- Coinbase and PayPal offer rewards amid US GENIUS Act restrictions.

- Rewards are framed as non-interest programs.

- Market perceives regulatory arbitrage with institutional demand expected.

Coinbase and PayPal continue offering stablecoin rewards despite the US GENIUS Act’s restrictions on issuers, defending compliance by framing returns as non-interest incentives.

This highlights regulatory ambiguities impacting stablecoin market strategies and could influence future legislative adjustments in U.S. crypto regulation.

Coinbase and PayPal’s Strategic Response to GENIUS Act

Coinbase and PayPal have continued offering stablecoin rewards despite the US GENIUS Act aimed at prohibiting such offerings. Following the Act’s enactment on July 18, 2025, both firms maintained programs promising annualized returns of 3%-5%. The Act, however, only regulates stablecoin issuers and does not limit secondary market activities like those of Coinbase and PayPal.

Coinbase CEO Brian Armstrong clarified during an earnings call that the company’s USDC rewards are structured as non-interest incentives. PayPal similarly justifies its PYUSD returns through third-party partnerships. Such programs remain legal under current interpretations, emphasizing rewards rather than interest.

Coinbase does not issue USDC and structures rewards as non-interest incentive programs. — Brian Armstrong, CEO, Coinbase

Market players view these rewards as regulatory loopholes. No significant statements have emerged from major crypto figures on this topic, though public discussion persists with legal experts asserting compliance. The interpretation of the Act suggests it sidesteps secondary market “reward” programs unless subsequent regulations specifically target them.

Regulatory Impact on Stablecoin Market Anticipated

Did you know? When Coinbase discontinued USDC lending in 2021, market dynamics shifted toward DeFi platforms, but regulations now favor compliant tokens, hinting at the same trend ahead.

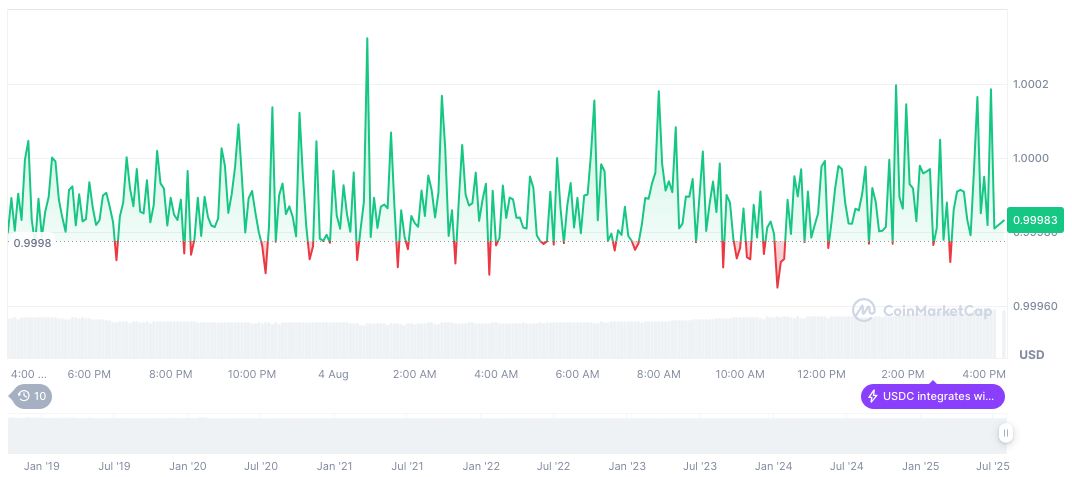

Coins like USDC have a current market cap of $64.38 billion and trade at $1.00 according to CoinMarketCap’s data. USDC’s price remained mostly stable over 24 hours with a 1.26% uptick, but it experienced a 1.34% dip in the past week.

Industry analysts expect the GENIUS Act to shift stablecoin products toward compliant platforms. More regulations are anticipated within 6–18 months, influencing financial, regulatory, and technological strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/genius-act-stablecoin-rewards/