- Coinbase’s Q1 2025 revenue reached $2.03 billion, marking a 24% YoY increase.

- Revenue fell short of the $2.1 billion analysts expected.

- Coinbase’s stock declined by 3% in after-hours trading.

Coinbase Global Inc. reported a Q1 2025 revenue of $2.03 billion. This figure signifies a 24% year-on-year growth but fell short of analysts’ $2.1 billion expectations, causing a 3% decline in stock price during after-hours trading.

Analyzed amidst a cryptocurrency market recovery, the shortfall suggests ongoing revenue challenges for established exchanges like Coinbase, according to sector experts. As noted from an unspecified source, “Coinbase reported Q1 2025 earnings of $2.03 billion, a 24% YoY increase, although it fell short of the $2.1 billion analyst expectations, leading to a 3% drop in after-hours stock price.”

Bitcoin Metrics and Regulatory Influence on Exchange Earnings

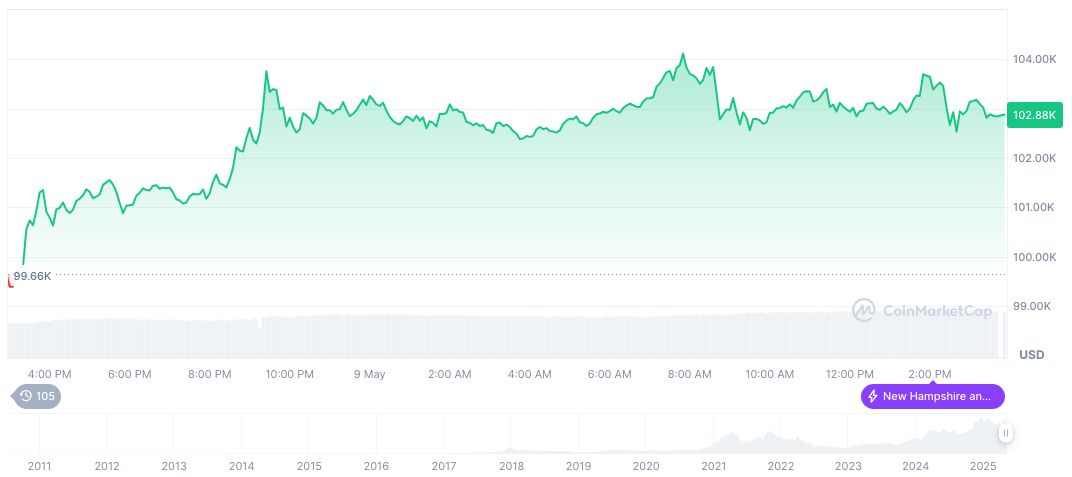

Bitcoin’s current metrics reflect resilience despite recent volatility. As of the latest update, Bitcoin’s price stands at $102,837.06, with a market cap of formatNumber(2_042_604_006_684.93, 2) and a trading volume decrease of 6.53% in the past 24 hours, per CoinMarketCap.

According to insights from the Coincu research team, future earnings for cryptocurrency exchanges may depend heavily on market volatility and regulatory clarity. Historical trends suggest that regulatory frameworks can significantly influence market confidence and trading activity.

The aftermath of Coinbase’s earnings announcement mirrors similar investor responses seen during previous earnings shortfalls, highlighting the firm’s historical sensitivity to forecast discrepancies.

Market Data and Future Insights

Did you know? The aftermath of Coinbase’s earnings announcement mirrors similar investor responses seen during previous earnings shortfalls, highlighting the firm’s historical sensitivity to forecast discrepancies.

Bitcoin’s current metrics reflect resilience despite recent volatility. As of the latest update, Bitcoin’s price stands at $102,837.06, with a market cap of formatNumber(2_042_604_006_684.93, 2) and a trading volume decrease of 6.53% in the past 24 hours, per CoinMarketCap.

According to insights from the Coincu research team, future earnings for cryptocurrency exchanges may depend heavily on market volatility and regulatory clarity. Historical trends suggest that regulatory frameworks can significantly influence market confidence and trading activity.

Source: https://coincu.com/336707-coinbase-q1-2025-revenue/