- Circle’s stock price fell over 8% after Q3 financial announcement.

- Revenue and profit exceeded analysts’ expectations significantly.

- Market cap decreased nearly 70% from its peak earlier this year.

Circle’s stock fell over 8% as Q3 financial results exceeded expectations with $740 million revenue and $214 million profit, yet market cap dropped to $21 billion.

The surprising financial gains highlight Circle’s growth, yet market cap decline raises concerns about investor confidence in the volatile stablecoin sector.

Circle Q3 Earnings: 66% Revenue Growth and 202% Profit Surge

Circle’s Q3 financial report, released prior to market opening, showed substantial growth with revenue amounting to $740 million, a 66% year-on-year increase. Profits also grew significantly, up 202% to $214 million year-on-year. This financial performance stood well above analyst projections, which had forecasted revenues of $700 million and profits of $31 million.

Despite surpassing financial expectations, Circle’s stock suffered a steep decline of over 8% during trading. The company’s market cap has contracted sharply, now amounting to around $21 billion, nearly 70% off its historical high. This fluctuation in market cap has not resulted in immediate changes to DeFi protocols using USDC as a core collateral.

Market analysts were surprised at the stock’s decline despite strong financial results. Circle CEO Jeremy Allaire did not release any direct remarks following the recent financial report, leaving industry observers speculating on market sentiment. The absence of reactions from key market influencers underscores the unexpected nature of this stock movement. Arthur Hayes, Co-founder of BitMEX, noted, “The reaction to Circle’s Q3 results highlights the ongoing skepticism surrounding stablecoins and their market impact.”

Regulatory Pressures and Market Responses

Did you know? Circle’s recent market cap, now at $21 billion, marks a steep descent from its peak earlier this year when it approached nearly three times its current value.

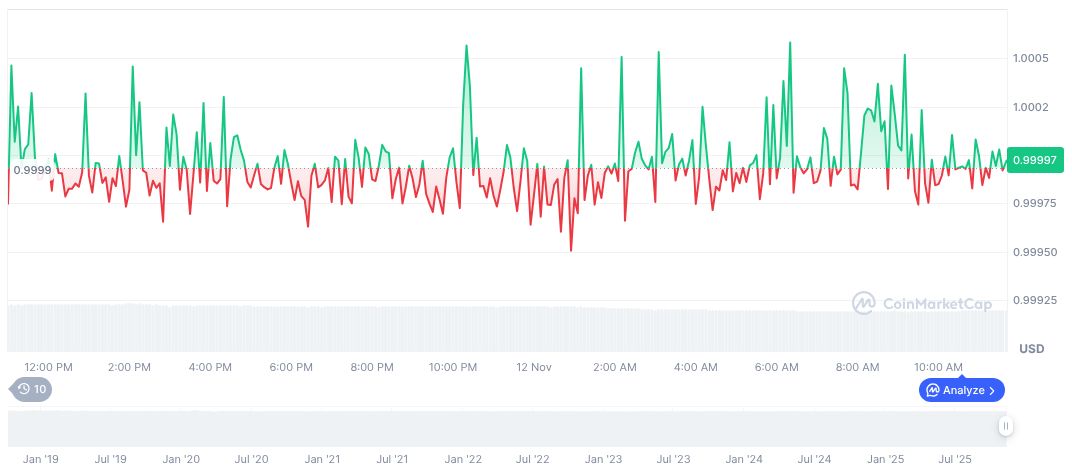

According to CoinMarketCap, USDC is priced at $1.00 with a market cap of $75.99 billion. Over 24 hours, the trading volume reached $14.30 billion, a decline of 9.87%. USDC’s value shows minor fluctuations over different time frames, reflecting its stability as a key stablecoin in cryptocurrency markets.

Insights from Coincu research team suggest that while financial resilience is evident, regulatory scrutiny around stablecoins may be contributing to investor caution. The importance of transparency and global regulatory compliance is crucial in understanding potential technological or financial outcomes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/circle-stock-drops-q3-results/