Key Insights:

- PENGU trades at $0.007080, approaching the critical $0.0066 support level amid persistent bearish pressure.

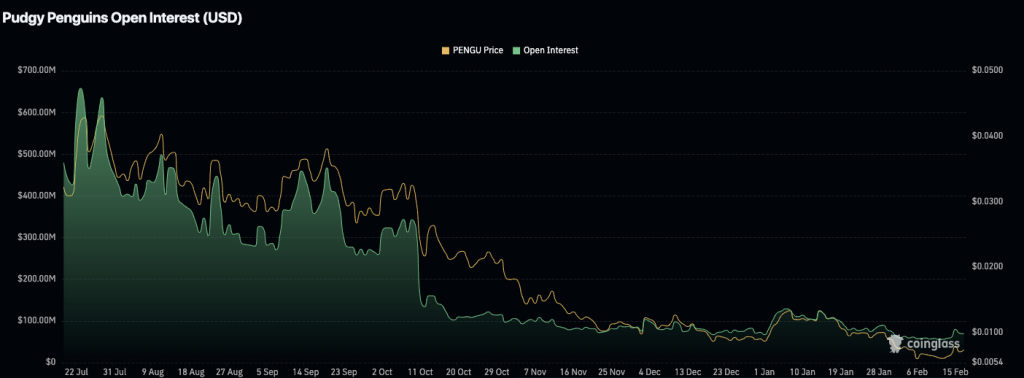

- Open interest plunges to $67.11 million from over $600 million, signaling fading leveraged participation since July.

- Analysts eye short setups near $0.0074–$0.0076, with stops above $0.00775 amid cautious market sentiment and discipline.

Pudgy Penguins (PENGU) price trades near a key range as sellers keep pressure on the market. Traders watch the $0.0066 level as downside risk grows. Market data shows fading participation and lower futures activity.

PENGU price today stands at $0.007080. The token is down 2.09% in the last 24 hours. Daily trading volume is $94,214,749, based on real-time data.

PENGU Price Nears Key Support at $0.0066

PENGU price action shows a bearish bias as lower lows form on the chart. Analysts track a move toward $0.0066 support. A break below this level may open the path to $0.00528.

Nehal stated, “Price is nearing my entry zone — no trade yet.” The trader added, “No confirmation = no position. Discipline first.” The plan shows a short setup near the current range.

The aggressive strategy targets shorts near current levels. A safer setup waits for rejection between $0.0074 and $0.0076. The stop loss is sitting above the $0.00775 level.

Traders note that losing $0.0066 may increase downside pressure, with the next lower low target standing at $0.00528. Market structure remains weak unless buyers reclaim higher resistance.

Open Interest Declines as Trader Activity Slows

Open interest in PENGU futures has dropped to $67.11 million. This marks a steep fall from levels above $600 million recorded in late July. The decline reflects reduced leveraged positions in the market.

The sharp contraction became more visible after mid-October. Participation cooled as prices moved lower. Brief rebounds in January led to short-term increases in positioning as overall activity remains far below summer peaks.

Lower open interest often shows reduced speculative demand. As leverage declines, price moves may reflect more cautious positioning. Traders now watch whether fresh capital returns or if activity remains subdued.

The broader market mood around PENGU remains cautious. Price continues to trade below earlier highs, as sellers maintain control near resistance zones.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/uncategorized/bearish-bias-strengthens-key-support-pengu/