- Bar on state investment in digital assets by Connecticut Governor.

- Bitcoin and digital assets restricted from state use.

- Potential precedent for similar regulations in other states.

Connecticut Governor Ned Lamont has signed a Bitcoin Reserve Ban preventing state entities from holding digital assets, announced yesterday.

The move establishes Connecticut’s regulatory stance on cryptocurrency within public sector agencies, potentially influencing similar future actions in other regions.

Connecticut Implements Ban on Public Sector Crypto Investments

Governor Ned Lamont officially signed Connecticut’s “Bitcoin Reserve Ban,” prohibiting state entities from investing in digital assets. This regulatory step aims to limit public sector exposure to cryptocurrencies like Bitcoin and Ethereum. These restrictions apply to government institutions across Connecticut.

Immediate implications include barring all state entities from holding or transacting cryptocurrencies. Industry analysts predict this could set a precedent for additional states or government bodies considering similar restrictions. The regulation impacts all altcoins, beyond just Bitcoin and Ethereum.

Ned Lamont, Governor of Connecticut – “Connecticut has officially signed the state’s ‘Bitcoin Reserve Ban.’ The state is now prohibited from accepting, holding, or investing in digital assets.”

Price Reactions and Regulatory Forecasts Post-Ban Announcement

Did you know? A similar regulatory measure was previously debated in New York but did not progress, leading to diverse state approaches to crypto policies.

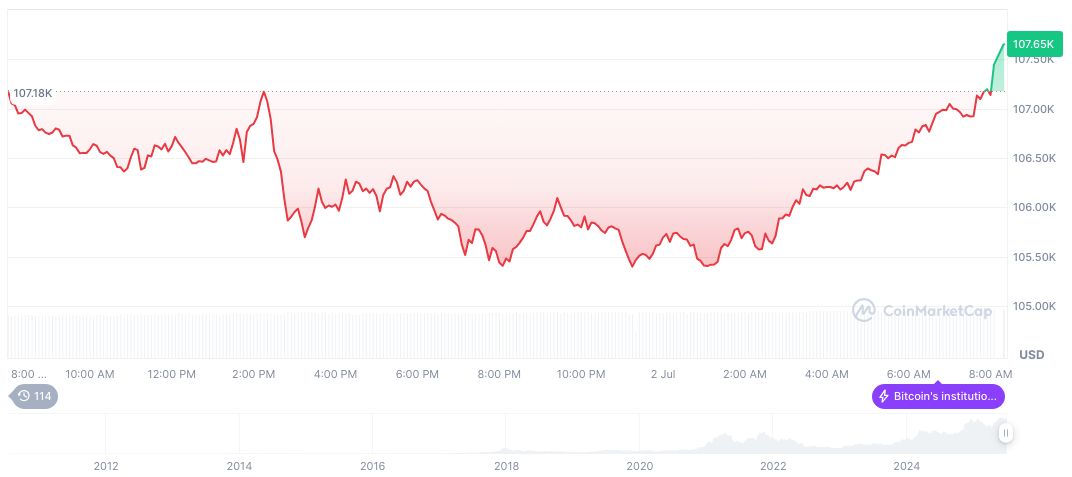

As of 06:20 UTC on July 3, 2025, Bitcoin (BTC) is trading at $109,351.68, with a market cap of $2.17 trillion, according to CoinMarketCap. Over the past 24 hours, its price increased by 2.37%, while it observed an uptick of 1.43% over the past week. The asset retains a market dominance of 64.32%.

The Coincu research team notes that Connecticut’s ban could signal increasing interest from regulators in safeguarding public funds. Rising regulatory measures might prompt caution among institutional investors in crypto, although private holdings and market cap fluctuations typically remain unaffected by such state-level actions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346571-connecticut-bitcoin-reserve-ban/