- Coinbase launches first U.S.-regulated perpetual futures for BTC and ETH.

- Nano contracts set to debut on July 21.

- Fills a major gap in U.S. derivatives market.

Coinbase Derivatives Exchange will launch U.S.-regulated nano Bitcoin (BTC) and Ethereum (ETH) perpetual futures in July 2025.

This expansion into U.S. perpetual futures could align the local market with global standards and attract increased trading interest.

Regulatory Milestone: CFTC Approves Perpetual Futures

Coinbase Derivatives Exchange announced plans for nano BTC and ETH perpetual products to comply with U.S. regulations. These offerings aim to fill the derivatives gap in the American market, providing spot-linked futures trading. Brian Armstrong, CEO of Coinbase, has overseen numerous growth phases. He stated, “We’re also developing a perpetual-style futures contract, unlocking a key product U.S. traders have been missing. Built in response to strong demand from crypto-native traders, these innovations make U.S. markets more accessible, competitive and aligned with global standards.” Coinbase Blog

The perpetual futures will first debut on July 21. This move ensures traders have access to leveraged cryptocurrency products that align with international trends, potentially boosting trading volumes and liquidity in the market.

Market responses have yet to fully manifest, though the regulatory clearance by the Commodity Futures Trading Commission (CFTC) marks a significant shift. Official statements from Coinbase highlight the product as addressing trader demand.

Potential Market Shakeup: Institutional Interest and Innovations

Did you know? Regulated crypto derivatives in the U.S. could attract institutional investors previously hesitant due to compliance concerns, potentially mirroring global market growth.

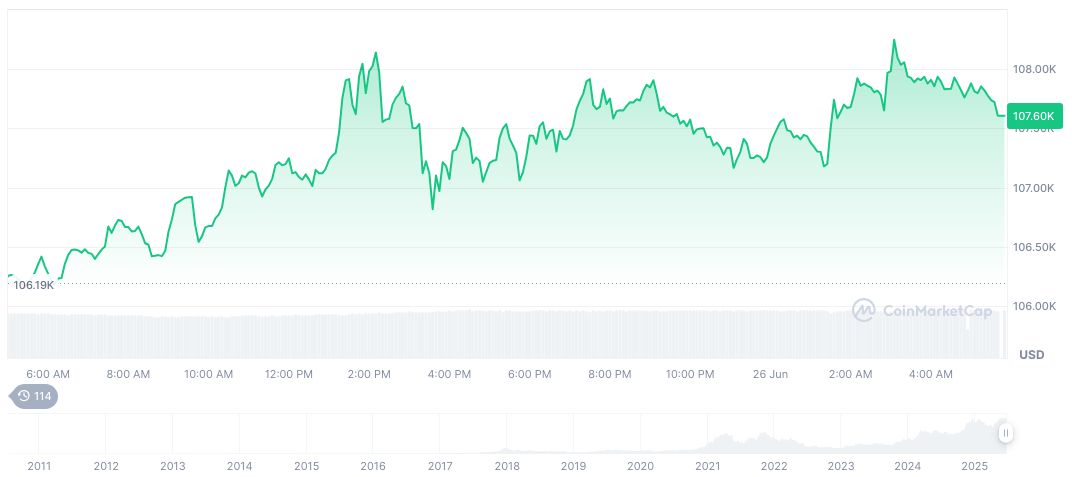

Bitcoin (BTC), traded at $107,405.34 with a market cap of $2.14 trillion, increased by 0.12% in 24 hours. In June 2025, BTC showed a 27.41% rise over 90 days, indicating robust growth. Data credit: CoinMarketCap.

Coincu research suggests that this launch may prompt competitive dynamics in the U.S. derivatives market, encouraging other firms to seek similar regulatory frameworks. Increased institutional participation could lead to further market innovations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345327-coinbase-us-perpetual-futures-launch/