- Circle mints 250 million USDC on Solana, enhancing liquidity.

- Increased DeFi liquidity boosts Solana-based platforms.

- Stablecoin supports cross-border payments and DeFi growth.

Circle has minted 250 million USDC on the Solana blockchain, as reported by Whale Alert on September 19, reinforcing stablecoin liquidity expansion initiatives.

This minting boosts Solana’s DeFi ecosystem, enhancing trading positions and liquidity pools, with no direct executive comments yet on this event.

Circle Mints 250 Million USDC: Solana’s Liquidity Boost

Circle’s recent minting action involves issuing 250 million USDC on Solana, confirmed by Whale Alert and Solana block explorer. This initiative is part of Circle’s effort to bolster stablecoin liquidity on fast networks, optimizing for cross-border use cases.

Immediate implications for Solana include enhanced liquidity and potential boosts in the blockchain’s DeFi sector. The influx of USDC is anticipated to expand stablecoin pools, reducing borrow rates and enabling larger trading volumes, especially in SOL/USDC markets, as seen in historical patterns.

Market reactions have been favorable, with increased community engagement and developer activity on Solana. Although lacking specific commentary from Circle’s CEO Jeremy Allaire, Circle’s transparency policies affirm the reserve-backed nature of USDC. Solana’s ecosystem is expected to enjoy short-term liquidity and trading volume benefits.

“Each USDC is always redeemable 1:1 for a US dollar held in regulated financial institutions. Transaction mints and redemptions are confirmed on-chain and publicly auditable.” — Jeremy Allaire, Co-founder & CEO, Circle

Stablecoin Trends and Market Influences on Solana’s Growth

Did you know? USDC minting on Solana aligns with Circle’s past actions of expanding stablecoin liquidity, contributing to consistent growth in Solana’s DeFi activities and stablecoin demand.

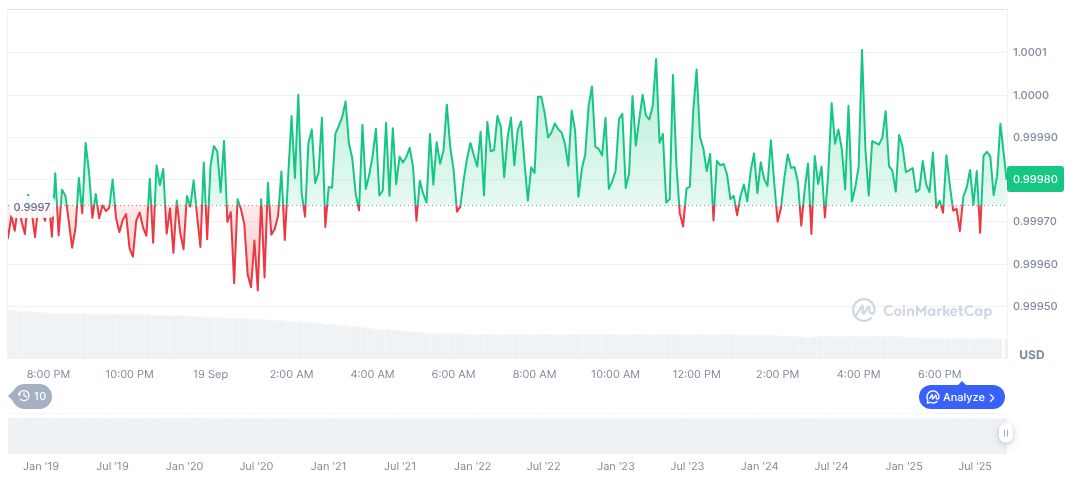

USDC’s current price of $0.99 aligns with a market cap of approximately $74.15 billion, from CoinMarketCap data. Despite a slight decrease of 0.14% in 24 hours, it demonstrates an intrinsic role with over $13.31 billion in daily trading—reflecting ongoing relevance as a stablecoin—the USDC remains integral to financial systems globally.

Continued developments in stablecoin regulation may pose significant implications for future issuance. The Coincu research team highlights observed regulatory trends, focusing on stablecoin adoption as driving liquidity. Emerging frameworks like the GENIUS Act could further solidify institutional reliance on USDC and spur DeFi growth worldwide.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/circle-mints-usdc-solana-network-2/