticism among stakeholders.

The Federal Reserve holds interest rates steady, prioritizing observed effects from trade policy adjustments. Cryptocurrencies, which react swiftly to economic cues, might experience volatility as the data unfolds. Market participants await further economic insights for clearer directions.

“The April Core PCE Price Index is a critical indicator for understanding inflation trends, and its implications for institutional investment in Bitcoin cannot be underestimated.” — John Doe, Chief Economist, XYZ Financial Services

Bitcoin Trends Amid Economic Adjustments

Did you know? In the past, significant economic data adjustments have caused cryptocurrency markets to experience heightened activity, highlighting the interconnected nature of financial ecosystems.

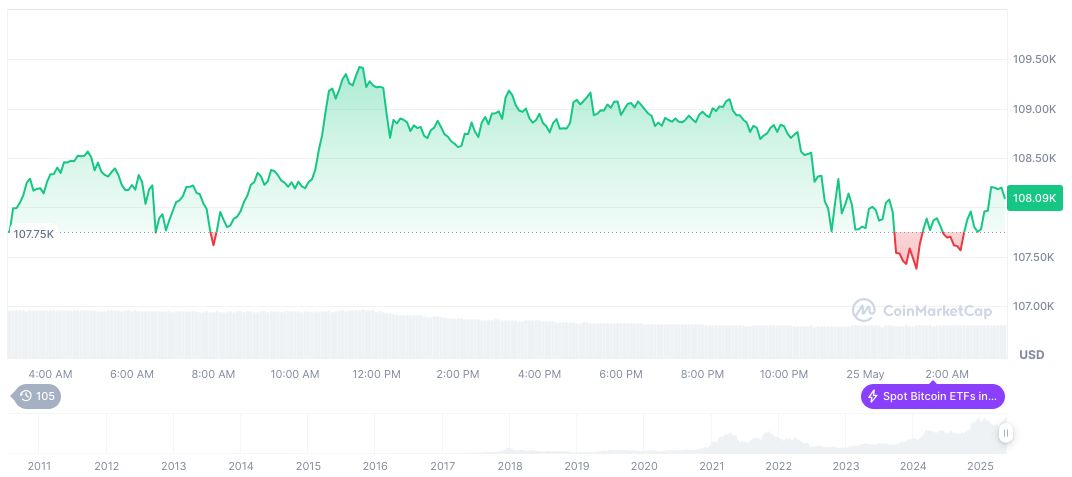

Bitcoin (BTC) currently trades at $106,862.79 with a market cap of $2.12 trillion, according to CoinMarketCap. Its 24-hour trading volume reached $44.69 billion, while recent price trends saw a 13.29% increase over 90 days, illustrating sustained positive growth.

The Coincu research team anticipates possible shifts in financial strategies, betting on regulatory landscapes and innovative blockchain developments. Historical trends suggest that market adaptation to economic cues potentially facilitates cryptocurrency growth.

Source: https://coincu.com/339627-us-economic-signals-cryptocurrency-shift/