- Circle’s IPO raised $1.1 billion, impacting USDC and stock markets.

- 28% market surge is noteworthy and significant.

- Market reactions could prompt more crypto IPOs.

Circle’s initial public offering on June 7 saw its stock surge by 28% on its debut on the New York Stock Exchange.

This significant market entry highlights growing institutional interest in cryptocurrencies, primarily driven by USDC’s market performance.

Circle IPO Raises $1.1 Billion, Sparks New Market Interest

Circle’s IPO was a major move in the cryptocurrency space, marking one of the largest in history with a pricing of $1.1 billion. Jeremy Allaire, Circle’s CEO, played a pivotal role in this watershed event, which attracted substantial attention from institutional investors.

Following the IPO, Circle’s stock surged by 28%, bringing the company to a market cap of $16.6 billion. This has broader implications by potentially paving the way for other crypto firms to enter public markets.

Carlos Guzman, Analyst at GSR, said, “This IPO performance will almost surely prompt others in crypto to want to go public.”

USDC Performance and the Ripple Effect of Circle’s IPO

Did you know? The S&P 500 closed above 6,000 points for the first time since February 21, reflecting a wider bullish sentiment driven by significant market events like Circle’s IPO.

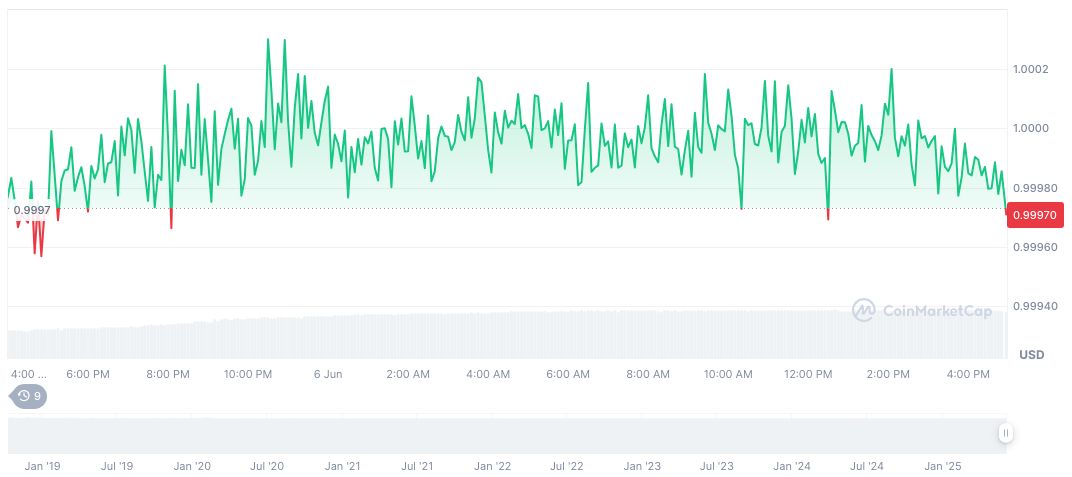

USDC, priced at $1, commands a market cap of $61.12 billion with a dominance of 1.88%, according to CoinMarketCap. The 24-hour trading volume is $9.78 billion, reflecting a 26.98% decline. USDC’s performance over the past 90 days highlights varied market conditions.

Coincu analysts suggest that Circle’s IPO has amplified USDC’s prospects. This could signal increased regulatory focus on stablecoins, further shaping crypto’s financial landscape. Technological advancements and market strategies like yield payments may center future competitive dynamics in this sector.

Eliézer Ndinga, Head of Strategy at 21Shares, commented, “Circle’s IPO is a watershed moment that could open the public markets to other long-standing crypto firms. Don’t be surprised if Circle expands into consumer-facing products like an on-chain forex app.”

Source: https://coincu.com/341988-circle-ipo-usdc-surge/