Disclaimer: The information presented in this article is part of a sponsored/press release/paid content, intended solely for promotional purposes. Readers are advised to exercise caution and conduct their own research before taking any action related to the content on this page or the company. Coin Edition is not responsible for any losses or damages incurred as a result of or in connection with the utilization of content, products, or services mentioned.

CoinEx Research has released its comprehensive report on the cryptocurrency market for July, highlighting significant volatility, notable recovery, and key developments throughout the month.

Market Volatility and Recovery

The cryptocurrency market experienced significant volatility in July. Bitcoin prices initially dropped to a low of $53,500 due to the German government’s sell-off but subsequently demonstrated remarkable resilience. The price quickly rebounded, even touching $70,000 following the Trump assassination incident. By the end of the month, Bitcoin was oscillating between $64,000 and $66,000. This price movement showcases Bitcoin’s maturity as an asset and highlights market participants’ confidence in its long-term value.

Strong ETF Inflows

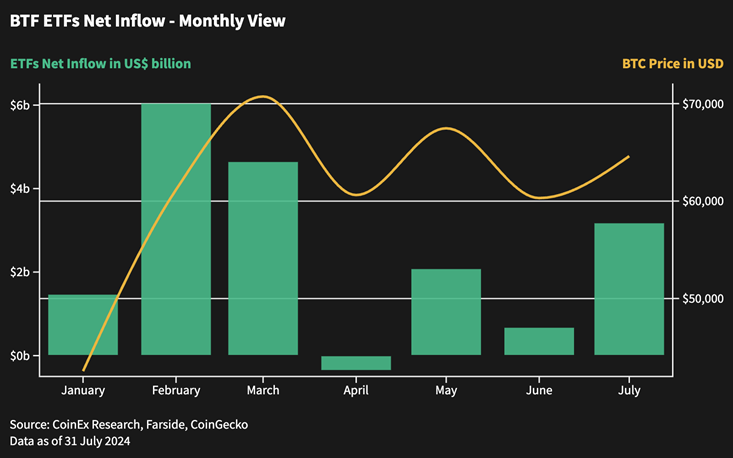

Bitcoin ETFs performed exceptionally well in July, with net inflows reaching $3.1 billion, a significant increase from June’s $666 million. This data reflects the growing interest of institutional investors in Bitcoin and indicates an accelerating convergence between traditional financial markets and cryptocurrency markets. The strong ETF inflows provide additional liquidity and stability to the Bitcoin market, helping to mitigate short-term price volatility and laying the groundwork for future price growth.

Impact of German Government Sell-off

The German government’s sale of approximately 50,000 bitcoins brought substantial supply pressure to the market, equivalent to about $3 billion in outflows. However, the market demonstrated an impressive absorption capacity. This sell-off did not lead to a market crash but helped establish a strong support level for Bitcoin in the near term. The concurrent $1 billion net inflow into ETFs further offset this pressure, highlighting institutional investors’ confidence in Bitcoin and the overall improvement in market liquidity.

Mt. Gox Distribution Challenge

As the Mt. Gox bankruptcy case progresses, the market faces another wave of potential supply pressure. Currently, 59,000 bitcoins (out of a total of 142,000) have been distributed to creditors through the Kraken and Bitstamp exchanges. While this may raise some concerns, considering the market’s successful absorption of the German government’s large-scale sell-off, industry experts generally believe this new supply pressure will also be effectively managed. Moreover, as the distribution process will span several months, its impact may be dispersed, reducing the immediate shock to the market.

Political Implications

The Bitcoin Conference held in Nashville in July became another highlight of the month, with speeches by presidential candidates Donald Trump and Robert F. Kennedy Jr. drawing widespread attention. Trump proposed establishing a strategic Bitcoin reserve for the nation, while Kennedy suggested that the Treasury Department purchase 550 bitcoins daily until the U.S. has a reserve of 4 million bitcoins. These proposals reflect the growing recognition of cryptocurrencies in the political sphere and, if implemented, could lead to a more favorable regulatory environment, attracting more institutional investment.

