- Shift in CME’s FedWatch data reveals probable policy change.

- 71.3% chance for 25 basis point cut in September.

- Market volatility increases amid uncertainty before Jackson Hole.

Ahead of Jerome Powell’s speech on August 22, CME ‘FedWatch’ data shows a 71.3% chance of a 25 basis point Fed rate cut in September.

Market volatility spikes as the crypto sector awaits Powell’s address, impacting Bitcoin and BNB, reflecting overarching economic anxieties and investor caution.

Data Highlights Fed’s 71.3% September Rate Cut Odds

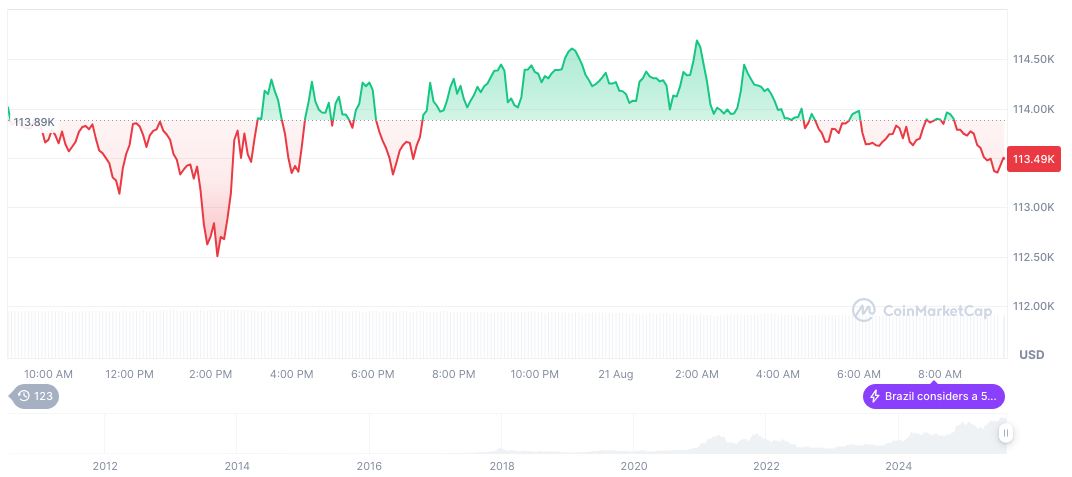

Prior to Powell’s anticipated remarks at Jackson Hole on August 22, 2025, the CME’s “FedWatch” tool displayed a sharp decline in the probability of a 25 basis point Fed rate cut, positioning it at 71.3%. In contrast, the probability for rates to remain unchanged clocked in at 28.7%, with mixed sentiment for October’s FOMC meeting, where only 14.6% forecasts no change. These probabilities underscore the market’s cautious stance ahead of Powell’s guidance. Subsequent impacts were notable across crypto markets, with significant price movements seen in major and altcoins.

The anticipated rate cut has already twisted market dynamics, with cryptocurrencies showing heightened volatility. Amid Powell’s silence, traders have exhibited risk-off behavior, with Bitcoin dipping slightly and BNB experiencing gains. Market participants are closely monitoring Powell’s forthcoming comments for clearer signals on interest rate policies. This cautious stance is reflected in the market’s ambivalence towards immediate economic outcomes. No official insights have yet been released by key leadership and industry figures.

Historical Context, Price Data, and Expert Analysis

Crypto Volatility Rises with Eye on Powell’s Speech

Did you know?

Historical precedents at Jackson Hole often stir significant reactions in crypto markets, with past surprises in Fed policy leading to sharp volatility in BTC and ETH.

Bitcoin’s current metrics indicate an ongoing turbulence. Trading at $112,907.71, it suggests investor hesitance ahead of the Fed’s potential rate cut. As of the latest update, its market cap stands at $2.25 trillion with a 24-hour trading volume of $59.12 billion, reflecting a decrease. BTC still dominates the market with a 58.51% share, according to CoinMarketCap.

Expert analysis from Coincu suggests that the current uncertainty may dampen short-term crypto sentiment, yet could fuel longer-term positioning as new economic policies clarify. This is evidenced by Bitcoin’s 60-day rise of 10.90%, illustrating its resilience despite macroeconomic challenges.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-expectation-impact/