- Circle’s IPO pricing strategy led to $1.72 billion in potential profit loss.

- Circle debuted on NYSE at $31/share, surged to $120.

- Overwhelming institutional demand, ARK Invest purchased millions of shares.

Circle launched its much-anticipated IPO on the New York Stock Exchange on June 5, pricing its shares at $31. After its IPO, Circle’s shares climbed to over $120, highlighting significant investor interest in the company.

Despite the successful debut, Circle incurred a significant financial impact, losing an estimated $1.72 billion in unrealized proceeds. Its pricing strategy contributed to one of the largest IPO underpricing cases in decades.

Circle IPO Soars: From $31 to Over $120 Per Share

Circle, officially entering the equity markets, became a major focus as it undertook its IPO on the NYSE. Involved institutions included Cathie Wood’s ARK Invest, which acquired a significant share, illustrating serious institutional backing.

Despite the successful debut, Circle incurred a significant financial impact, losing an estimated $1.72 billion in unrealized proceeds. Its pricing strategy contributed to one of the largest IPO underpricing cases in decades. It appears that there are no directly sourced quotes from Jeremy Allaire or other Circle leadership regarding the recent IPO event.

The market response was overwhelmingly positive, with Circle’s shares peaking at more than $120 soon after the debut. While no official comment has emerged from Circle’s leadership, the purchase by ARK Invest conveys confidence in the company’s prospects.

Analyzing Circle’s IPO Impact and Market Stability

Did you know? Circle’s IPO is the seventh-largest underpricing event in nearly 40 years, highlighting the challenges in pricing for rapidly appreciating stocks.

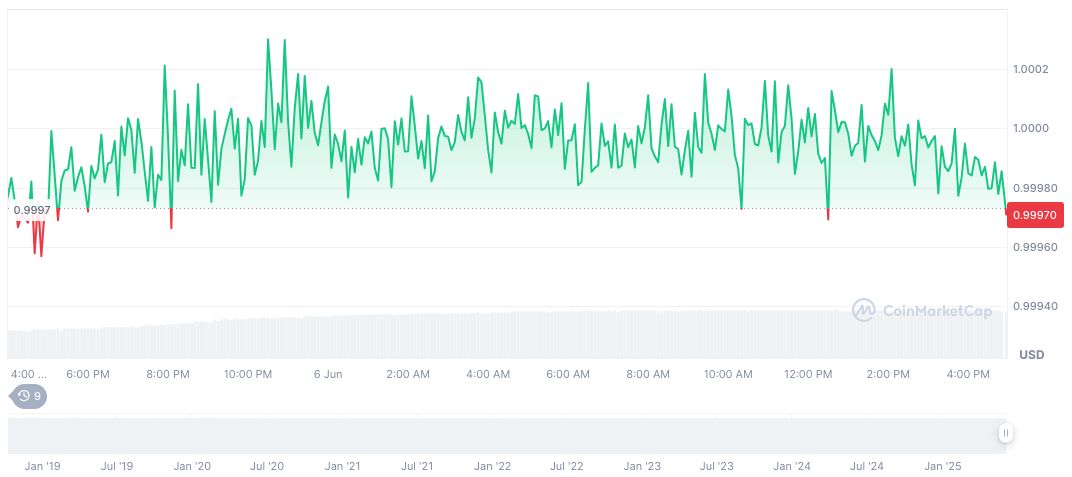

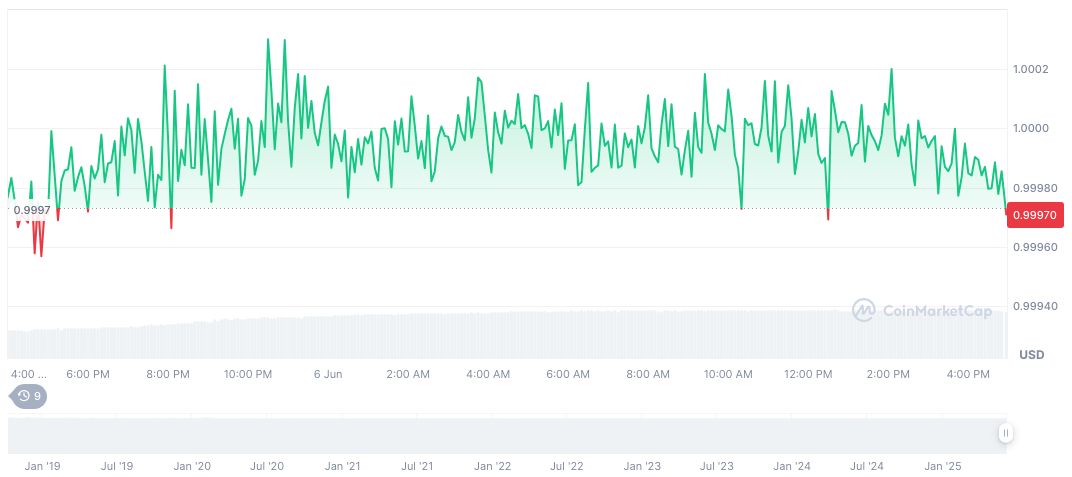

According to CoinMarketCap, USDC, issued by Circle, remains at $1.00 with a $61.12 billion market cap. Dominating 1.86% of the market, USDC’s 24-hour trading volume loomed at $7.65 billion, indicating a 47.13% decrease. The coin experienced modestly fluctuating changes over 30 days, reflecting market stability.

Coincu’s research highlights potential regulatory traction in the wake of Circle’s IPO. Given its scale, it’s poised to influence broader institutional interest in crypto markets, with regulatory outcomes potentially shaping fintech’s future landscape. Notably, Circle’s CCTP v2 speeds up cross-chain transfers.

Source: https://coincu.com/342053-circle-ipo-pricing-loss/