Ethereum ETF Launch

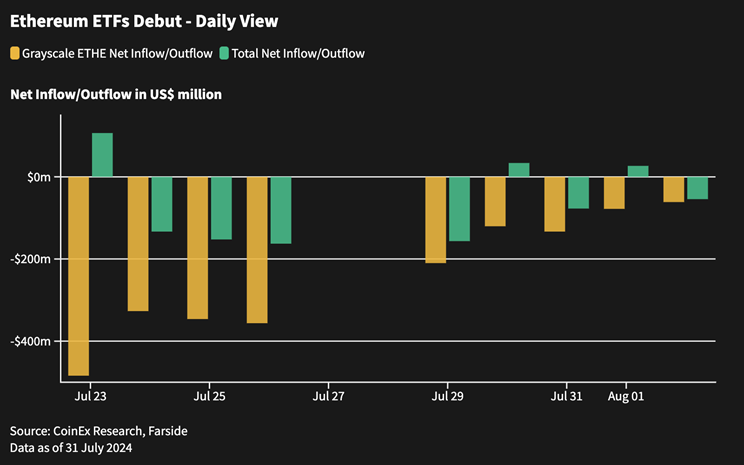

Following the approval of Bitcoin ETFs in January this year, nine spot Ethereum ETFs began trading on July 22, marking another important milestone in the cryptocurrency industry and regulatory landscape. However, the first week of trading saw a net outflow of $542 million, with Grayscale’s ETHE fund alone experiencing an outflow of $1.97 billion. This initial performance led to Ether’s price dropping from around $3,500 before the ETF launch to about $3,000 by the end of July. Analysts expect that if the current outflow rate continues, the outflow pressure from Grayscale’s ETHE may ease within 1-2 months.

Solana’s Rise

Solana has been a standout performer in this bull market, with its ecosystem primarily driven by the meme token sector. The Pump.fun platform emerged as a winner, creating over 1.5 million meme tokens and generating 510,000 SOL in revenue. From on-chain data, Solana surpassed Ethereum in daily active users and daily transactions, and even overtook Ethereum in DEX trading volume for the first time in July, although some of this volume may be attributed to “wash trading.” This trend reflects the diversity and innovation speed of the cryptocurrency ecosystem while highlighting the intensifying competition between different public chains.

Stablecoin Inflows Increase, Market Liquidity Improves

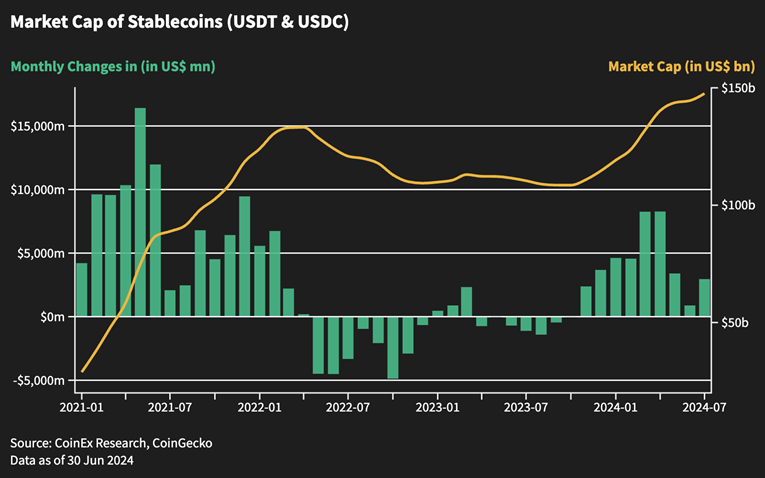

Stablecoin inflows began to recover in July, with a net issuance of approximately $290 million, approaching levels seen in December last year. This growth indicates improving market liquidity and may signal the onset of the next wave of market growth. Compared to August 2021, when stablecoin inflows continued to rise after a two-month correction, fueling subsequent market growth, industry insiders anticipate even stronger stablecoin inflows in August and September this year, potentially bringing more liquidity and upward momentum to the market.

Conclusion

Despite the challenges and volatility experienced in July, the cryptocurrency market, particularly Bitcoin, has demonstrated remarkable resilience and maturity. Strong ETF inflows, improving liquidity, and growing institutional interest paint a positive picture for Bitcoin. However, investors should remain vigilant of ongoing factors like the Mt. Gox distribution and broader economic trends. The cryptocurrency market continues to evolve, with key developments such as the rise of Solana and the launch of Ethereum ETFs indicating a dynamic and competitive landscape ahead.

About CoinEx

Established in 2017, CoinEx is a global cryptocurrency exchange committed to making trading easier. The platform provides a range of services, including spot and margin trading, futures, swaps, automated market maker (AMM), and financial management services for over 5 million users across 200+ countries and regions. Founded with the initial intention of creating an equal and respectful cryptocurrency environment, CoinEx is dedicated to dismantling traditional finance barriers by offering easy-to-use products and services to make crypto trading accessible for everyone.

CoinEx Research remains committed to providing in-depth analyses and insights into the evolving cryptocurrency market, helping investors navigate through the complexities and opportunities that lie ahead.

Source: https://coinedition.com/coinex-research-releases-july-cryptocurrency-market-report-volatility-resilience-and-growth/