- Classover will allocate $400 million for Solana assets, aiding decentralization.

- A pioneering move marking significant crypto adoption.

- Potential financial and regulatory risks loom over this strategy.

Classover Holdings, Inc. (Nasdaq: KIDZ) announced on May 1 its plan to sell up to $400 million equity to Solana Strategies Holdings LLC, integrating Solana (SOL) tokens into its reserves.

The decision positions Classover among the first Nasdaq-listed entities to leverage Solana for treasury purposes, potentially paving the way for broader corporate adoption.

Classover’s $400 Million Solana Integration Strategy

Classover Holdings has embarked on a notable financial directive, signing an equity subscription agreement to sell up to $400 million in Class B stock with Solana Strategies Holdings LLC. This collaboration aims to integrate Solana tokens deeply into the company’s core financial strategy. Classover plans to allocate significant parts of its reserves to purchasing and holding Solana (SOL) for the long term while operating validator nodes to enhance Solana’s network security and decentralization.

The implications of this move suggest a wider acceptance of cryptocurrency, particularly Solana, within institutional spheres. It also highlights potential risks such as SOL’s price volatility and regulatory scrutiny, alongside shareholder dilution concerns.

Classover Holdings, Inc., Investor Relations, “Classover will, subject to certain limitations, allocate a significant portion of the proceeds received from the sale of any shares under the facility to the purchasing, long-term holding, and staking of Solana (“SOL”) tokens — positioning itself among the first publicly traded companies to integrate SOL directly into its core treasury operations.”

Solana’s Market Data and Future Prospects

Did you know? In contrast to Bitcoin’s early adoption for corporate treasuries, Classover’s move makes it one of the first major Nasdaq-listed companies to formally dedicate a substantial portion of its reserves to Solana (SOL), a Layer 1 alternative asset.

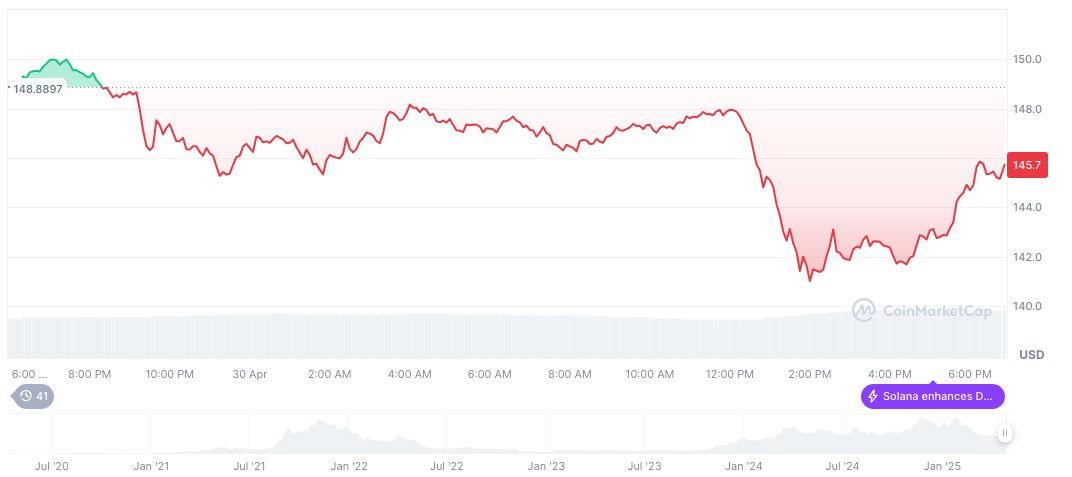

Solana (SOL) is currently priced at $150.34, with a 24-hour trading volume of $3.28 billion per CoinMarketCap. As of May 1, 2025, Solana’s market cap stands at $77.86 billion, holding a 2.58% market dominance. Over the past 30 days, SOL has seen a price increase of 19.48%, despite a 90-day decline of 36.06%.

Insights from Coincu Research suggest that Classover’s initiative may influence other corporates contemplating adoption of alternative Layer 1 assets. However, they caution that regulatory challenges and market volatility represent ongoing hurdles. Classover’s strategy will provide a critical test case for potential technological and financial outcomes.

Source: https://coincu.com/335248-classover-solana-400-million-initiative/