- XRP trades near $2.44 after losing triangle support, with $2.40 as the key defense zone.

- CME launches regulated XRP options, adding institutional access but near-term volatility risk.

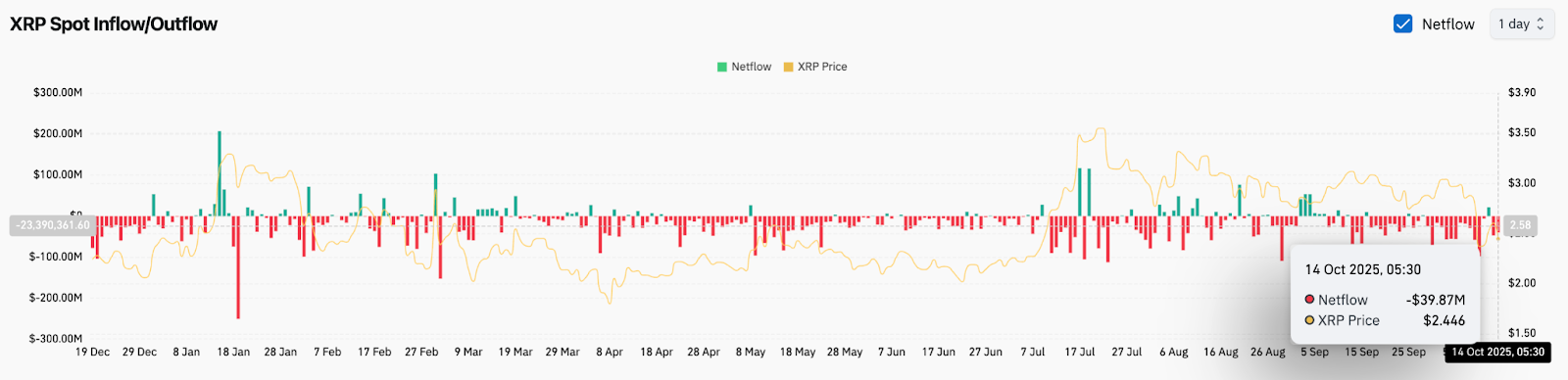

- Coinglass data shows $39.8M in outflows, reflecting cautious accumulation as buyers wait for clarity.

XRP price today trades near $2.44, down over 6% in the last 24 hours as the token extends its breakdown from a multi-month symmetrical triangle pattern. The decline followed a brief rebound attempt near $2.63, but sellers regained control after price failed to reclaim the 20-day EMA. The focus now turns to whether XRP can stabilize above its long-term ascending trendline around $2.40.

XRP Price Weakens After Triangle Breakdown

The daily chart shows XRP decisively breaking below the converging triangle structure that has governed price action since July. Immediate resistance now stands at $2.63, where the 100-day EMA intersects the lower boundary of the broken pattern. Overhead hurdles remain near $2.82 and $2.84, aligning with the 50-day and 20-day EMAs respectively.

Related: Pi Price Prediction: Pi Struggles for Stability Near $0.21

If buyers fail to defend the $2.40–$2.45 region, the next support sits near $2.22 and deeper around $2.05, where the ascending trendline from March converges with historical accumulation zones. The RSI has retreated toward neutral territory, suggesting that momentum remains weak but not yet oversold. Volume trends confirm limited buyer participation following the breakdown, keeping pressure on the downside.

CME Group Launches XRP Options

In a major development for market accessibility, the CME Group has officially launched CFTC-regulated XRP and Solana options, expanding institutional trading opportunities for both assets. The move adds regulatory clarity and enables more sophisticated hedging and speculative strategies, but near-term sentiment has been muted as broader market weakness persists.

Analysts note that derivatives listings often generate volatility in early trading phases, especially as liquidity providers adjust exposure. For XRP, this could amplify short-term swings within the $2.40–$2.80 corridor before equilibrium returns. Over the longer term, institutional-grade options could enhance liquidity depth and price discovery, factors that typically benefit large-cap assets once market confidence stabilizes.

On-Chain Data Shows Persistent Exchange Outflows

Data from Coinglass reveals a $39.87 million net outflow on October 14, continuing a two-week streak of consistent withdrawals from exchanges. While negative netflows generally indicate accumulation, the current pattern appears more cautious, reflecting investor repositioning rather than aggressive buying.

Related: Cardano Price Prediction: ADA Price Attempts Recovery

The overall trend of diminishing inflows since late September mirrors broader risk aversion across altcoins. Analysts suggest that sustained outflows paired with subdued volume point to reduced speculative demand, underscoring the need for a clear catalyst before a meaningful reversal.

Technical Outlook For XRP Price

From a technical perspective, XRP remains in a vulnerable position below all major short-term EMAs. The 200-day EMA at $2.63 now acts as an important pivot level. Regaining that threshold would signal structural recovery, potentially reopening the path toward $2.82 and $3.00.

On the downside, losing the $2.40 support could invite further selling pressure toward $2.22 and $2.05. The ascending trendline from April continues to provide medium-term support, while the On-Balance Volume (OBV) indicator remains weak, suggesting that broader accumulation has yet to resume.

Outlook: Will XRP Go Up?

XRP’s near-term direction will depend on whether the $2.40 zone attracts strong demand before the next derivatives settlement cycle. The launch of CME-regulated options provides a long-term positive for market structure, but technical momentum remains tilted bearish for now.

Related: Ethereum Price Prediction: Bhutan Adopts Ethereum For National Digital ID

If price holds above $2.40 and reclaims $2.63 in the coming sessions, a rebound toward $2.82–$3.00 remains possible. However, a daily close below $2.40 could invalidate this scenario and shift focus to $2.20. As institutional products begin trading, traders should expect heightened volatility and a potential retest of key demand zones before stabilization occurs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-cme-launches-xrp-options-and-outflows-deepen/