- Circle finalizes IPO, aligning governance with financial institutions.

- Circle’s IPO boosts trust and institutional cooperation.

- USDC solidifies role as stablecoin within payments infrastructure.

Heath Tarbert, President of Circle and former CFTC Chair, confirmed Circle’s IPO on the NYSE, reinforcing its transparency and governance standards as an internet-based financial service firm.

This event positions Circle as a key player in integrating stablecoins with traditional finance, bolstering institutional trust and partnerships.

Circle’s Strategic IPO on NYSE Enhances Transparency

Circle’s IPO on the NYSE marks a significant step for the firm, demonstrating its commitment to transparency and regulatory adherence. This move is expected to cement Circle’s reputation in the financial and crypto sectors, given its dual nature as a regulated financial entity and a Web3 pioneer.

Tarbert underscored Circle’s unique position as both a financial services company and an internet infrastructure firm. “We are built on the open internet, and we are an internet company that is also a financial services company. In that regard, we’re rare. And the more people that understand who we are and the unique power of stablecoins, is something that is really important to us. The IPO in many ways makes that very clear.”

The market reacted positively, with Circle’s actions setting a new precedent for crypto entities pursuing public market credibility. Tarbert emphasized that Circle does not see banks as competitors but as partners in expanding stablecoin use, aligning with his statements on growth potential and transparency.

Market Response and Long-term Implications for Stablecoins

Did you know? Circle’s IPO aligns with regulatory trends seen in other fintech firms, echoing the transparency shift exemplified by Coinbase’s 2021 listing.

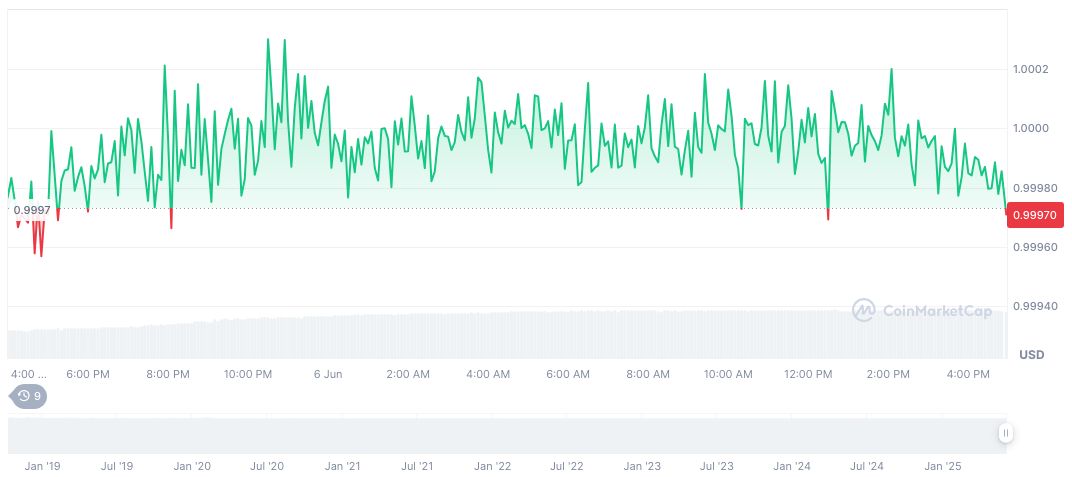

According to CoinMarketCap, USDC currently holds a market cap of $61.11 billion with a 24-hour trading volume of $8.84 billion, despite experiencing a slight 0.01% decrease over the past 24 hours. The stablecoin’s circulating supply is 61.11 billion, with its dominance at approximately 1.86%.

The Coincu research team notes that Circle’s IPO could set a transformative precedent for crypto firms eyeing public markets. This could lead to heightened regulatory standards and more robust integrations between traditional financial institutions and stablecoins, reinforcing the role of entities like Circle in the digital economy. Explore how Circle’s recent advancements in cross-chain transfers align with these goals.

Source: https://coincu.com/342019-circle-ipo-transparency-governance/